In 2010, Colorado became one of the first states in the nation to respond to the consequences of the economic crisis by passing major reforms to the defined benefit plan. Landmark legislation, Senate Bill 10-001, reversed the course of PERA funding and returned it to sustainability. Since 2010, conditions continue to evolve and PERA has responded.

PERA now faces changes that will have a significant impact in the future. First, PERA members and retirees are living longer and, on average, receiving a benefit over a longer period. Second, the PERA Board of Trustees has reviewed the recommendations of economists, actuaries, and investment advisors and determined that the expected rate of return on its investments may not be as high moving forward as it has been in the past. Therefore, last year, the Board lowered its expected rate of return to 7.25 percent from 7.5 percent previously.

Changes in economics and demographics have increased the time PERA needs to become fully funded, and therefore also increased the risk level of PERA’s funding – not only for PERA members, but for all taxpayers throughout the state of Colorado where PERA members live, work, and support the economy.

PERA measures funding risk using a “signal light” color framework to clearly categorize and communicate the current level of risk to each division. Today, all PERA divisions are in the orange category, indicating that PERA needs to formulate a plan to reduce that risk. (Read more about what the orange signal light means for PERA). Shortening that period of time is an appropriate step to secure the retirement for the 565,000 members and retirees that make up PERA today.

The PERA Board has asked PERA staff to undertake an effort to inform and listen to members, retirees, employers, taxpayers and others about improving PERA’s funded status and reducing its risk exposure, while also maintaining secure retirement benefits and strengthening the Colorado economy.

Known as PERAtour, the first stage includes gathering input on principles and guidelines for future changes. PERA staff held a series of meetings this spring, and attendees at the meetings were overwhelmingly supportive of preserving a fair and sustainable retirement system that provides a dignified retirement for public employees for both today and the future. They also recognized that, like in 2010, potential changes will require shared responsibility and teamwork from all participants: members, retirees, and employers. (More detailed results of feedback are available on the PERAtour website, where feedback can still be provided.)

The Board expects to explore different options to improve PERA’s funded status this fall in order to make any recommendations for necessary action to be considered during the 2018 legislative session. Such efforts have recent precedent in SB 10-001, which required that all stakeholders contribute to the solution.

Senate Bill 10-001 Recap

In 2009 and 2010, the PERA Board of Trustees worked with PERA members, retirees, employers, and other stakeholders to develop a package of recommendations for the Legislature to consider in order to increase funding for the plan while also reducing costs over time. The leading principle of those recommendations was shared sacrifice, meaning that all members – retired, current, and future – as well as employers gave up something as a way to improve the sustainability of the fund.

