Every month, Colorado PERA distributes millions of dollars in retirement benefits to more than 110,000 retirees living in Colorado. Those retirees spend their retirement income in their communities, contributing to the local and regional economies and supporting thousands of jobs.

The economic effects of PERA retiree spending are the focus of a recently released report, Colorado PERA’s Economic and Fiscal Impacts, prepared by Boulder-based Pacey Economics.

In 2021, PERA paid $4.35 billion in retirement benefits to more than 110,000 Colorado retirees, resulting in $6.8 billion in total economic output and supporting 31,449 jobs statewide, according to the report. In addition, retirees paid $382.2 million in state and local taxes on those PERA benefits.

The multiplier effect

Every dollar a retiree receives from PERA is a dollar they can spend on goods and services in their community — at the grocery store, restaurants, retail stores and other businesses. That spending sets off a multiplier effect as businesses then spend money to stock more inventory and hire more staff. The result is that original PERA dollar continues to be invested in the local community as businesses and their employees also purchase goods and services.

This cycle of spending illustrates the economic measure of “value-added,” which counts only the additional production of goods and services resulting from PERA distributions rather than total output.

Pacey Economics estimates a PERA retiree’s economic output multiplier at 1.56, meaning an extra 56 cents are generated in the economy for every dollar a retiree spends. In total, PERA retiree spending resulted in $3.16 billion in added economic value statewide last year.

PERA benefits as a stabilizing force

PERA distributions are a source of regular, reliable income for the thousands of Colorado retirees who receive them. That consistent flow of income is especially helpful to local and regional economies during times of uncertainty and downturn.

“Retiree and beneficiary spending is a vital part of Colorado’s economy,” said PERA Executive Director Ron Baker. “The stabilizing effect of that spending has been evident amid the economic uncertainty we’ve experienced in recent years.”

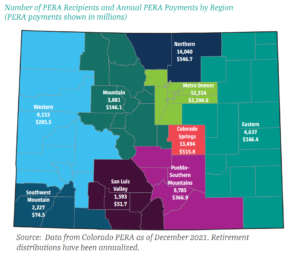

While the Denver metropolitan area has the largest number of benefit recipients, the impact of PERA benefits is especially large in rural areas of Colorado, where there may be lower economic activity. In rural parts of the state, PERA distributions are higher per capita and they make up a larger portion of county payroll.

For example, in Custer County, PERA retirees received more than $7 million in retirement distributions in 2021, representing more than 37 percent of payroll. In Denver County, $383,118,000 in PERA distributions amounted to just over 1 percent of payroll. Statewide, PERA benefits make up 2.9 percent of payroll.

For more information, including detailed breakdowns by region and county, download the full report here.

Don’t forget, not all PERA retirees are in Co. We actually are adding too the National economy also, not just Co. This my change without a COLA adjustment!

What percentage of CO PERA retirees live out of state?

Approximately 10 percent of PERA retirees live outside of Colorado.

PERA PR Officials have ROSE color glasses super glued to their heads. So much sugar should be packaged and sold to pay down PERA’s lack of full funding. Many older retirees who retired without the higher salaries of today are struggling to buy food, gas and pay the cost of housing with high inflation and cut rate COLA’s.

What is the average Para monthly check to all participants.

Hi Carolyn, the average monthly benefit in 2021 was $3,220.

Yet, in an audit of ECSD’s error my annuity was decreased. First, I had a 2022 retroactive over payment taken out of my April 2022 check. Then I was told that ESCD should repay me -as they had been refunded for the overpayment error. So, I sent 6 emails before I saw a small check. My questions are: How does a $70.oo refund account for approx $20. decrease in my life time monthly annuity?

Where was my COVID bonus?, and wouldn’t this return my annuity 5 fold? How can you say that my long awaited for bonus that came my last few years before retirement can’t be considered in it’s entirely- because it was a certain % OVER the allowable increase? Yet, turn around and decrease my annuity payment a YEAR after retiring?

Don’t get me started on my 401K rollover into a toilet spiral flush.

Underappreciated & underrespected;