The Colorado Board of Trustees on Friday, June 16 approved the release of PERA’s 2022 Annual Comprehensive Financial Report (ACFR). The ACFR contains a detailed account of PERA’s finances, investment performance, and funded status for the year ended Dec. 31, 2022.

The ACFR provides valuable insight into PERA’s financial health, operations, and membership for the year. PERA has routinely earned awards for excellence in financial reporting for the ACFR.

Financial highlights

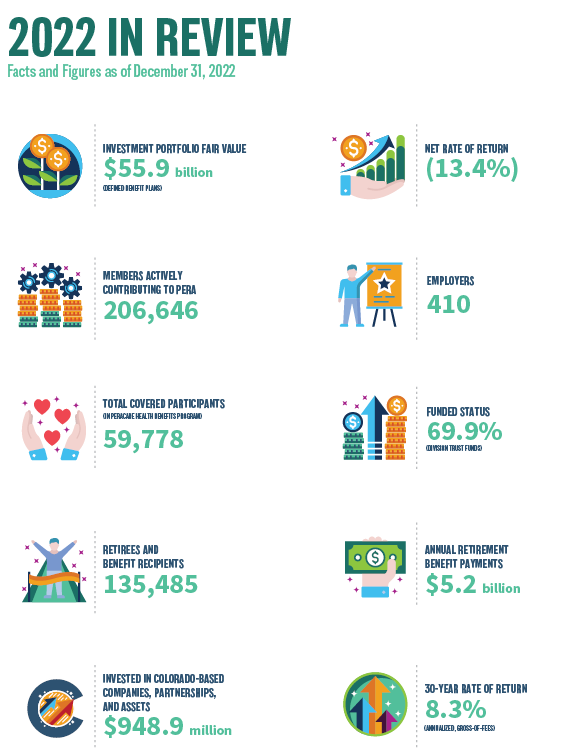

Like many investors, Colorado PERA experienced a negative return on its investment portfolio in 2022. The total fund ended the year with a return of -13.4% net of fees, compared to the benchmark’s -13.7% return.

While the markets may go up or down in a given year, PERA’s portfolio is designed to generate value over the course of several decades. Over the past 10 years, the total fund has achieved an annualized return of 8.0%, while the benchmark earned 7.1%.

“2022 was a challenging year for investors, including Colorado PERA, but our strategic asset allocation ensures we have a well-diversified portfolio that can withstand different market environments,” said Interim Executive Director/Chief Investment Officer Amy C. McGarrity. “Our focus on long-term financial outcomes contributed to our ability to pay $5.2 billion in benefits to more than 135,000 PERA retirees last year alone.”

As of the end of 2022, PERA manages an investment portfolio of $55.9 billion for the defined benefit plans and $5.1 billion for the defined contribution plans. PERA’s funded status at the end of the year was 69.9%.

Explore highlights from the ACFR in an interactive online format here.

Automatic Adjustment Provision

The Automatic Adjustment Provision (AAP), as set in state statute, adjusts member and employer contributions and annual benefit increases based on PERA’s progress toward its goal of full funding by the end of 2047. The AAP calculation is made on an annual basis, to take effect the following year.

Based on 2022’s financial results, adjustments via the AAP will not be needed next year. That means member contributions will remain unchanged in 2024. Eligible benefit recipients will receive a 1% Annual Increase in July 2023 and another 1% Annual Increase in July 2024.

More information:

- Digital Snapshot

- 2022 Annual Comprehensive Financial Report (PDF)

- 2022 Popular Annual Financial Report (PDF)

- 2022 Actuarial Valuation (PDF)

Automatic adjustment provisionA provision of Colorado law that automatically changes PERA contributions (from employers, employees, and the state) and annual benefit increases based on PERA’s funding progress.AapA provision of Colorado law that automatically changes PERA contributions (from employers, employees, and the state) and annual benefit increases based on PERA’s funding progress.Annual increaseAn adjustment to PERA retirees’ monthly benefit payments, paid in July each year. The Annual Increase amount is set in statute and can adjust up or down based on PERA’s funding progress. It is not tied to inflation.Defined benefitAlso known as a pension, this is a type of pooled retirement plan in which the plan promises to pay a lifetime benefit to the employee at retirement. The plan manages investments on behalf of members, and the retirement benefit is based on factors such as age at retirement, years of employment and salary history.Defined contributionA type of individual retirement plan in which an employee saves a portion of each paycheck (along with a potential employer match) and invests that money. The employee’s retirement benefit is based on their account balance at retirement. A 401(k) is a type of defined contribution plan.Asset allocationAn investor’s mix of stocks, bonds, and other investments. PERA’s strategic asset allocation is set by the PERA Board of Trustees.BenchmarkA tool used to measure performance. For example, an investor can use a stock index as a benchmark to measure his/her own investment performance compared to the market as a whole.

