In June, PERA released its 2022 Annual Comprehensive Financial Report (ACFR), which contains detailed information on PERA’s finances, investment performance, and funded status for the year ended Dec. 31, 2022.

The ACFR is a lengthy report with a large amount of information. To make it easier to digest, we’re highlighting some key facts and figures from the report to help those who want to know more about PERA’s finances.

This information is also available in an interactive format at copera.org/snapshot.

Plan assets and funding

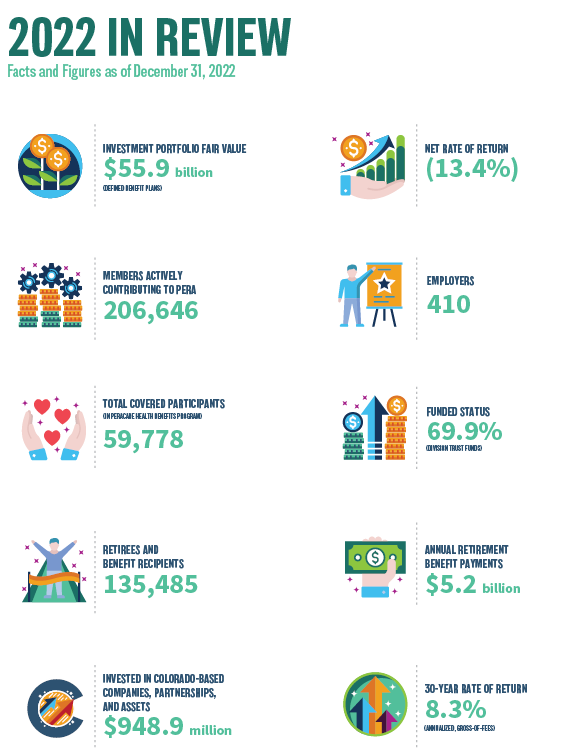

As of the end of 2022, PERA manages an investment portfolio of $55.9 billion for the defined benefit plans and $5.1 billion for the defined contribution plans. The defined benefit assets are split between the five division trust funds from which PERA pays benefits: State, Local Government, School, Denver Public Schools, and Judicial.

Last year, 206,646 members across 410 employers were actively contributing to their PERA accounts. Member and employer contributions to PERA totaled approximately $3.4 billion.

Fifty-nine percent of PERA’s investment assets are managed in-house by PERA staff, at an annual savings of $60 million compared to external management. Those assets are spread across six asset classes: Global Equity, Fixed Income, Real Estate, Private Equity, Alternatives, and Cash.

RELATED: Asset Classes Explained

PERA’s funded status at the end of the year was 69.9%, up from 67.8% at the end of 2021. According to state law, PERA must reach 100% funded by 2048.

Benefits paid

PERA paid a total of $5.2 billion in pension benefits to 135,485 retirees and beneficiaries in 2022, for an average monthly benefit of $3,238. The average age at retirement was 59.1 with 22.6 years of service credit.

PERA provides benefits to nearly 1 out of every 10 Coloradans who are current and former teachers, state troopers, snowplow drivers, corrections officers, and other public employees who provide valuable services to all of Colorado. Of the $5.2 billion paid last year, $4.5 billion went to 112,509 PERA retirees living in Colorado. That steady stream of income flows to every county in the state, providing stability to state, regional, and local economies.

Visit copera.org/snapshot for more details, including a county-by-county breakdown of benefits paid.

RELATED: PERA Benefits Contribute Billions of Dollars to State Economy, Support Thousands of Jobs

More information:

- Digital Snapshot

- 2022 Annual Comprehensive Financial Report (PDF)

- 2022 Popular Annual Financial Report (PDF)

- 2022 Actuarial Valuation (PDF)

Global equityA type of investment that includes publicly traded stocks in companies based in the United States and abroad.Asset classesA category of similar investments. Common asset classes include global equity (such as publicly traded stocks), real estate, and cash.Trust fundA fund in which money and/or other assets are held and managed by trustees on behalf of plan participants. PERA maintains trust funds for each of its Defined Benefit Plan divisions (State, Local Government, School, Denver Public Schools, and Judicial).AlternativesA broad category of investments that don’t fit into traditional categories like stocks and bonds.Defined benefitAlso known as a pension, this is a type of pooled retirement plan in which the plan promises to pay a lifetime benefit to the employee at retirement. The plan manages investments on behalf of members, and the retirement benefit is based on factors such as age at retirement, years of employment and salary history.Defined contributionA type of individual retirement plan in which an employee saves a portion of each paycheck (along with a potential employer match) and invests that money. The employee’s retirement benefit is based on their account balance at retirement. A 401(k) is a type of defined contribution plan.Private equityA type of investment in which investors purchase shares of a company that is not traded on a public stock exchange.Fixed incomeA type of investment that pays investors a fixed rate of interest over a set period of time. Bonds are a common type of fixed income investment.Asset classA category of similar investments. Common asset classes include global equity (such as publicly traded stocks), real estate, and cash.

