In this story:

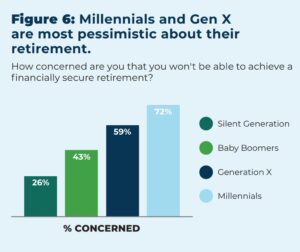

- Members of Generation X and Millennials are more concerned than other generations about their ability to save enough for retirement

- Younger generations are also more likely to be worried about the effects of the pandemic on their retirement planning

- Generations agree on the value of defined benefit plans like Colorado PERA

A recent survey by the National Institute on Retirement Security found that Americans who fall into the Generation X and Millennial categories are more pessimistic than older generations about their retirement prospects and are more likely to be concerned about how the COVID-19 pandemic might have affected their retirement plans.

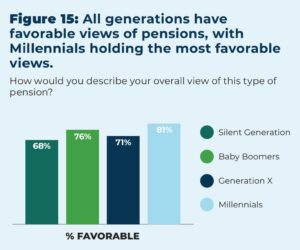

The survey also found the various age groups have some important points of agreement, including the overall state of retirement security and the need for greater access to retirement plans like those offered by Colorado PERA.

Where the generations differ in retirement outlooks

The National Institute on Retirement Security surveyed 1,203 people in December 2020. For the purpose of the survey, Millennials were defined as those who were 25 to 43 years old, Generation X as 44 to 55 years old, Baby Boomers as 56 to 74, and the Silent Generation as anyone 75 and older.

NIRS found that while the generations agree that there’s a retirement crisis in the United States, Generation X and Millennials have generally more pessimistic views of the situation. Seventy-two percent of Millennials and 59 percent of Generation X said they’re concerned about achieving a financially secure retirement, versus 43 percent of Baby Boomers and 26 percent of the Silent Generation.

Additionally, 64 percent of Millennials and 54 percent of Generation X said they’re more concerned about their retirement in light of the COVID-19 pandemic, while 42 percent of Boomers and 25 percent of the Silent Generation said the same.

The younger generations were also far more likely to have dipped into their emergency or retirement savings during the pandemic, according to the survey.

Where the generations agree

The NIRS survey found broad agreement across the generations on the challenges workers face while saving for retirement, with large majorities of each group saying the average worker cannot save enough money for retirement on their own.

The four generations also agree that it’s important to provide for retirees. Majorities of each group support Social Security and would be in favor of increasing contributions. Each group also agreed on the importance of defined benefit retirement plans, also known as pensions, which provide retirees with a lifetime benefit they can’t outlive. Eighty-one percent of Millennials described their views of pensions as favorable, and 68 percent of the Silent Generation said the same. All four generations agreed that every American worker should have access to a pension plan.

Where PERA factors in

In Colorado, the state’s largest workforce — public employees like state workers, teachers, corrections officers, snow plow drivers and others who serve our state — has access to a pension through Colorado PERA.

PERA is a hybrid defined benefit plan, providing a defined benefit pension to most members and offering a choice between the defined benefit plan and defined contribution plan to others. Of those given the choice between the DB and DC plans, 9 out of 10 choose the DB option.

The average PERA member retires at approximately 59 years old and lives until their early 80s, receiving benefit payments from PERA every month while they’re retired. In 2020, PERA paid more than $4.2 billion in pension benefits to more than 107,000 retirees living in Colorado, with an average monthly benefit of $3,204. At a time when many workers are anxious about their ability to save enough for retirement, defined benefit plans like PERA not only provide peace of mind in retirement, they also serve as an effective recruiting tool for public employers looking to attract and retain employees.

Hybrid defined benefitPERA’s Defined Benefit (DB) Plan is “hybrid” in that it combines features of a traditional DB plan with some of the features of defined contribution (DC) plans, such as portability.Defined benefitAlso known as a pension, this is a type of pooled retirement plan in which the plan promises to pay a lifetime benefit to the employee at retirement. The plan manages investments on behalf of members, and the retirement benefit is based on factors such as age at retirement, years of employment and salary history.Defined contributionA type of individual retirement plan in which an employee saves a portion of each paycheck (along with a potential employer match) and invests that money. The employee’s retirement benefit is based on their account balance at retirement. A 401(k) is a type of defined contribution plan.

Wish you had included me of the silent generation in your survey. I can’t spend it all. Paid off house ,car etc . No bills, travel – – can have anything I want except A yacht or an airplane. tee hee

The peace-of -mind from a DB plan is priceless.