With respect to the Automatic Adjustment Provision (AAP), as the article states, “Based on 2022’s financial results, adjustments via the AAP will not be needed next year. That means member contributions will remain unchanged in 2024. Eligible benefit recipients will receive a 1% Annual Increase in July 2023 and another 1% Annual Increase in July 2024.”

The reality is that retirees will be receiving a NEGATIVE adjustment. Monthly benefits will be LESS due to INFLATION and LACK OF A REASONABLE COLA!

The fact that the funds book or market value (a guess at best) is based on one day of a year (the last day) is a farce, just like the AAP. The AAP won’t increase if the fund’s value increases and it will NEVER catch up with inflation!

…and yet investment are forced to include Green initiatives rather than what would produce the best returns.

Hi Lyle, PERA does not have any environmental, social or governance (ESG)-centric investment requirements and does not screen investments based on any specific ESG criteria. Our priority is maximizing long-term, risk-adjusted returns so we can continue paying benefits, and our focus is on financial sustainability first and foremost. We encourage you to take a look at our Investment Stewardship Report (copera.org/investment-stewardship) to better understand how we serve as stewards over plan assets.

As others have said. We just keep slipping further behind in our financial situation… so sad… PERA use to be a wonderful retirement… now we are a joke…

Let those who have achieved a 13.4 percent return in 2022 in their personally managed accounts be the first to throw stones at PERA! Well done, PERA!

I should have said “achieved better than a negative 13.4 percent return”. I know I didn’t.

I don’t think anyone is throwing stones at PERA for a MINUS 13.4 % market valuation, because it’s neither a loss nor a return, it’s just a hypothetical number (had PERA liquidated all their positions at the close of business on Dec. 31, 2022). Although, investments spread among Money Market & CD accounts, U.S. Treasury bills, Dollar Index funds (Currency Foreign Exchange), and/or Commodity assets would have posted a “positive return” at the end of 2022 (exactly the kind of investments casual savers favor with the most yielding interest).

However, PERA Board & Staff would caution results for one year should not be used to characterize fund performance; nevertheless the challenge to compare PERA’s results to one’s own personally managed funds brings up a good point, i.e., it is one’s choice and money to pay for investment advice, access, and fees for one’s personal accounts; but in contrast with PERA’s results, it’s the membership that pays PERA’s salaries and various investment fees and it’s the membership that suffers from poor long term results.

It’s not the fact that most savers outshined PERA’s results for 2022, as personally managed 401 (k) accounts also fared poorly (unless, one was already retired and cautious with their investments, and such accounts probably out performed PERA, but relying on a single year’s return is mere speculation). The point is PERA spent hundreds of millions of members’ dollars on consultants, last year, to achieve 2022’s negative result (and that does NOT count the routine operating costs for administrating the fund to process benefit claims or operating this website, or hosting townhalls, etc.).

The gain or loss at the end of 2022 is irrelevant; like a strawman argument comparing investment performance just to give PERA accolades; and for what? – charging members to make mediocre (and often secret) investments. One end-of-year market valuation is a red hearing (although politicians might use it to argue for more benefit cuts). The real issue is PERA’s long term fund solvency, hampered by politicians shortchanging employer contributions, resulting in BENEFIT CUTS for retirees (lack of a COLA, common in DB plans, equates to a cut during high inflation).

-handsoffmypera@hotmail.com–

Agreed.

Right on, Tom!

I cannot believe these negative comments about PERA. PERA took us through a pandemic while thousands of others lost jobs and apartments. People who know I have PERA benefits are envious. I have been told by financial planners that those who have PERA benefits need little or no financial planning at all. The market goes good and bad and sometimes

we have to suck it up like all the rest. PERA makes the ride so much easier. I am thankful for what we have. There are thousands out there that wish what we are blessed with. Just hush and enjoy the rest of your life.

Well said, Glenn!

“Just hush and enjoy the rest of your life.” Sounds like a PERA Board Trustee!

You read my mind GM Santo.

I totally agree with your comments, Glenn. I feel blessed to be a PERA retiree. I have nothing negative to say.

You should get a new financial planner.

I agree with Glenn’s comments! Would all of you PERA naysayers, rather give a little each year based on Senate Bill 18-200; or take a monthly benefits cut or even lose your pension due to insolvency? If you look at your Retiree Annual Statement, you’ll see what your total contribution was plus interest; and what PERA has paid you in total benefits since retirement. Mine is +82% after 8 years.

I think that PERA should at least acknowledge that the cost of living increase is far more than the cost of our adjustments and has been out of balance for a very long time. Something needs to be done about this. We struggled to raise families on teacher’s salaries for years and now we face the same situation, if not worse for the remainder of our lives. Social Security realizes this and has made better adjustments for its retirees.

