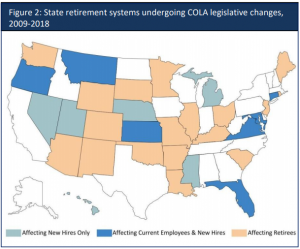

By now, Colorado PERA members are well aware that their Annual Increase (AI), or cost-of-living adjustment (COLA), has undergone some belt-tightening changes with the passage of Senate Bill 200 last year. What members and retirees may not know is that this action followed a broader trend for public pension plans throughout the U.S. In the past decade, pension funds in 18 states, including Colorado, have enacted reforms that changed COLA for existing retirees. Seven states have adjusted COLA for current employees and new hires, and another six have changed them for new hires only.

While there are many types and variations of Annual Increase and COLA (ad hoc, fixed, simple, compounding), essentially the adjustments to retirement benefits are meant to counterbalance inflation, which reduces the purchasing power of a fixed income. These adjustments are of additional importance to states such as Colorado, where a majority of public employees do not participate in Social Security. But unlike Social Security, defined benefit plans, including PERA, typically pre-fund COLA via employee and employer contributions over the course of employees’ careers.

The structure of pension plans varies widely, so it’s only natural that COLA do, too. PERA’s COLA is automatic, or predetermined by a set formula; and it’s compounded, meaning that annual benefit increases are calculated based on the original benefit plus any prior benefit increases. PERA’s annual COLA changes are influenced by the financial performance of the fund. For some PERA retirees, the COLA is based on factors such as the rate of inflation and the health of the Annual Increase Reserve for each membership division.

The COLA may also be affected by a person’s age, date of hire, or years of service and the length of time in retirement. If all of this seems complex, it is – because it varies for different PERA members. For a full explanation of how PERA’s COLA calculations work in practice, refer to the Annual Increase (AI) fact sheet.

The primary reason so many states have targeted COLA in their pension reform efforts is cost, along with the U.S. economy’s recent track record of historically low inflation. The NASRA research (on page 3) notes that a compounded automatic COLA of 1.5 percent will add 11 percent to the lifetime cost of a retirement benefit, and a 3 percent COLA adds 26 percent to that cost.

The changes to PERA’s pension fund were enacted by the State Legislature, as is often — though not always — the case with pension alterations around the country. One key component of the Colorado General Assembly’s efforts in 2018 was the addition of an automatic adjustment provision, which could enable COLA to decrease or increase depending on PERA’s progress toward reaching full funding within a closed 30-year time frame. The upshot for PERA members and retirees: The recent changes to the pension plan are not without pain and angst, but they’re part of a national trend toward protecting the long-term viability of public pension funds as well as stabilizing the funded status of the PERA plan which benefits all stakeholders.

ColaAcronym for cost-of-living adjustment; a type of annual adjustment meant to prevent a person from losing buying power due to inflation.ColaAcronym for cost-of-living adjustment; a type of annual adjustment meant to prevent a person from losing buying power due to inflation.Annual increaseAn adjustment to PERA retirees’ monthly benefit payments, paid in July each year. The Annual Increase amount is set in statute and can adjust up or down based on PERA’s funding progress. It is not tied to inflation.Defined benefitAlso known as a pension, this is a type of pooled retirement plan in which the plan promises to pay a lifetime benefit to the employee at retirement. The plan manages investments on behalf of members, and the retirement benefit is based on factors such as age at retirement, years of employment and salary history.Fixed incomeA type of investment that pays investors a fixed rate of interest over a set period of time. Bonds are a common type of fixed income investment.

I worked for 31 years and was only able to buy A year. I retired with a promised 3 1/2 % annual increase to cover future COLA. That effectively has been stripped from me and my earned retirement. Meanwhile those with short service and larger salaries were allowed to buy huge numbers of years and they receive a retirement payment on this large salaries. So my question is why do long term workers like myself have their benefits stripped from them to cover the wealthy short term employees who bought decades worth of service that they did not put in?

