For all the talk about how much public pensions cost state

and local governments—and by extension, taxpayers who don’t work in the public

service sector—the positive economic effects these plans have on virtually

every state and city in the country have received far less attention.

A new report by the National Institute on Retirement Security (NIRS) provides a much clearer picture of just how significant this contribution is. On January 10th, NIRS released “Defined Benefit Pension Expenditures (opens in a new tab)" href="https://www.nirsonline.org/reports/pensionomics-2018-measuring-the-economic-impact-of-defined-benefit-pension-expenditures/" target="_blank">Pensionomics 2018: Measuring the Economic Impact of Defined Benefit Pension Expenditures,” which quantifies how much public service retirees spend in and around their communities.

These amounts could hardly be more significant: In 2016,

retiree spending of pension benefits created $1.2 trillion of economic output

and supported about 7.5 million jobs across the U.S., which is almost 5 percent

of the country’s entire workforce. These funds also poured $202.6 billion into

federal, state, and local coffers in the form of taxes.

About the results, NIRS executive director Diane Oakley

said, “Pension expenditures are especially vital for small and rural

communities where other steady sources of income may not be found if the local

economy lacks diversity.”

When retirees receive their monthly check, the ripple

effects begin. In 2016, almost $295 billion was paid to about 10.7 million

retired state and local public service workers and their beneficiaries. These

people then use this money to pay for goods and services such as food, health

care and retail products, and most of this everyday spending, of course,

happens where retirees live. The report concludes that each dollar paid in

pension benefits in 2016 supported $2.13 in total economic output nationwide.

But that’s not all. By their nature, public pensions invest

much of what they receive as contributions from employees and employers, which

means that thanks to pensions’ strong long-term investment returns and the

shared funding model, in 2016, each taxpayer dollar that went to supporting

these pensions generated $8.48 in total economic output.

This already impressive return on investment has an even

more acute impact in Colorado, where 90 percent of the state’s retirees choose

to live after they end their careers instead of heading for retirement hotspots

such as Arizona or Florida.

Economic and business analysis firm Pacey Economics calculated the economic impact of benefits paid to retirees in the Colorado PERA system, and found that these retirees generate about $6.5 billion in annual economic output on $4.1 billion in benefits paid, which supports about 35,000 non-public service jobs statewide.