Just signed up for Social Security and learned a few things! If you have Social Security and have less than 20 years they cut your Pay 512.00 a month. If you have 20 years or more they still cut it , but less, and at 30 years it isn’t cut. The real shocker is that if you and your spouse are both PERA retirees (both with cut SS) then they will cut SS of the deceased again if you receive their death benefits ?

Below is a link to a PERA article about this issue. Write to your congressional representative!

https://peraontheissues.com/an-update-on-2023-wep-gpo-legislation/?utm_source=POTI&utm_medium=email&utm_campaign=6-7-23

The question is how do we band together and let our representative in the Ways 8 Means Committee know we want them to complete their amendments foe HB 82 (Social Security Fairness Act of 2023) and get this to the floor for a vote. There are over 240 members from both sides of the floor supporting this. We need to write letters and make calls to let our representatives know how critical this bill is to us.

I suggest AARP members contact both the state and national offices of AARP to urge them to lobby for a COLA for PERA retirees and support H.R. 83, respectively.

Opps, typed too fast … it’s H.R 82 (not 83)

I am concerned with PERA Board & Staff (PERA B.S.) operating a “Hybrid Program,” for groups with different financial needs, i.e., retirees, and soon to retire, DB plan participants with shorter-term horizons; and recently hired working members (those hired after 2006, who did not elect the DB plan under PERA Choice), as DC plan participants with longer-term horizons. PERA B.S. is incapable of satisfactorily managing the DB plan with their strategy to focus only on a long-term fund solvency by 2048. It should be obvious that DB and DC plans are at odds with each other, and a “hybrid program” is questionable for both.

Immediate and more secure investments are satisfied by bonds and interest (representing liquidity), in contrast with long-term investing in equities on a cost-averaging basis (through payroll contributions with a limited number of varying investing vehicles based on risk levels), due to high P/E ratios. Likewise, opportunistic market timing (one way to reach 100% fund solvency by 2048) is foregone, as more liquidity isn’t available for “buying low” when the opportunity presents itself. Buying on a correction is a professional money manager’s dream, as even buying on the dip has been successful. A portfolio that has significant saver-like investments (which older investors prefer and have) actually outperformed the market and posted positive returns in 2022. Unfortunately, dividing the investing membership-base between short-term (DB plan) participants and longer-term or higher risk tolerant (DC plan) participants eliminates the opportunistic buying power of the membership overall. Dividing active members from retirees seems more designed to diffuse complaints, as the intent is to abandon retirees to inflation and let new hires fend for themselves (with the goal of only offering DC plans eventually). The Hybrid plan, or PERA B.S. performance doesn’t provide good returns for DB plan participants, and by definition they have no concern for the performance of anyone’s DC plan! The very notion of buy low and sell high is totally abandoned by PERA B.S., as DB plan participants tend to be more conservative while many DC plan participants haven’t been in the market long term (or have enough contributions) to effectively “time the market,” primarily because current equity prices are too expensive. The biggest disadvantage of dispersing fund balances into 401(k), 457, or DC plans, instead of remaining solidified in one DB plan, is the loss of control and scale in timing the market and the purchasing power of larger investments. It seems political expedience has won out over what’s best for all PERA members, as private and external fund managers reap fees and are awarded contracts that simply fleece both DC and DB plan participants. Indeed, the secret of exchange traded funds historically outperforming actively managed funds (besides diversity) is low management fees over time.

TOWN HALL QUESTIONS… SAVE THEM FOR THE PENSION REVIEW SUBCOMMITTEE ON JULY 17TH

The Annual Comprehensive Finacial Report (ACFR) is the epitome of “Figures don’t lie, but liars can figure.” Here are some questions the ACFR raises:

Why are retirees’ annual increases based on the Automatic Adjustment Provision (AAP), that uses funds’ market valuation on one day, at the end of the preceding year? Why doesn’t PERA Board & Staff (PERA B.S). provide a representative market valuation based on an average for all the days major markets are open in the prior year? Why doesn’t PERA B.S. estimate a daily market valuation of its holdings, and if it doesn’t or can’t, then how can PERA B.S. possibly estimate funding level of various pension trusts will be in 2048? I suspect PERA B.S. will say “private equity” (those secret investments) are too difficult to readily calculate (if ever, LOL!). Nevertheless, SB18-200 imposed benefit cuts and contribution increases predicated upon trust funds being 100% funded by 2048; and that’s what really determines the AAP from any year to the next; but in the long run, most retirees will DIE without an inflation adjusted increase before 2048 (the last inflation adjusted increase was in 2017*).

