A lot has been written lately about PERA’s unfunded liability – or the difference between the projected amount of money needed to pay the PERA benefits earned to date and the amount of money currently available to pay these benefits.

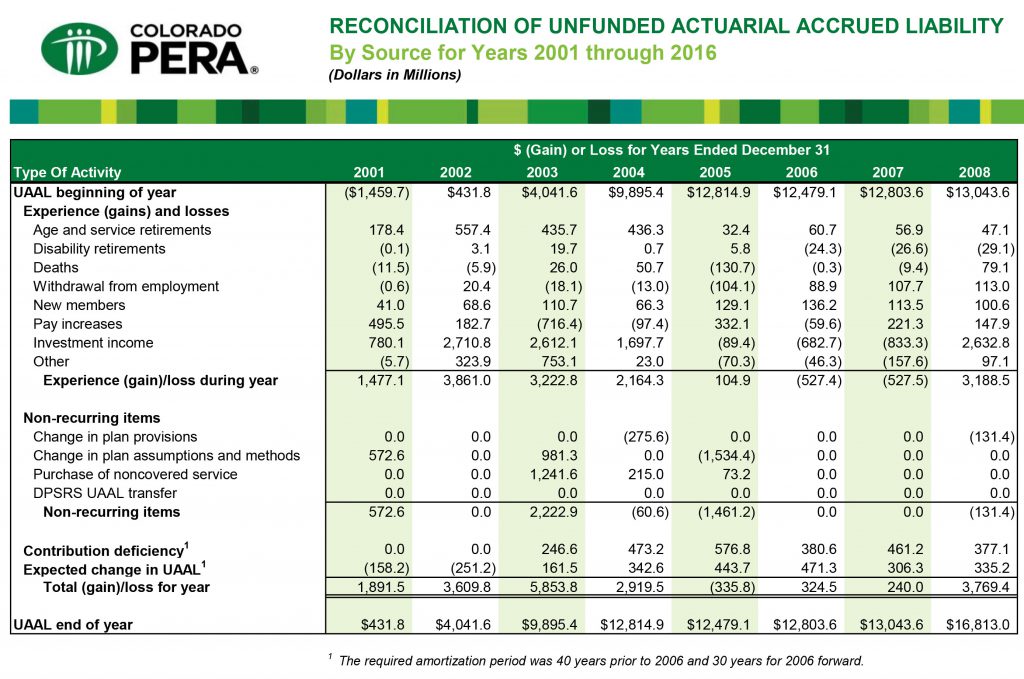

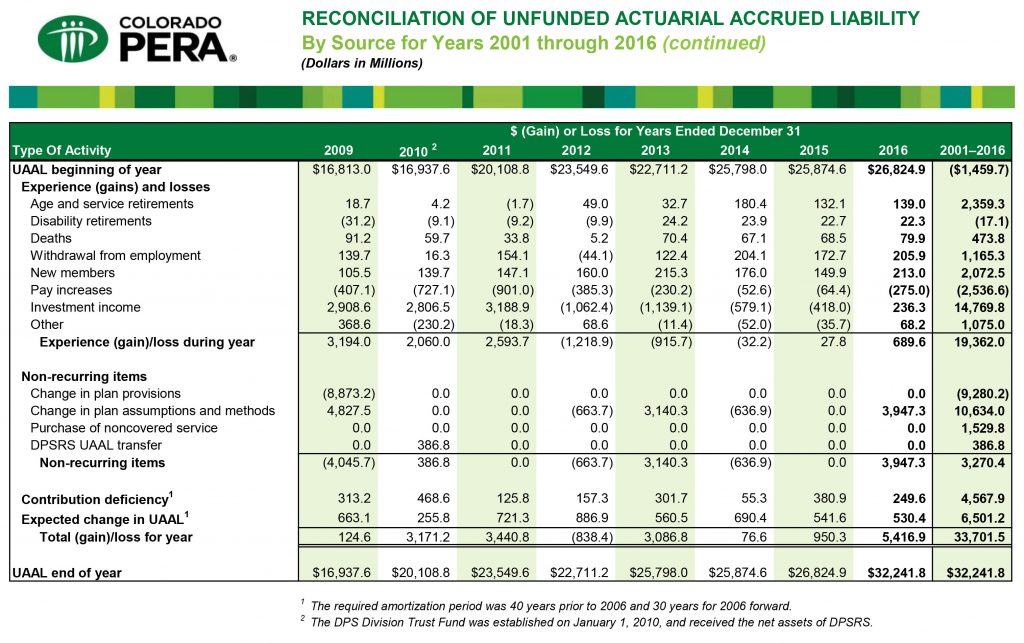

At the end of 2000, the PERA trust funds had more assets than were projected to be needed to pay current and future benefits to members and retirees in the plan at that time. However, since 2000, PERA’s unfunded liability has grown and the funded status has declined. The following tables show the various causes of the $32 billion shortfall that the Board’s legislative recommendation is intended to address. If adopted, the Board’s recommendation would return PERA to full funding over the next 30 years.

The last column on page 2 shows the totals for all causes of growth in the unfunded liability between 2001 and 2016. The bulk of the increase can be attributed to (1) less than anticipated investment income ($14.8 billion), (2) changes in plan assumptions and methods ($10.6 billion), and (3) contribution deficiencies ($4.6 billion).