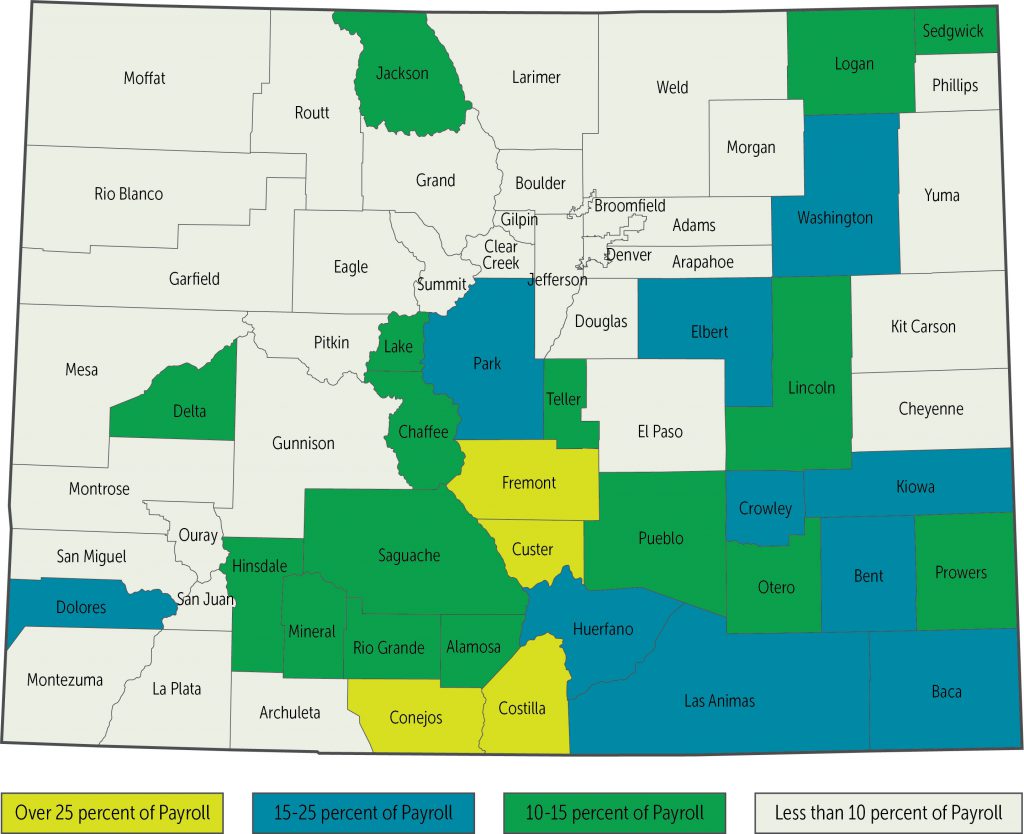

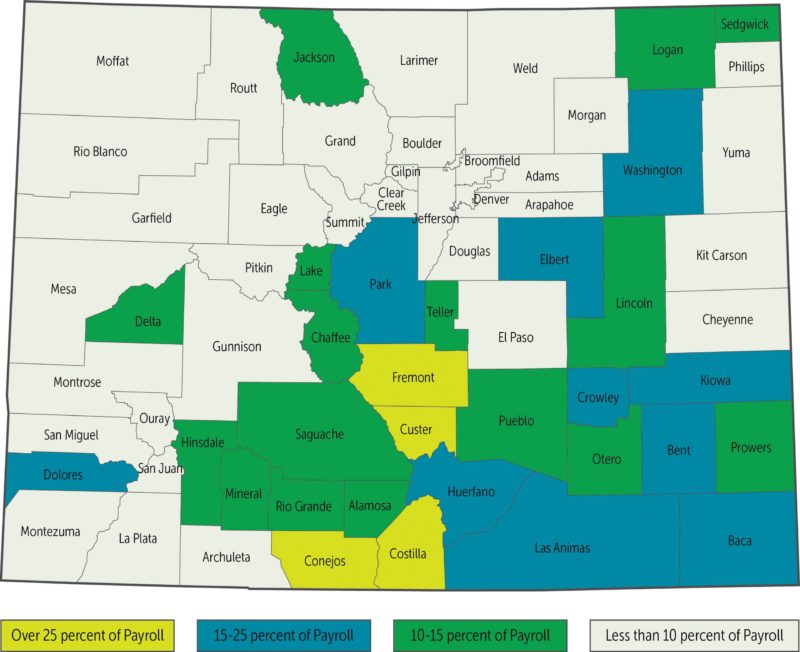

As the accompanying chart illustrates, in almost half the

counties in Colorado, PERA benefit distributions amount to at least 10 percent

of area payroll, and that number rises to more than 25 percent of payroll in

four counties. And per Oakley’s comments, Colorado’s more sparsely populated areas

see the greatest impact from these funds.

The political and economic discussions around public pensions are complex and thorny. But as these debates continue, it’s worth remembering what invaluable contributors they are to the national as well as local economies.

Defined benefitAlso known as a pension, this is a type of pooled retirement plan in which the plan promises to pay a lifetime benefit to the employee at retirement. The plan manages investments on behalf of members, and the retirement benefit is based on factors such as age at retirement, years of employment and salary history.

Wow. My hope is all policy stakeholders will read and understand this report. To those who advocate a 401k style alternative to a pension, these same retirees, if forced into a 401k, would likely have less financial stability, increasing their likelihood of moving to a state with a lower cost of living for retirement. . Doing so would negatively impact Colorado’s long term economic security, another reason to keep the defined benefit Pera package.

So, clearly, it would behoove the entire community to reinstate the COLA as contractually promised .

If these pensions are so valuable to the community then let’s mandate that all working Americans be enrolled in these plans.