The Labor Department on April 6 introduced a rule to address conflicts of interest in retirement advice. The rule is intended to protect investors by requiring professionals who provide investment advice about retirement plans and IRAs to abide by a “fiduciary” standard – putting their clients’ best interest before their own profits.

Prior to the finalization of the rule, Colorado PERA submitted a comment letter expressing support for a rule that would change fiduciary standards for investment advisers. In the letter, PERA wrote in “support for rules that raise the bar for investment advice to help individual investors achieve retirement security” and urged the Department of Labor to “adopt the proposed rules that require a fiduciary level of advice by investment advisers.”

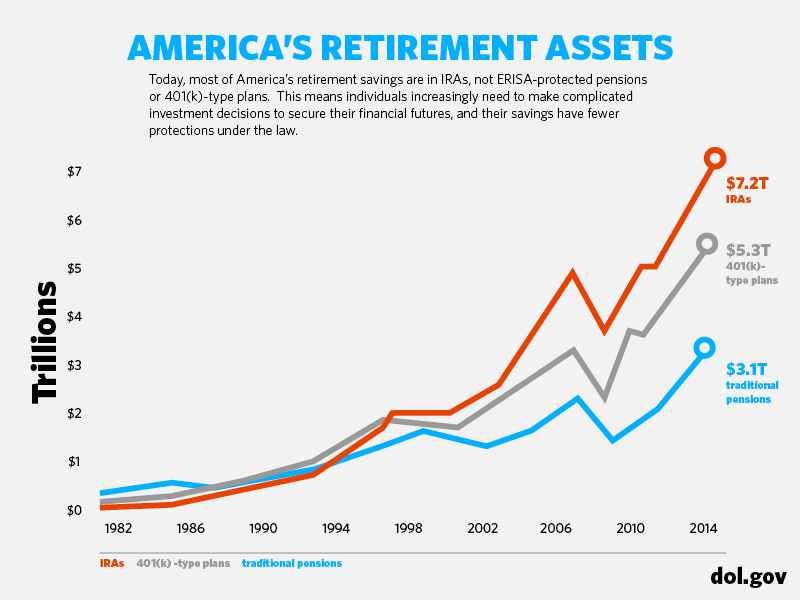

Today, Americans hold more of their retirement savings in IRAs than in either 401(k)-type plans or traditional pensions like PERA’s defined benefit plan which are subject to fiduciary duties by law. At PERA, every employee and each trustee is a fiduciary for all PERA members and retirees. The new rules will expand that fiduciary standard to far more professionals offering advice about retirement, requiring a group that encompasses those working with IRAs to adhere to the same legal fiduciary standard.

According to the New York Times, those rules – six years in the making – will restrict these new fiduciaries from accepting compensation or payments that would create a conflict unless they qualify for an exemption to ensure the customer is protected.

The decision to finalize the rule does not come without some controversy. As USA Today explains, critics fear the cost of advice will rise and that there will be fewer advisers serving an ever-growing number of people who need help with their investments and retirement plans.

Business Insider reports that the regulation could “level the playing field” for investors holding $12 trillion in retirement accounts like IRAs and 401(k) plans, while Forbes says that “some $40 billion” could be saved over the next decade by everyday individuals looking to save for retirement.

Below, we provide a recent digest of news articles about the new fiduciary rule as well as links to information from the Department of Labor.

- White House to financial advisers: put savers’ interests first, NPR

- What new rules on retirement savings mean for investors, The New York Times

- Department of Labor resources

- FAQs: Conflicts of Interest Rulemaking

- Fact Sheet: Final rule to protect retirement savings

- Chart: Compare the proposed and final rules

- Final Rule: Read the final rule, Regulatory Impact Analysis and other related documents

- Fact Sheet: Middle Class Economics: Strengthening Retirement Security by Cracking Down on Conflicts of Interest in Retirement Savings

FiduciaryA person who manages money on someone else’s behalf and who has a sworn responsibility to manage those funds in the best interest of the client. Defined benefitAlso known as a pension, this is a type of pooled retirement plan in which the plan promises to pay a lifetime benefit to the employee at retirement. The plan manages investments on behalf of members, and the retirement benefit is based on factors such as age at retirement, years of employment and salary history.

VOYA?