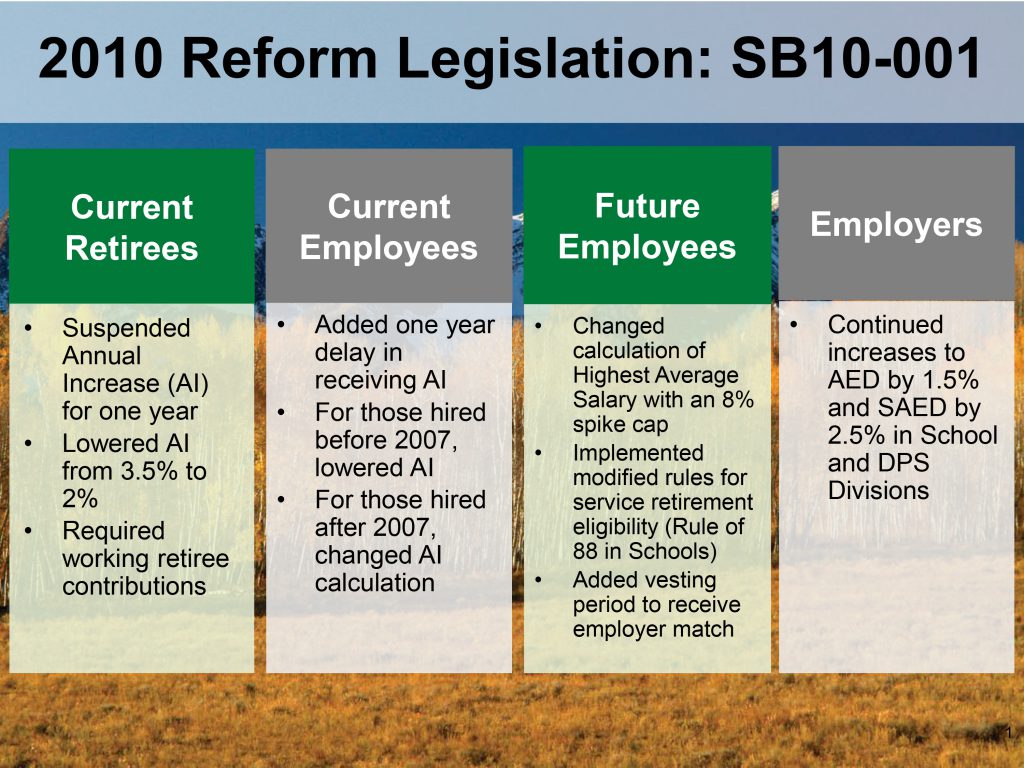

Major provisions of the changes recommended by the PERA Board in 2009 and approved by the legislature and signed by the governor in 2010 included:

- Increases in contributions from members and employers to reduce the unfunded liability over time;

- A 2 percent cap on the Annual Increase or Cost of Living Adjustment (COLA), for all current and future retirees; and

- Increases in the minimum age to qualify for service retirement for new members as well as other provisions such as requiring retirees who return to work to make employee contributions at the same rate as all members working for that employer.

- Some recommendations made by the Board were not included in the enacted legislation. These included increasing the number of years in the Highest Average Salary calculation and a higher age for service retirees in the School Division.

These changes illustrate the willingness of the PERA Board, membership, and employers to take critical (and often self-sacrificial) steps to improve PERA’s risk profile and ensure a long future ahead.

ColaAcronym for cost-of-living adjustment; a type of annual adjustment meant to prevent a person from losing buying power due to inflation.Annual increaseAn adjustment to PERA retirees’ monthly benefit payments, paid in July each year. The Annual Increase amount is set in statute and can adjust up or down based on PERA’s funding progress. It is not tied to inflation.Unfunded liabilityThe difference between the projected amount of money needed to pay benefits earned to date and the amount of money currently available to pay those benefits.Defined benefitAlso known as a pension, this is a type of pooled retirement plan in which the plan promises to pay a lifetime benefit to the employee at retirement. The plan manages investments on behalf of members, and the retirement benefit is based on factors such as age at retirement, years of employment and salary history.

I feel the shared sacrifice approach as outlined in the 2010 Reformed Legislation SB10-001 is the correct approach. Continued efforts towards gaining the funding at desired levels should be PERA and stakeholders highest priority to maintain the integrity of the system and overall health of the entire fund. I appreciate PERA board and stakeholders making the necessary changes to spiking salaries, employer and employee contributions, and reduced AI from 3.5% to 2% to improve the overall funding outcome. I would urge all stakeholders to look for opportunities to minimize overall expenditures to manage PERA in a way that fraud, waste and abuse are not among the issues in which outside agencies can indicate take away from the overall efforts of fully funding PERA. I know sometimes folks will step over a dollar to pick up a dime. However, the small things can impact PERA’s overall operational readiness and ability to meet a fully funded account sooner. Thank you for the opportunity to leave this message.

The concept of shared responsibility seems like a fair and just response for current PERA employees, future PERA employees and PERA employers. Each of these groups have the ability to change their financial plans as they approach future retirement dates. Employees can work longer and/or save more, and employers can contribute more. Most current retirees, however, do not have such flexibility, and should not be expected to sacrifice their promised retirement benefits in order to deal with a looming PERA funding shortfall. They were promised their retirement benefits by their employers while still working, and used that promise to plan for their retirement years. Changing those promised retirement benefits after an employee’s retirement is not a just response.

I could not have said it any better. Thanks Tom!!

Totally agree, Tom. I have been working toward retiring this summer (2018), and it seems unfair to pull the rug out when I have been contributing in good faith for 11 years. I’m already 74.

We need an approach that covers all participants – not just retirees. I believe that view has been expressed. Salute to all who are working on the solution!

At the launch of the PERAtour, I predicted that the dog and pony show would end with pain spread all around via new legislation. Trotting out SB10-001 is simply communicating, “Look, we’ve done it before and now circumstance beyond our control force us to do it again.” PERA still places a happy spin on its sequel monster movie: Actuarial Reality Meets Risky and Unpredictable Markets. I’m pretty sure it has a gory ending.

RE: A Response To PERA On The Issues’, “How Today Is Different From 2010”

[SENATE BILL 1 & ARE THINGS REALLY DIFFERENT TODAY…?]

–

The admission of PERA Board and Staff to fail to recognize simple economic realities and respond with minimal financial stewardship should be a clear indictment of the politicization of the PERA Board and intentional undermining of plan stability (through dilution of member representation on the board with gubernatorial appointments, which occurred in 2006 subsequent to removal of the state auditor from the board, and short sighted legislation reducing the time horizon for assessing actuarial soundness from 40 to only 30 years without a corresponding fund contribution by the legislature and/or employers).

