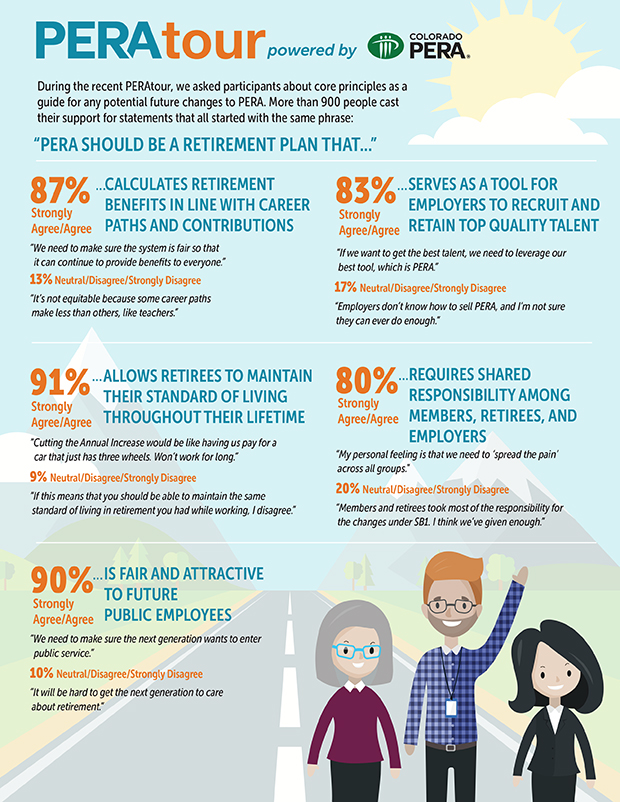

Which principles and priorities should guide the development of future changes to help reduce PERA’s risk profile? That question was posed to 900+ attendees at a dozen statewide community meetings as part of the first phase of our PERAtour earlier this summer. The input from meeting participants and comments submitted on our dedicated website will be used by the PERA Board of Trustees as it considers making recommendations to the Colorado General Assembly in 2018 to improve PERA’s funded status.

If you were unable to attend one of the PERAtour events in person, a full recording of the conversation can be found on the PERA YouTube channel. Additionally, a presentation that was given to the PERA Board on these principles can also be found on YouTube.

The graphic below highlights the principles and priorities shared at the community meetings, as well as feedback gathered from PERA members, retirees, and concerned citizens who participated either in person or online.

I am concerned that when a PERA presentation was made to a political group, it was stated that there would not be any additional “employer” PERA contribution under consideration, yet when this presentation was made to employees and retirees it was stated over and over again that there will be “shared” sacrifice. I am concerned that the current working class will carry the sacrifice…when we have already carried the sacrifice. Due to step increases being eliminated, and only now receiving a 2% raise in almost 9 years, our retirements are approximately 30% less then anticipated. We have made our sacrifice.

Sandra,

Thank you for your comment. The PERA Board of Trustees will be considering all options when they meet later this fall.

Please don’t hit the retirees so hard again. We’ll never recover from the last hit. The reduced cost of living adjustment from last time has left us with a big deficit, and there’s no way we can begin to keep up with just the cost of groceries alone on 2%. In my 70s, I don’t want to have to try to find another job and go back to work.

From the statistics that were pozted about PERA retirees, it is pretty clear that the median age at retirement is less than 60 years of age, and that means half are retiring in their early to mid 50s! That was fine in the days when life expectancy was in the mid to high 60s, but today a retiree can reasonably expect to live into their 80s, and PERA was not designed to pay out benefits for 20 or more years. A significant change that penalizes early retirement should be part of any fix for funding PERA into the future.

I am in 100% agreement. This is one important step that should be taken to stabilize the future of PERA.

“Shared Sacrifice” is a rather worn out slogan to divert attention away from the artificial nature of any so-called funding shortfall, lack of any evidence of a “crisis,” the true culpability of employers in failing to make appropriate contributions, and of course less than average investment returns and questionable fund expenditures.

–

Needless to say, the politicized PERA Board and staff seem ready to balance the state budget (through the red-herring of fund insolvency) on the backs of retirees AGAIN!

I agree that we need to discourage early retirements. People are not only living longer but are remaining capable and productive in later years. It makes sense to raise the retirement age.

During my working years when PERA DID NOT GIVE THE ANNUAL COST OF LIVING INCREASE, I heard the refrain: You will see this increase when you retire. Well, today this refrain doesn’t hold the tune they were singing in the 70s. I do want to see a solvent retirement. Why not let retirees keep investing in the 401 or a special fund beyond retirement? Would this type of investment help?

Raising retirement age to 65 years old makes sense considering how long people live now. And years worked before receiving a benefit should be at least seven years.