Hello Mike,

Thank you for your question. In 2003, the amount of service credit members may purchase was limited to 10 years and the cost to purchase service has increased since then to reflect the cost of providing the benefit. The formula to calculate a benefit has not changed (years of service times Highest Average Salary times 2.5 percent). Contributions made by members and their employers and investment income are used to pay benefits. Members with long public service careers do not subsidize those with shorter tenures.

All well and good if teachers were not always behind on the pay scale. When my husband and taught scholl we were always $120.00 per month behind the inflation. The state has an obligation to pay us the promised retirement since employment didn’t pay the bills.

The recent SB 200 changes, that eliminated Cost Of Living Adjustments for the next 2 years and reduced the Cap thereafter, was a classic money grab by the legislature at the behest of the PERA Board. They chose to take a substantial amount of money from the “stakeholders” who can least afford to lose income to inflation. Retirees living on fixed incomes will have these current losses compounded each year for the rest of their lives.

Eliminating Cost Of Living Adjustments that were in place when people retired was, and is, an unconscionable practice. Our new Governor and new legislature can change this practice irrespective of the “trend” this article references or the misguided recommendations of the PERA Board.

Changing the title from COLA to Annual Increase changes the purpose from “keeping up with the cost of living” to “giving pensioners a raise”. Different optic. It’s intended to change how taxpayers feel about pension increases- COLAs reflect reality. AI’s suggest pensioner greed. Shame on you PERA. Shame on the Colorado legislature.

Dear Mr. Waldorf,

Just to be clear, in Colorado statute the amount paid to retirees is called an “Annual Increase.” We’ve sometimes used the more familiar term “COLA” when we’ve written about this feature of the PERA plan. PERA’s official publication on the topic is called “Annual Increases for Benefit Recipients” and may be found here: https://www.copera.org/sites/default/files/documents/2-247.pdf

Dear PERA Rep:

The Article begins by using the terms “Annual Increase” and “Cost Of Living Adjustment” within the very first sentence as though they are interchangeable.

So if your point here is to clarify that Colorado law does NOT provide or promise a true “Cost of Living Adjustment,” it would be helpful if you stated that more clearly.

The ongoing practice employed by PERA Reps, Agency HR Reps, and Legislators, to use the term COLA will continue to mislead potential new hires, current state employees, and retirees. Using the term suggests that there is a reasonable formula in place to provide increases consistent with the current cost of living.

Clearly, we all need to have conversations with our legislators about the need to enact legislation that will clearly provide a true Cost Of Living Adjustment for employees when they retire.

Paul,

Thank you for your comments. We appreciate the feedback.

Interesting when I retired it was called COLA not AI. I’m disappointed.

The notion that inflation in the US is low is incorrect. It ignores aspects that fluctuate more widely that aren’t included in the figure. For example, for 2019 my pre-Medicare health insurance premium went up 40% (no change in plan). Other health costs are increasing faster than “inflation” and healthy food continues to escalate in price along with property taxes and housing costs. Rates on savings accounts are still lower than inflation, so retirees are hit in multiple ways and continue falling further behind. I’m disappointed that PERA didn’t fight harder to maintain annual increases for retirees.

I too have been impacted by the outrageous premium increase combined with the elimination of COLA. Like others, if I had not relied on the promises that had been made I might have made different decisions.

Here. Here. I second what Linda said word for word.

I totally agree. My health Insurance through PERA is outrageous. I have to get the cheapest insurance which makes my deductible $6,000 and max out of pocket $12,000. I can’t afford the better plans. I was also promised %2 Annual Increase every year. At this rate, my PERA will dwindle every year not increase. Shame on you PERA. I PERA should go to legislation and fight to get whatever Social Security Benefits we have earned and should receive. I’m a widow and I can’t even get my dead husband’s Social Security because I’m retired PERA. PERA step up and fight for your Retirees!!!

What was the ROI or investment gain/loss for PERA in 2018? I have not seen it published.

Dear Mr. Belknap,

The PERA Board of Trustees will be voting on releasing the 2018 financials on June 21. Please look for details on the copera.org website after that date.