–

Past failures are instructive and related to present needs which can be enumerated as suggestions to increase fund performance; and at the end of this post will be listed; but since they are routinely ignored, it may be better to first examine what is really going on with PERA, i.e.,: PERA IS BEING SET UP TO FAIL !

–

In political parlance undermining PERA is the highest act of undue interference with civil service and the merit system, another phrase familiar to public servants should also explain what is really occurring, i.e., “PERA is being set up to fail.” Many governmental programs out of favor with a new administration, or prior to justifying privatization, are targeted with staff reassignments, budgets reallocation, and convoluted new mission statements. For dedicated civil servants who just “work harder without question” this may explain why career paths seem determined less by skill and program knowledge and more by luck or who you know. Ingeniously, the presence of a union and preservation of poor performers help sabotage meritorious operations (which explains the advancement and promotion of the inept as well as public sector union involvement in politics, like many private enterprises bound to elected representatives and government through cronyism and pay-offs). Ordinarily, I refrain from laying out my grievances so candidly for fear of providing a blue print for the lazy administrator or slow politician, but the current assault on PERA is pretty much a nuclear attack on public service in Colorado and more importantly strikes at efficient governance for the citizens of the state (attacking PERA also attacks TABOR, whether or not you favor it’s fiscal restraint).

–

To be blunt, too many disparate political interests are conspiring to steal from public pension funds simply because that’s where the money is, and it serves both the ideological camps of anti-government/tax groups and the “every thing for schools” tax and spend liberals (but also charter school advocates). Limiting the employers’ (state’s) contribution leaves more money for legislators to support schools (the educational lobby/extortionists) and still spread largess among constituents, cronies, and family members.

-Failing to pay the prerequisite contributions to provide promised benefits promised is how the state circumvents TABOR and other fiscal restraints; but robbing Peter to pay Paul is really a shell game that enables TABOR scofflaws to keep spending (along with the ingenious re-labeling of taxes as user fees, while privatization essentially allows government to be financed off the books, e.g., tolls, tuition, and exempt special district costs); and ultimately places all government at risk, even if the stock market or the economy does well! When capitol markets were out of this world in the 90’s, PERA was over-funded! And in light of the then new TABOR amendment, PERA’s over-funding: allowed legislators to lower the state’s contribution; even permitted Governor Owens to cull decades of hires under Democratic administrations through early retirements; and also allowed a private financial investment firm to offer IRA’s to public employees with a match by the state as payback for campaign contributions.

–

The decade just described is all the history one needs to understand PERA is being SET UP TO FAIL in order to sell it off for campaign contributions from private “defined contribution” administrators. In the meantime competent employees are retained through grandfathered retirement provisions and false advertising that PERA is still a great retirement plan while the simultaneous debasing and robbing of PERA continues. Ultimately the state will not be able to attract even mediocre employees; and will be paying privateers more than if state salaries and PERA had been left alone.

–

Increased labor costs will be passed along to taxpayers, some of which may include, but are not limited to: the additional layer of private sector management, stock holders, and dividends; higher salaries to compensate for poor retirement benefits; private sector related labor costs of Social Security (FICA); IRA contributions; Pension Benefit Guarantee Fund premiums; Unemployment Insurance taxes on retired workers returning to their same jobs under private enterprise (heretofore effectively disallowed by court order for PERA recipients); and OSHA requirements from which states are exempt; etc. And any one who believes services provided will improve will be sorely displeased as they deteriorate, which will be a certainty as private companies leave the industry or declare bankruptcy to avoid fulfilling all if any of the promises made to secure the contracts that raided the public treasury in the first place (starting with state pension funds).

–

Having laid out the immediate and long range reasons behind politicians setting-up PERA to fail, it is with some caution that any suggestions to improve fund solvency are offered (since the so-called fiscal crisis has been nefariously manufactured in order to privatize PERA), but here goes:

–

01.) PERA Staff and management need to be compensated (or discharged) based on fund investment performance;

–

02.) Paid PERA staff and management should NOT be covered under a defined benefit plan such as offered to other covered civil servants, unless PERA employees are hired exclusively through open and competitive tests of merit and fitness (No state patronage jobs should be covered);

–

03.) Revolving Door & Non-Compete provisions for PERA Board Members and upper staff and management against conflict of interests should be adopted by prohibiting concurrent or subsequent employment in the financial or lobbying industries;

–

04.) Limit PERA covered salary to the current amount paid to the highest classified merit system position in state government (for state funds and do NOT adjust it for inflation automatically, thus eventually excessive high salaried members earnings will not skew benefit payments);

–

05.) Legislate sound actuarial and longevity tables for contributions and benefit payments (which may entail raising the retirement age for non-vested members);

–

06.) Claw back 3% of all benefits ever paid (from future payments) made to the highest 7% of annuitants for current beneficiaries based on monthly amounts before application of any annual adjustments (as PERA was never designed to be welfare for the rich);

–

07.) Stop balancing the state budget on the back of workers and retirees;

–

08.) Plus numerous other simple common sense suggestions which have been ignored for years… etc.