Note that changes in plan provisions had a positive effect on the funded status ($9.3 billion), largely due to the impact of Senate Bill 1 (SB 1) passed in 2010 that immediately reduced pension liabilities at the end of 2009. Even though PERA is still benefiting, and will continue to benefit, from the SB 1 changes which lowered the rate at which new PERA members earn benefits, the combined negative impact of other causes more than offset the positive impact of those changes.

Note: numbers in parentheses are positive (or gains) and dollars are represented in millions.

Trust fundA fund in which money and/or other assets are held and managed by trustees on behalf of plan participants. PERA maintains trust funds for each of its Defined Benefit Plan divisions (State, Local Government, School, Denver Public Schools, and Judicial).Unfunded liabilityThe difference between the projected amount of money needed to pay benefits earned to date and the amount of money currently available to pay those benefits.

Request photos of Pera HQ indoor office furniture, statues, costs expended, be published. Also, why is money being spent on a second Pera HQ building and projected costs involved? When Pera members have to tighten the belt, it should be expected that Pera HQ in Denver do the same or more to cut way back.

Dear Mr. Green,

Thank you for your comments. PERA has satellite offices currently in Westminster and Lone Tree and we are evaluating how to better serve our membership through these types of facilities around the state (but there are no plans for a new headquarters). PERA’s administrative costs are low when compared to other plans and are disclosed on page 115 of the Comprehensive Annual Financial Report: https://www.copera.org/sites/default/files/documents/5-20-16.pdf

Has anyone at PERA calculated the cost to PERA membership of the frivolous lawsuits brought on by Walker Stapleton that PERA has had to deal with over the years? In my opinion, he has deliberately violated his oath as a Trustee by requesting detailed member info that he is clearly not entitled to by law. He has repeatedly violated every Board member’s responsibility to act only in the interest of members, not for his own political career benefit. Members deserve to know this cost to their fund so they can vote appropriately in the next Gubernatorial election. Walker needs to clearly understand that PERA members are voters and we will not tolerate his gamesmanship.

PERA has supplied 2 documents that contribute to the review of PERA’s unfunded liabilities.

The December 26, 2017 release of “Sources of PERA’s unfunded liabilities” on PERA “On The Issues”, (posted December 26, 2017

I feel that these reports are incomplete and will contribute to misleading the discussion on PERA reform this legislative session.

I would like PERA to quantify the impact of various legislative actions in 1999 through 2004 and provide members, and our elected officials an accurate quantification of the costs to PERA’s assets. In 1999 the Legislature “Gave” a 401(k) program to employees, but only funded it through taking the match from PERA’s assets. There was no state cost to this. What was the total of PERA funds that were taken for 401 funding, and what would these funds represent as assets if they had remained in PERA?

In 2000 the legislature reduced the rate of employer payroll contribution by 1% then authorized “an additional minimum 0.25% employer payroll contribution. Again, how much money did the state not pay into PERA, and what would this be worth today if these assets had remained invested by PERA?

While I cannot recall the date or details, I recall that during Governor Owens administration, the cost to purchase years of service was reduced. We heard as state employees that the Governor wanted to get rid of the more senior (expensive salary) employees to reduce the costs. If this happened, what are the costs of allowing years of service to be purchased below costs? How can this be quantified to illustrate the “cost” past legislation HAS put on PERA at the cost of the members.

Colorado PERA contribution Rates (June 2015)

IN this report and other’s you list the Supplemental Equalization Disbursement (SAED) as an ‘employer’ contribution, while other PERA reports correctly state

Required all PERA employers to pay Supplemental Amortization Equalization Disbursement (SAED) equal to 0.5% beginning 1/1/08. The SAED would increase by an additional 0.5% of covered salary a year until it reached a total of 3.0% in 2013. The SAED is notes in the statue as being funded from foregone compensation increases from employees.

SAED rates should be credited to employee payments, not listed as a state contribution. These rates are pay from foregone compensation increase from employees.

With past activities clearly quantified by PERA we will be provide better facts to the legislature this session to make sure changes to PERA will not be fairly shared by all participants.

Sincerely,

Timothy Larsen

Dear Mr. Larsen,

PERA believes that the tables above provide an accurate picture of the sources of PERA’s unfunded liabilities and do quantify as you’ve suggested the “impact of various legislative actions.” PERA was fully funded at the end of 1999 and 2000, so that’s the reason why the tables begin with 2001.

On the first table, please see the row “Age and service retirements” for the losses associated with the changes made to allow for early retirement in the early 2000s. You’ll also see the losses associated with the “Purchase of noncovered service” that occurred in 2003, 2004, and 2005. As for the contribution deficiency, that is summarized in the far right column on the second table ($4.6 billion).

You are correct that the SAED, while paid by employers, is to come from foregone wage increases. The reason for the SAED contribution not going into member accounts is to use it to reduce the unfunded liabilities of the plan (and so it would not be subject to withdrawal and the associated matching amounts in member accounts). SB 1 in 2010 called for an additional 2 percent increase in the AED and SAED for the larger State and School Divisions.

Regarding your response on the SAED: Yes, BUT… I’m sure that Walker Stapleton and other anti-PERA politicians are referring to SAED as another burden that PERA employers have had to shoulder, when it actually came out of employees pockets.

Great point, Timothy!

Is the contribution short fall listed reflect only base contributions? Or does it also take into account opportunity loss from missed investment growth that would have been gained on the contributions?

If it only takes into account the base contribution shortfall what is the total loss including opportunity loss?

Dear Mr. Nelson,

PERA has not calculated the investment impact of lower than actuarially required contributions on the funded status or amortization period of the plan.