Generation X – the group of Americans born between 1965 and 1980 — is often referred to as the “Forgotten Generation.” It’s a smaller group than both the Baby Boomers that came before and the Millennial generation that followed.

With the oldest members of Generation X soon approaching retirement, it’s important to look at where they stand financially. New research from the National Institute on Retirement Security (NIRS) finds that many members of Gen X are struggling to meet retirement savings targets and risk having a significantly lower standard of living when they stop working.

Access to employer-sponsored retirement plans

According to the NIRS researchers, the decline in the number of employers offering defined benefit (DB) pension plans is a major factor in Gen X’s retirement readiness. In 1980, more than 80 percent of workers in the private sector had access to a DB plan, according to the U.S. Bureau of Labor Statistics.

Today, few private employers offer pensions to their workers. Most employees only have the option to save for retirement in employer-sponsored defined contribution (DC) plans like 401(k)s or on their own in individual retirement accounts (IRAs). According to NIRS, just 14 percent of Gen Xers were participating in a DB plan as of December 2020.

The potential challenge of relying solely on DC plans is a person’s retirement income depends on how much they contributed over the course of their working years and the investment gains they may have earned over that time.

Since Generation X was the first generation to enter the workforce when DB plans were on the decline, they’re the first to see the effects of that shift on their finances on a large scale.

Generation X’s retirement readiness

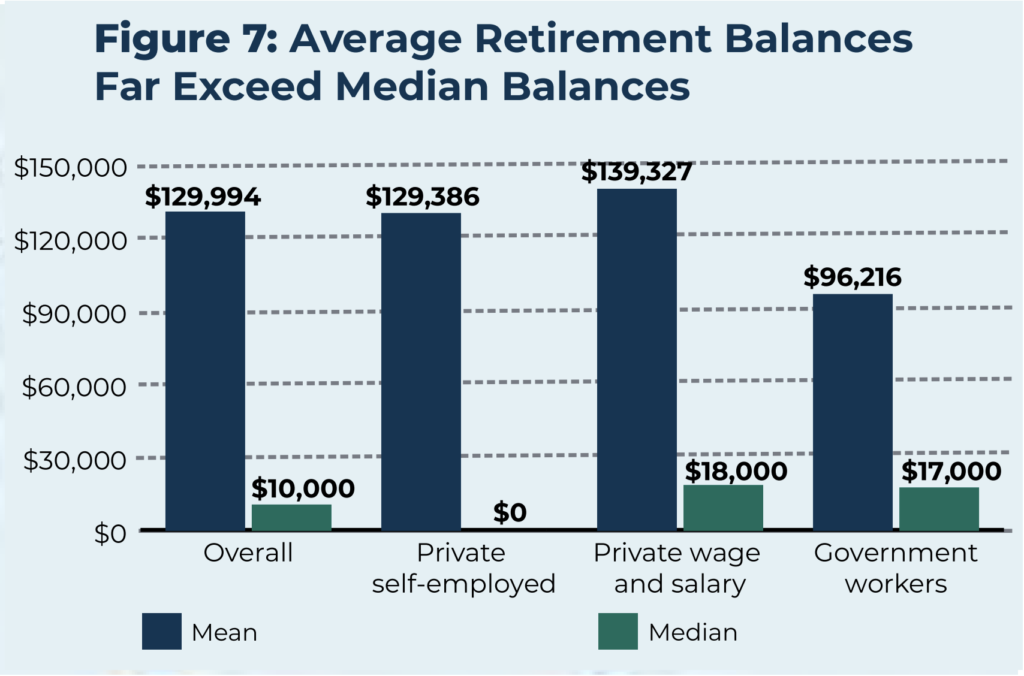

The NIRS researchers found that just over half of Gen Xers participated in an employer-sponsored retirement plan in in 2020. Of those contributing to a private account like a 401(k), the average balance was $129,994. The median account balance, which isn’t skewed by high earners, was $10,000 for individuals and $40,000 for households.

Additionally, 40 percent of Gen Xers have accounts with no balance at all, according to NIRS.

The researchers warn that retirees who don’t have enough savings to live on will have to rely on Social Security, which wasn’t designed as a full income replacement. In 2023, the average Social Security benefit is about $1,700 a month.

It’s not all bad news, however. The youngest Gen Xers are in their early 40s, which are often a person’s prime earning years. That means younger members of the generation still have time to bolster their savings and improve their retirement security.