I think you have covered the issue, I especially like the last five suggestions, as I feel the people at the lower end of PERA will suffer the most from any changes we will experience.

I recall that following SB1 passage that there was a claim that retirees contributed about 90% of the fix by the adjustment in their COLA/AI. If this is accurate, could PERA show the residual contributions for each of the other groups (Current Employees/Future Employees/Employers) to inform us of the shared sacrifice that was made by each group? Going forward with a new solution to address the significant under-funding, a shared sacrifice should be created that leaves retirees harmless and places more shared sacrifice on other groups, especially the group that has not made all of its annual required contributions.

Jerry, Thank you for your comment. All current and future members and retirees participated in the shared sacrifice of SB 1. In other words, 90 percent of the solution was the reduction in benefits (affecting current and future retirees as well as current members by having to work longer) and increases in contributions (made by current members through the SAED). The remaining 10 percent may be attributed to the increases in the employer contribution (the AED). All future retirees will be subject to the one-year wait to receive an annual increase and have the 2 percent cap applied to them.

This information is detailed in the Senate Bill 10-001 Report that may be found here: https://www.copera.org/sites/default/files/documents/sb10-001report_dec2015.pdf. See page 2 for a quick summary of the savings attributable to each change contained in SB 1. The nearly $15 billion in savings due to the reduction in the annual increase takes into account current and future retirees.

Excellent suggestion, Jerry. The people least able to take another hit are retirees. I would like to see the breakdown of sacrifice in each of the groups.

As much as I have always thought well of PERA, I don’t understand this. After SB 1, PERA repeatedly touted those changes as ensuring that PERA would be able to pay all promised benefits “indefinitely”. It is only seven years later, and now we are told that PERA just now figured out that people are living longer? That makes no sense. Also, why are the steps that were taken only last year, which were also touted as a “fix”, now suddenly considered to be insufficient? I don’t mean to sound accusatory, because I don’t intend that. I think, however, we need some more direct answers, rather than generalities (e.g., telling us that we’re in the “orange category”).

Also, I think that PERA needs to more directly respond to the argument voiced by many (both regarding SB 1 and recently) that taking benefits from current retirees is hardly a “shared sacrifice”. Future retirees, depending on their target retirement date, have a much greater ability to adjust to to plan changes than current retirees. They can plan to work a bit longer, make adjustments to other long term investment strategies, etc. This is especially frustrating since most retirees relied at least in part on PERA’s promises, counselors’ advice and other resources (which I found to be very helpful) to figure out the many issues associated with making sound retirement decisions.

Thank you, David, for your comments.

The time it will take PERA to achieve full funding is beyond the 30-year goal established by the Board. This is not like in 2008/2009 when the PERA trusts were projected to be depleted within that 30-year time frame. The current situation calls for the PERA Board to make recommendations to the Colorado General Assembly to reduce the risk of another severe economic recession returning PERA to the conditions faced prior to SB 1.

The Board is very aware of the impact of benefit reductions and contribution increases on all of PERA’s stakeholders and input such as yours will be shared with them to assist in the development of any legislative proposal.

Do you remember the cola calculator that PERA provided for us? Easy to use to calculate the sacrifice that we made. It shows your income side by side with the 2% and the old cola of 3.5%. The things that bothers me is that PERA over all the meetings that I went to assured us that this was fixed and that PERA didn’t need to be 100% funded because obligations were spread out over many years. I must have been a fool to of believed them because I made my decision to retire when I did on that information. No retiree can go back and change that decision based on incorrect information. How many remember when PERA was 100% plus funded? Do you remember what they did then? My brother-in-law gets a nice retirement through Missouri Lagers and a nice social security benefit not reduced by WEP. Missouri Lagers at this time boasts a 95% funded ration. Maybe PERA needs to look at structuring PERA after a model that is working. I found this information on Bloomberg News.

