Recent polling by Gallup shows nearly half of U.S. investors are interested in sustainable funds that take into account environmental, social and governance (ESG) factors, but few have heard much about them or invested in them. Additionally, 70 percent of respondents said they would be likely to include ESG funds in their 401(k) portfolio, if their employer offered them.

Since 2011, PERA has offered the PERAdvantage Socially Responsible Investment (SRI) Fund to members interested in directing their PERAPlus 401(k), 457 or Defined Contribution (DC) Plan savings into sustainable investments.

While PERA invests Defined Benefit (DB) Plan funds on behalf of PERA members and retirees, the SRI Fund provides members the opportunity to invest their personal savings with a focus on socially responsible or ESG leadership. The fund is designed for long-term performance through investment in companies that demonstrate strong ESG practices — that is, companies that have shown an ability to manage risks and take advantage of opportunities associated with environmental, social and governance issues.

What makes the PERAdvantage SRI Fund “sustainable”

PERA offers a range of PERAdvantage fund options to 401(k), 457, and DC Plan participants, but the SRI Fund is the only one with a stated focus on environmental, social and governance factors. In 2019, PERA updated the SRI Fund, selecting new asset managers with portfolios offering better market coverage, lower costs and a stronger focus on ESG leadership.

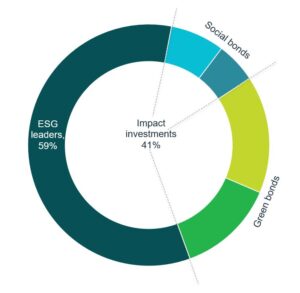

The SRI Fund has two underlying portfolios: The BlackRock ACWI ESG Fund (stocks), which makes up approximately 60 percent of the fund, and the TIAA-CREF Core Impact Bond Fund (bonds), which makes up approximately 40 percent of the fund. Both portfolios include investments that are tilted toward positive ESG exposure. The bond fund also includes investments aimed at driving positive environmental and social impact.

For example, the BlackRock fund mirrors an index with more than 500 stock holdings, but companies with primary business in tobacco, controversial weapons, fossil fuel extraction and thermal coal power are not included. Holdings in the information technology sector make up nearly a quarter of the index, with some of the top holdings including companies like Apple, Microsoft and Tesla.

The TIAA-CREF bond fund includes investments in projects like affordable housing, renewable energy and land conservation. TIAA-CREF says the investments in the Core Impact Bond Fund resulted in the avoidance of nearly 275 million metric tons of emissions, energy savings of 7.7 billion kilowatt hours and the conservation of nearly 850,000 acres in 2020.

As with all PERAdvantage funds, the primary objective of the SRI Fund is to deliver financially sustainable risk-adjusted returns to participating members. In 2021, the SRI Fund provided a return of 10.2 percent for the year. The 10-year annualized return was 8.8 percent. As of the end of 2021, PERA members had more than $40 million invested in the fund.

Learn more:

- SRI Fund fact sheet

- Enroll in a PERAPlus 401(k) and/or 457 Plan

- PERA’s Investment stewardship program

StewardshipThe practice of overseeing or managing something entrusted to one’s care. PERA’s approach to investment stewardship is focused on ensuring the financial sustainability of the fund that pays benefits to retirees and beneficiaries.StewardshipThe practice of overseeing or managing something entrusted to one’s care. PERA’s approach to investment stewardship is focused on ensuring the financial sustainability of the fund that pays benefits to retirees and beneficiaries.EsgAcronym for environmental, social, and corporate governance factors that can be used when making investment decisions.EsgAcronym for environmental, social, and corporate governance factors that can be used when making investment decisions.Defined benefitAlso known as a pension, this is a type of pooled retirement plan in which the plan promises to pay a lifetime benefit to the employee at retirement. The plan manages investments on behalf of members, and the retirement benefit is based on factors such as age at retirement, years of employment and salary history.Defined contributionA type of individual retirement plan in which an employee saves a portion of each paycheck (along with a potential employer match) and invests that money. The employee’s retirement benefit is based on their account balance at retirement. A 401(k) is a type of defined contribution plan.

I appreciate that PERA offers this, but it would be nice if we had separate SRI funds that were 100% equity and 100% bond. By only offering a balanced fund choice, it eliminates folks who want to invest in an SRI fund but don’t want a 60/40 split.

I beg to differ! PERA overall is not a retiree pension program to Bragg about. Actually, it is a poor investment. Example: check another government pension program offered by the Federal Government. Not even close!

(I will spare the details – check it out)

What are you talking about?