PERA is a replacement benefit plan for Social Security, yet the Annual Increase is not indexed to inflation. Per the current annual report, PERA won’t reach full funding for 26+ years. Retirees will be devastated by inflation and an inadequate A.I. Many retirees don’t have time (or health) to plan or adjust financially. Quite simply PERA is failing retirees until legislative changes are made. Time for change!

I’m happy to be a PERA member. Our (PERA’s) annual investment return has been impressive. Yes, I wish our annual increase was larger, but a least we’re not talking about benefit cuts like social security beneficiaries are.

I totally agree, David. Our benefits are much more generous than Social Security.

I also receive a pension from the New York State Teacher’s’ Retirement System.

“It is 99.3% funded. 85% of its income comes from investment returns. It invests its assets to achieve optimum long-term returns with an appropriate level of risk. The System is among the 10 largest public pension funds in the nation based on total assets, according to Pensions and Investments. It is among one of the most secure and well funded public pension plans in the country thanks to a proven investment strategy and dedication to thoughtful stewardship.”

I have brought this to the attention of PERA several times over the years. I receive no response to my emails. You would think they might take a look at what this pension plan is doing right.

What was New York State Teacher’s Retirement System’s investment return for 2022?

20 years ago and more, PERA returns increased dramatically year by year. Now that the returns are considerably less (my monthly pension seems to have become stagnant for quite a few years now), is it possible that we could take less of a hit on our social security?

I agree with Glenn Blanco.

Sometimes, people are unable to see the world around them. The majority of people in our nation will rely on Social Security. I would trade Social Security for PERA any day of the week. The federal government doesn’t seek our input or listen to our concerns. If a person is not happy with how PERA is operating then come up with viable solutions to address their concerns rather than just complaints. Complaining is easy. Solutions require effort.

Your observation or lament about Social Security is off topic, except as a ploy to distract from the real issue (e.g., look at them, they have it worse than you, be happy for what you have, love it or leave it, etc.).

However, your suggestion to come up with viable solutions is spot on! The solution is for PERA members to organize, towards lobbying elected officials to institute a COLA! A decent COLA for retirees is very much needed; and that may require the state (employers) to make their actuarially required contributions (ARC) to the pension fund to restore long-term solvency; but that in turn requires the state to quit being a deadbeat and honor their obligations and keep their promises.

The devil is in the details, but retirees have nothing to lose by organizing to seek a decent COLA (as inflation could make PERA worth less than Social Security … doubly unfortunate for many PERA members who’ll lose significant amounts of Social Security they’d otherwise be entitled due to their PERA pension and the GPO and WEP).

If you don’t think it’s too much effort, I’d encourage you to write your state representatives (asking for a decent or reasonable COLA) and organizing with fellow PERA members to further that goal. Hopefully you wouldn’t do the opposite and lobby to keep things as they are, because that’s unnecessary since PERA’s Board of Trustees already does that.

I agree with you, Christopher. Well said.

The observation that PERA is still better than Social Security is off topic, except as a ploy to distract from the real issue (e.g., look at them, they have it worse than you, be happy for what you have, love it or leave it, etc.).

However, coming up with viable solutions is a good idea! The solution is for PERA members to organize, towards lobbying elected officials to institute a COLA! A decent COLA for retirees is very much needed; and that may require the state (employers) to make their actuarially required contributions (ARC) to the pension fund to restore long-term solvency; but that in turn requires the state to quit being a deadbeat and honor their obligations and keep their promises.

The devil is in the details, but retirees have nothing to lose by organizing to seek a decent COLA (as inflation could make PERA worth less than Social Security … doubly unfortunate for many PERA members who’ll lose significant amounts of Social Security they’d otherwise be entitled due to their PERA pension and the GPO and WEP).

I encourage retirees to write their state representatives (asking for a decent or reasonable COLA) and organizing with fellow PERA members to further that goal.

handsoffmypera@hotmail.com

As a widow who joined PERA late in life and took a large windfall Social Security monthly loss of $440 a month the 1% cola on Pera Pension versus the cola on what is left of my monthly Social Security is a joke. When I was forced into retiring early i could I thought still look ahead to a comfortable if not plush retirement. However, with a 1% cola every year I am quickly falling behind. Is this how Colorado treats its retired teachers and government employees? Are we destined for senior poverty even though we thought that PERA would give us a modest retirement. And what about our representatives working towards ending the penalization of our earned Social Security benefits because later in life we decided to become public servants. Shouldn’t that be rewarded, not penalized. Who is fighting for us?