After the Town Hall, consider attending another meeting, i.e., the Pension Review Subcommittee (PRS) hearing on July 17, 2023 (see link below), or log-on to listen or participate remotely. The PRS informs the Pension Review Commission (PRC) regarding PERA and makes recommendations for legislation regarding benefits. The PRS and PRC may be additional bureaucratic layers between lawmakers and public servants, but they were created to take the heat off of PERA B.S., and retirees should appeal to them, because PERA B.S. points to them, and all lawmakers, in a circular blame game to deflect questions about its fiduciary duty to members (by claiming they primarily just make investments and process benefits, because it’s the law to disregard the welfare of retirees). PERA B.S. and their supporters will likely be at the PRS to regurgitate the Town Hall and portray members as appreciative of a good job of investing in a challenging market last year?

Retirees should go on record and inquire, “Why, despite years of crushing inflation and recent soaring market returns, is there only a 1% increase this year?” Are PERA B.S. inaccurately forecasting future assessments, investing poorly, remiss in not acknowledging fund values on the last day of the prior year are meaningless, and are they malfeasant in not advocating for a fair COLA? You’ll have to be civil and hold your tongue if some legislators gaslight you (many pit the taxpayers against PERA members, as if the latter are not part of the former), but the point is to show up, be cordial, but be heard! Follow this link or drop and drag it into your browser or search the Colorado General Assembly’s website –

LINK – https://leg.colororado.gov/content/ipensionrevewsubcomm2023asccheduleandmeetingmaterials

ALTERNATE LINK (Online web-cast for the day of the meeting,-https://sg001-harmony.slig.net/00327/Harmony/en/PowerBrowser/PowerBrowserV2/20230705/19/14788) – Colorado (sliq.net)

_____________________________________

FOOTNOTE * – Retirees haven’t had a reasonable increase since 2009, when SB10-001 eliminated any increase for a year, and then introduced so-called COLAs, that were capped at 2%. Retirees have been subject to successive waves of ex post facto laws in a legislative shell game reneging on a defined benefit plan with an escalator clause for inflation (integral to a good retirement, which was promised in lieu of being paid wages prevailing in the private sector). In essence, 2010’s legislation was a case of “Fool me once, shame on you,” but the 2018 legislation creating a NON-COLA (by basing any increase on the solvency of a fund which the legislature raids), is a case of “Fool me twice, shame on me.” Additionally, when most retirees earned their benefits, the law only allowed for the program to be financed through employer and employee contributions and increases, not draconian cuts to benefits – which the lack of a COLA is!

Are we ever going to get some cost of living increase?

Hi James, eligible retirees will receive a 1% annual increase with their July 2023 benefit payments and an additional 1% in July 2024. The annual increase percentage is set in statute and adjusts up or down based on PERA’s funding progress. The only way that would change is if the state legislature changes the law. This page has more information on how annual increases work: https://www.copera.org/annual-benefit-increases

So the annual report says an average monthly benefit was around 3200, per month. At 1%, the average benefit is $32 / month?!?! In what universe can that be called good management? Where is the fiduciary responsibility to act on the interests of member retirees??

Home insurance alone went up by 5x that amount last year. I don’t need to quote the inflation figures and interest rate hikes that crushed home values.

PERA must introduce legislation to reinstate the conditions under which we retired. 3.5% “guaranteed annual increase”. ( I still have the written paperwork, and PERA information put out for retirees in 2006!)

The State is capable of back-filling these contracts.

Poor James Stewart got the brush-off, in reply to his post… but I doubt Mr. Thorpe will get an “official reply” from PERA. I think PERA is in a bind to fulfill their fiduciary duties to members (all of them should do the honorable thing and resign as a message to the legislature). Indeed, it is the lawmakers that PERA members should contact (politely, but constantly until they say they will work on special session to provide retirees a COLA). The 3.5% annual increase was often cited by PERA as protection against inflation, and prompted many to continue working longer, enter into contracts to buy service credit, etc. Unfortunately the Colorado courts illegally upheld the 2010 legislation that eliminated the 3.5% annual increase. PERA can only do what the law allows, except for the part that says they have a fiduciary duty to members, so they go along with the politicians raiding the pension fund (primarily to finance ongoing state programs and bribe the electorate with TABOR refunds). Oh, by the way, did you know that TABOR does NOT require a vote of the electorate to exceed government spending limits or increase taxes … if it’s for pensions or the result of a court order. ’nuff said – ;-o

“Set in statute” largely because Pera supported the law that broke promises to current retirees. Pera is the only state retirement system in the USA that supports screwing their own retirees.

