At a recent hearing of the U.S. Senate Committee on Health, Education, Labor, and Pensions, lawmakers discussed the state of the country’s retirement system and debated what needs to change to better prepare American workers for retirement.

The results of a new survey of working-age Americans, however, are clear: They want access to a defined benefit (DB) pension plan.

The three-legged stool

Experts have historically promoted the idea of a “three-legged stool” of retirement planning. The three legs represent the three traditional sources of income: Social Security, a DB pension plan, and personal savings.

As the retirement planning landscape in the U.S. has changed, many people find themselves entering retirement with just one or two of those legs, likely falling short of what they expected to be earning. In fact, only about 7 percent of retirees are receiving income from all three sources, according to the National Institute on Retirement Security (NIRS).

In 1980, more than 80 percent of workers in the private sector had access to a DB plan, according to the U.S. Bureau of Labor Statistics. That number has steadily fallen over the years, and in 2023, only 15% of private-sector workers had access to a DB plan. Today, pensions are largely only available to public employees.

That shift from DB plans to defined contribution (DC) plans like 401(k)s has had an impact on the retirement readiness of members of Generation X who are nearing retirement. According to NIRS, the median retirement account balance for Gen X households is just $40,000 and 40% have no balance at all.

READ MORE: How the Shift Away From Pensions Has Affected Gen X’s Retirement Readiness

Workers want more

In a 2023 nationwide survey of working-age Americans, NIRS found a high level of pessimism about retirement and strong support for pensions. More than half of survey respondents said they’re concerned about achieving a secure retirement, and an even larger percentage—77%— said they agree the average worker can’t save enough on their own.

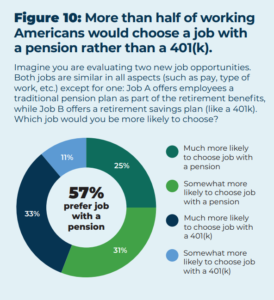

An overwhelming majority of people who took the survey—82%—expressed positive opinions about DB plans, saying that all workers should have access to a pension. In addition, 57% said they would choose a job with a pension over one that only offered a 401(k).

PERA and retirement security

Colorado PERA has been providing a DB plan to the state’s public employees since 1931. It’s been a valuable recruitment and retention tool for employers, and PERA’s offerings now include both DB and DC plans that cover more than 671,000 current and former public workers.

PERA also offers the optional PERAPlus 401(k) to all members, and some PERA employers also offer the PERAPlus 457 Plan. Some members also have a choice between the PERA DB Plan and the PERA DC Plan, which features a variety of low-cost investment options for members who want to invest their retirement funds on their own. DC Plan members can also annuitize their account balance at retirement to convert it to regular monthly income.

By offering multiple plan options, PERA can continue to meet the needs of its diverse membership and provide a stable source of retirement income to the state’s vital public employees for generations to come.

Defined benefitAlso known as a pension, this is a type of pooled retirement plan in which the plan promises to pay a lifetime benefit to the employee at retirement. The plan manages investments on behalf of members, and the retirement benefit is based on factors such as age at retirement, years of employment and salary history.Defined contributionA type of individual retirement plan in which an employee saves a portion of each paycheck (along with a potential employer match) and invests that money. The employee’s retirement benefit is based on their account balance at retirement. A 401(k) is a type of defined contribution plan.

NICE TRY, DEFENDING A “HYBRID PLAN”

PERA’s three-legged stool collapsed when the state stopped making its fair and required share of contributions (in order to balance the state budget). The three-legged stool mentioned in this article is for PRIVATE SECTOR workers, since Colorado PERA usually reduces Social Security and personal savings are hard to accrue on a state salary. Regardless, did it really take a survey to discern most workers desire legacy or traditional DB type pensions? However, perhaps DC plans offered by PERA are simply a politically induced reward to financial industry lobbyists; and hardly supports recruitment and retention in public employment; but nice try slipping the alleged value of PERA’s DC plans in at the end of the article.

As far as Colorado PERA members are concerned, the only surveys that matter are the polls at caucuses, and during primary and general elections (to send a message to the politicians who wrecked many PERA members retirement security by eliminating their COLA!).

Defined Benefit plans should be made available to all Americans with the stipulation that our state / federal governments must not be allowed to borrow from or borrow against the plans.

I am pleased that people are talking about the need for Defined Benefit Plans. So far, I have often heard people expressing resentment against government workers having them while they are provided with the inferior outcomes from Social Security. And in their frustration, they were expressing that Defined Benefit Plans should be taken away from government workers.

Remember that in my experience as a public school employee, I receive miniscule social security payments and the 401 / IRA accounts offered thru work never offered matching funds as is often the case in private businesses.

I would imagine that most want a retirement plan that gives them a cost of living raise, so they like us PERA retirees won’t keep falling behind year after

year.

Wouldn’t it be great if the legislature received the same raise we receive?

Teetering on the three legged stool, reduced Social Security, COLA so small it’s another injustice, low wage history from PERA and waiting for the rug to be pulled out too. Inflation and average gross income continue to rise in the Denver area.

I’d like to get a grip, how about the Windfall Elimination on PERA being addressed and dealt with.

It is only a “Defined Benefit “ if the definition you pay for isn’t changed once the benefit is earned. PERA currently has a “dwindling benefit plan” because the “defined “ part has been stripped away completely 3 or 4 times, and reduced to almost nothing when it is paid.

Since I retired, (2008) PERA is in arrears to my contract close to 260K.

Go to teach in Colorado…. They offer a ‘defiled benefit’ plan.

“By offering multiple plan options, PERA can continue to meet the needs of its diverse membership and provide a stable source of retirement income to the state’s vital public employees for generations to come.”

In what universe does an intermittent 1% annual increase “continue to meet the needs” ? Are you really that deaf ? PERA does not cover my needs, its not even close anymore.