I encourage PERA members to read one of the best articles I have read from Fisch Financial trying to explain PERA’s funding situation in ways that non CPA members can understand.

https://fischfinancial.org/2022/09/25/colorado-peras-funded-status-the-signal-light-report-and-the-aap/#:~:text=If%20you%20look%20at%20the,%25%2C%20State%20Division%2064.0%25).

or in case the link doesn’t work google Colorado PERA’s Funded Status Fisch Financial, Sept. 25, 2022 article.

I remember the years of Walker Stapleton (R) as State Treasurer (which automatically put him on PERA’s board) and his (R) cronies across the country screaming the sky was falling with public defined benefit contribution pensions. It was a coordinated attack with numerous conservative think tanks and politicans hammering newspapers and the internet across the US that public pension plans were going broke and you would be left holding the bag. Invoking the old “envy your neighbor” trick- claiming public employees were getting rich on their fat public pensions while you were working hard with no pension all while paying for theirs. Remember when he sued PERA board members (and lost) to obtain the identities and benefit records of PERA members? We are now living with the results of the changes Senate Bill 18-200 brought us which is shared hardship between employees, employers and retirees. As the article states it is hitting retirees particularly hard right now because we are living on fixed income and experiencing record high inflation. I am thankful for our current legislature and State Treasurer. Less PERA drama!

Can anyone post comments here, or only PERA members (if only members, does that include those who work at the retirement association)? What about PERA’s consultants and contractors, and their employees and friends? After reading some comments, can scammers or AI chat bots post comments (do scammers or AI chat bots sometimes reply?).

“The … 2022 Annual Report by the PERA Board is an important update that provides valuable insights into the organization’s performance and financial status. This report plays a crucial role in promoting transparency and…,” blah, blah, blah… please send $10 with a self-addressed return envelope to the following address for more insightful commentary…

Hi Joseph, we appreciate your concern and we do our best to prevent and remove any spam or scam comments on PERA On The Issues. The content on this site is public and meant for PERA members, retirees, and other stakeholders, including the general public, so we do not restrict commenting to only PERA members. The PERA staff who monitor these comments respond under the name PERA On The Issues, as you can see here. Thanks for reading.

RRRRr U U N N U U TTTTT sSSs

R Rr U U Nn N U U T S

R R R r U U N n N U U T Ssss

R R U U N n N U U T S

R R UuuU N N UuuU TT sSSS?

_ ARE YOU NUTS ? _

This Is The Reply From PERA:

“Hi Joseph, we appreciate your concern and we do our best to prevent and remove any spam or scam comments on PERA On The Issues. The content on this site is public and meant for PERA members, retirees, and other stakeholders, including the general public, so we do not restrict commenting to only PERA members. The PERA staff who monitor these comments respond under the name PERA On The Issues, as you can see here. Thanks for reading.”

If I were a PERA member or retiree (isn’t the latter both?), I might think your reply and moderator policies are nuts, or at least arbitrary and capricious.

What is meant by the, “general public?” Citizens, taxpayers, any human on the planet?

Who are the other “stakeholders?” Does that apply beyond individuals to businesses, organizations, and include private equity concerns used by PERA, whose identities are secret?

Does “the content on this site is public,” mean anyone can post comments on anything and be considered protected speech under the First Amendment (anonymously or otherwise)?

Finally, where are the published rules for posting comments on this site or is publication purely at the discretion of anonymous PERA staff?

Looking forward to your reply…

_ ARE YOU NUTS ? _

This Is The Reply From PERA:

“Hi Joseph, we appreciate your concern and we do our best to prevent and remove any spam or scam comments on PERA On The Issues. The content on this site is public and meant for PERA members, retirees, and other stakeholders, including the general public, so we do not restrict commenting to only PERA members. The PERA staff who monitor these comments respond under the name PERA On The Issues, as you can see here. Thanks for reading.”

If I were a PERA member or retiree (isn’t the latter both?), I might think your reply and moderator policies are nuts, or at least arbitrary and capricious.

What is meant by the, “general public?” Citizens, taxpayers, any human on the planet?

Who are the other “stakeholders?” Does that apply beyond individuals to businesses, organizations, and include private equity concerns used by PERA, whose identities are secret?

Does “the content on this site is public,” mean anyone can post comments on anything and be considered protected speech under the First Amendment (anonymously or otherwise)?

Finally, where are the published rules for posting comments on this site or is publication purely at the discretion of anonymous PERA staff?

Looking forward to your reply…

Our Privacy and Security Notice (https://www.copera.org/privacy-and-security-notice) and Social Media Policies (https://www.copera.org/social-media-policies) apply here. – Kurt

P.S. 2 My “R U Nuts” Comment… Thank you for removing the comment by “James,” which made no sense, included a suspect website, and was the reason I started questioning who moderates and posts on this site.