HERE’S 3 EASY QUESTIONS FOR PERA TO (NOT?) ANSWER:

1]-At what share price(s), and for how many shares, did the fund sell Zoetis Inc.; +2]- how many shares does PERA still hold of Zoetis inc.; &3]- what price(s), for how many shares, did the fund pay for Nividia Corp.?

Just Tuned-in to the Town Hall dog & pony show…And making comments as they come to mind during the Town Hall… Wow, is it the worst ever! So far we’re gonna get to waste money looking for a new chief thief, and the reason we’re not getting a COLA (in answer to the first question) is because that’s the legislature’s call, so sorry – 1% (be grateful for that). Naturally, since this is a “retiree’s meeting,” they were quick to point out that SB-200 “fairly” distributed the necessary actions across all members and it wouldn’t be fair to impose greater contribution rates on working members??? I suspect, in the evening version of this dog & pony show, they’ll assuage concerns about rising contribution rates by saying it wouldn’t be fair to reduce retirees’ benefits more. NOT A PEEP ABOUT THE EMPLOYER CONTRIBUTING MORE OF WHAT THEY OWE AND ARE IN ARREARS … Now some off-hand remark about the Social Security WEP is something you need to contact Washington about… now some drivel about they have a new phone system (boy does that sound like a government procurement scam, contractor field day, and waste of money). OH …. STOP PRESS now they’re doing a little survey, “Do You Want More Town Halls?” Let me guess – The Survey Says, “Yes Sir, May I Have Another!” Now the Financial lady is trying to tell everyone to be patient, until 2048 for full funding status…and a decent annual increase… Ha! Now they’re pulling the “Shared Sacrifice” card again… How many retirees will be dead long before they get an annual increase that remotely keeps up with inflation… “patience, they say.” What a farce … Now they’re taking calls quasi-active member questions, retired teachers, about how their return to work retirement (non-)reduction impacts the fund (different than other retirees who return to work, because they don’t have a bunch of kids to hide behind) or why did PERA oppose it… PERA opposed it because it costs the fund money (again they don’t say that the real issue is that educational employers wouldn’t make the actuarially required contribution to hold the fund harmless)… Now someone named Ed is asking about insufficient fund solvency possibly resulting in no benefits and once again the financial lady’s response is, “Wait until SB-200’s shared sacrifice works it way through to 2048, to make everything good.” … Although you’ll be dead by then. This is a ridiculous waste of everyone’s time and PERA member’s money! The poll question results … Just as I suspected an overwhelming majority said YES! Now more about firing the last “Chief Thief.” I’ve heard enough … I don’t want to miss the “Price Is Right.” In closing, these board and staff members should all resign for violating their statutorily required fiduciary duty to lobby for a COLA! COLA NOW!

Amen!

These townhall meetings are a joke…message from PERA Executives is for retirees to be “patient “ while we experience our PERA benefit being eroded by inflation. PERA was ok with supporting a reduction and freeze of the AI, but now all answers are political and the have no credibility or integrity in supporting retirees!! Are some of you ready to get rid of these PERA employees that don’t fulfill their fiduciary responsibilities to PERA retirees? If so, reply to this post! I’m tired of hearing excuses and no action!

I’m tied of hearing all of the political answers by PERA employees that have a fiduciary responsibility to represent retirees. Our AI has been eroded over several years and these PERA employees have no interest in hearing PERA retirees! Maybe it’s time to find PERA employees that will listen to and support retirees concerns. If you agree reply to this post. Thank you for reading my post.

REPLY TO MARK JAMES (And Others Similarly Inclined):

PERA Board & Staff (PERA B.S.) are just apparatchiks of the governor and lawmakers, fearful for their own jobs and more concerned with feathering their own nests than fulfilling their fiduciary duty to lobby for a COLA for retirees. However, don’t complain to either Board members or staff, as the fish rots from the head down… IT’S THE POLITICIANS YOU MUST CONTACT AND IMPLORE TO DO THE RIGHT THING! Just keep contacting them relentlessly (politely but firmly). Start by tuning-in to “Colorado General Assembly’s Pension Review Subcommittee” on July 17th (google those words to figure out how). You might consider contacting the state Attorney General, Denver’s District Attorney, and the State Treasurer and inquire what they think of this long running ELDER ABUSE & FRAUD?