Americans Are Dying Younger, Saving Corporations Billions

Life expectancy gains have stalled. The grim silver lining? Lower pension costs

By

John Tozzi

@jtozzMore stories by John TozziAugust 8, 2017 3:00 AM CDT

Steady improvements in American life expectancy have stalled, and more Americans are dying at younger ages. But for companies straining under the burden of their pension obligations, the distressing trend could have a grim upside: If people don’t end up living as long as they were projected to just a few years ago, their employers ultimately won’t have to pay them as much in pension and other lifelong retirement benefits.

In 2015, the American death rate—the age-adjusted share of Americans dying—rose slightly for the first time since 1999. And over the last two years, at least 12 large companies, from Verizon to General Motors, have said recent slips in mortality improvement have led them to reduce their estimates for how much they could owe retirees by upward of a combined $9.7 billion, according to a Bloomberg analysis of company filings. “Revised assumptions indicating a shortened longevity,” for instance, led Lockheed Martin to adjust its estimated retirement obligations downward by a total of about $1.6 billion for 2015 and 2016, it said in its most recent annual report.

Mortality trends are only a small piece of the calculation companies make when estimating what they’ll owe retirees, and indeed, other factors actually led Lockheed’s pension obligations to rise last year. Variables such as asset returns, salary levels, and health care costs can cause big swings in what companies expect to pay retirees. The fact that people are dying slightly younger won’t cure corporate America’s pension woes—but the fact that companies are taking it into account shows just how serious the shift in America’s mortality trends is.

It’s not just corporate pensions, either; the shift also affects Social Security, the government’s program for retirees. The most recent data available “show continued mortality reductions that are generally smaller than those projected,” according to a July report from the program’s chief actuary. Longevity gains fell short of what was projected in last year’s report, leading to a slight improvement in the program’s financial outlook.

“Historically, mortality rates annually have tended to come down year-over-year,” says R. Dale Hall, managing director of research at the Society of Actuaries. The professional association compiles mortality data that many private pension plans use in their projections. “There really has been a little bit of slowdown in mortality improvement in the United States,” Hall says.

Dear Mr. Clevenger,

Thank you for sharing this information. Every four to five years, PERA’s actuaries review the assumptions of the plan versus what happened. One of the assumptions they review is longevity, and the experience of the PERA membership is that they are living longer in retirement. This is why the Board of Trustees adopted new mortality tables to better reflect this situation. The reduction in national longevity has not been the experience of Colorado PERA retirees who are living longer than other Americans.

As to your concern about the reduction in Social Security benefits because of participation in PERA, we recommend that you contact your federal congressional representatives and encourage them to support S.915 and H.R.1205. More information on these bills may be found here: https://peraontheissues.com/index.php/2017/07/26/colorado-pera-social-security/

As a State of Colorado retiree I applaud the efforts being attempted to bring about the solvency of the PERA Pension program. Back in 2010 and afterwards, the lawsuit that followed the last changes failed and the result has been further diminishing benefits for state workers and retirees who have devoted a lifetime of quality work to the State of Colorado. I predict that after these new changes are installed, more changes will be requested in the future and by then no one will recognize the pension system and its value will have further diminished along with the trust level of all state workers and retirees. I also feel you will continue to see the required annual contribution by our legislature will NOT be paid consistently to the pension plan each year impacting the solutions to this problem for the State of Colorado. Why is this a continuing issue? Further, and very importantly, our spouses, children, and grandchildren will continue to suffer as the beneficiary survivor benefits will be lower than the deceased employee/retiree anticipated and their survivors quality of life will be impacted by these real reductions in benefits. We will further see the continuing erosion of the U.S. Middle Class which was once the real backbone of our economy. Not anymore. If you really want a total view of the U.S. state- by- state pension problems and what each state is facing go online and look up the research that has been compiled on all 50 states and U.S. Territories. My feeling is this issue will be with us for a long time and the quality of our workforce will continue to change detrimentally and may never recover to the levels of past generations.

One of the driving factors to all of the funding issues (state and local) is and has been T.A.B.O.R.. TABOR allows state law makers to abdicate many of their responsibilities with regard to funding as it pertains to taxes. A balanced budget is a good thing. However, the population of Colorado is exploding without a proportional increase if funding. This population increase has caused an increased demand on public services. TABOR has not allowed government at any level to properly adjust input to funding to provide for the increased demand. We cannot continue to balance budgets by CUTTING. This approach will ultimately destroy the public sector. History shows us that public service employees are essential to the well being of any society. Moreover, PERA retirees DO also contribute, significantly, to the tax base.

Is anything being considered to deal with TABOR? Instead of dealing with the symptoms, the ultimate approach needs to be to deal with the illness.