How PERA combines the best of DB and DC plans

The State of Colorado created PERA in August 1931 and since then, PERA has grown to include DB and DC offerings covering more than 670,000 current and former public employees.

The PERA defined benefit Plan is available to all PERA members and is designed to provide lifetime income in retirement. The average monthly benefit was $3,238 in 2022.

Some members have a choice between the PERA DB Plan and the PERA DC Plan, which features a variety of low-cost investment options for members who want to invest their retirement funds on their own. Members can also annuitize their account balance at retirement to convert it to regular monthly income.

PERA also offers the optional PERAPlus 401(k) to all members, and some PERA employers also offer the PERAPlus 457 Plan. Both are low-cost options for setting aside extra money for retirement, and both have Roth options for saving after-tax dollars.

Together, PERA’s defined benefit and defined contribution plans help ensure that Colorado’s public employees have the income they need in retirement, regardless of which generation they’re a member of.

Defined benefitAlso known as a pension, this is a type of pooled retirement plan in which the plan promises to pay a lifetime benefit to the employee at retirement. The plan manages investments on behalf of members, and the retirement benefit is based on factors such as age at retirement, years of employment and salary history.Defined benefitAlso known as a pension, this is a type of pooled retirement plan in which the plan promises to pay a lifetime benefit to the employee at retirement. The plan manages investments on behalf of members, and the retirement benefit is based on factors such as age at retirement, years of employment and salary history.Defined contributionA type of individual retirement plan in which an employee saves a portion of each paycheck (along with a potential employer match) and invests that money. The employee’s retirement benefit is based on their account balance at retirement. A 401(k) is a type of defined contribution plan.

This PERA Pro-Hybrid Plan Article Is Horsefeathers!

First, why propagate generational divisions except to further divide working PERA members from retirees (the latter pretty much relies on the DB plan)?

Second, “Gen-xers” generally are covered under Social Security and/or have collective bargaining, and/or receive higher private sector wages with perks and better employer matches than public servants (remember public servants, they’re the ones Colorado’s PERA was created to serve because they don’t have any of the things mentioned above!).

Third, but not last, this article simply furthers the elimination of PERA’s legacy DB plan; and in favor of an essentially worthless DC plan; but given the selection of the private sector vendor (or their options) for 401(k) and 457 plans, it seems the DC component was designed to reward private providers more than provide value to members.

Thanks for another illuminating article (illuminating in that it sheds light on how PERA is becoming a disincentive to work in public employment in Colorado).

PERA is among the most poorly funded public pension funds in the US. It’s retirees will receive annual increases of up to 2% in the best of times, and between 0 to 1% most years ahead due to high federal spending and the slow and inadequate Fed response to inflation.

The US capital markets have changed forever due to an increasing share of GDP being collected and spent by government at all levels. Defined Benefit pensions may never see the return of their historic gains.

Indeed, many retirees and others are experiencing a nuanced, modern definition of socialism … shared poverty. Cheers & best wishes!

If we had known that we would never receive a pension increase, after we retired would we still have spent all those years working for less than the private sector? (I consider 0% or 1% no increase)

Short answer is no….. just look at the teacher shortages. We worked for substandard salaries, and then retired under contracts to get a reasonable annual increase. That has turned into a net annual loss, not matching or even competing with inflation for nearly 15 years now.

PERA and CO took deferred compensation away from those who had already earned it.

The crowning irony…… they took our money ( their financial obligation), in order to insure they could continue to meet their financial obligations!! Good luck Colorado, in recruiting good teachers.

Are those of us who are penalized hundreds of dollars per month because of the windfall penalty ever going to get our fair share of Social Security that we paid into for years?

I agree about the windfall tax, why is that never mentioned in any articles! We paid into SS and are being robbed!

Hi Jerrie, we’ve covered federal WEP/GPO legislation multiple times this year. You can find the most recent article here: https://peraontheissues.com/an-update-on-2023-wep-gpo-legislation/. We continue to monitor this issue and will let our readers know of new developments when and if they happen.

DB recipients are limited to 1.5% raises, no matter what happens to the economy. This year, we only got a 1% raise, even though inflation averaged 8% in 2022. It doesn’t take long for retired folks to get extremely poor at this rate. We need to tell our legislators that we want raises that are closer to the increase in the cost of living.