As the Legislature debates the details of Senate Bill 18-200, intended to improve PERA’s funded status and lower its overall risk, it is helpful to keep in mind how PERA compares to similar public employee retirement plans across the country – both today and if legislation is approved.

The proposed legislation incorporates many of the recommendations that the PERA Board approved last September, including changes to the age and service requirements necessary for a full service retirement benefit. The Board had recommended increasing those requirements to age 65 for most divisions with a minimum of five years of service. (The recommendation for State Troopers was a lower, but still increased, age.). These increases reflected the data gathered from the experience study that showed the PERA retiree population was living longer than previously projected. Read more about the Board’s changes to actuarial assumptions here and here.

As currently written, the bill would increase age and service requirements for all members who begin employment on or after January 1, 2020, inline with the Board’s recommendations. The bill would also change retirement eligibility for all current members who are age 46 or younger as of that date by adding one year to retirement eligibility for every four years less than age 46, not exceeding 65 years of age.

The minimum age at which an employee can retire and receive a full retirement benefit (often shortened to “retirement age”) is an important component of any retirement plan. Even for Social Security (which is not really a retirement plan but rather a social safety net to reduce old-age poverty), the retirement age for a full, or normal, retirement benefit, is now 66. For many years, it was 65 but has been gradually increasing for people born in 1938 or later. It will continue increasing until it reaches 67 for people born after 1959.

Different pension plans determine retirement eligibility using a variety of factors that typically include some combination of age at retirement combined with years of service (or purchased service, in some cases).

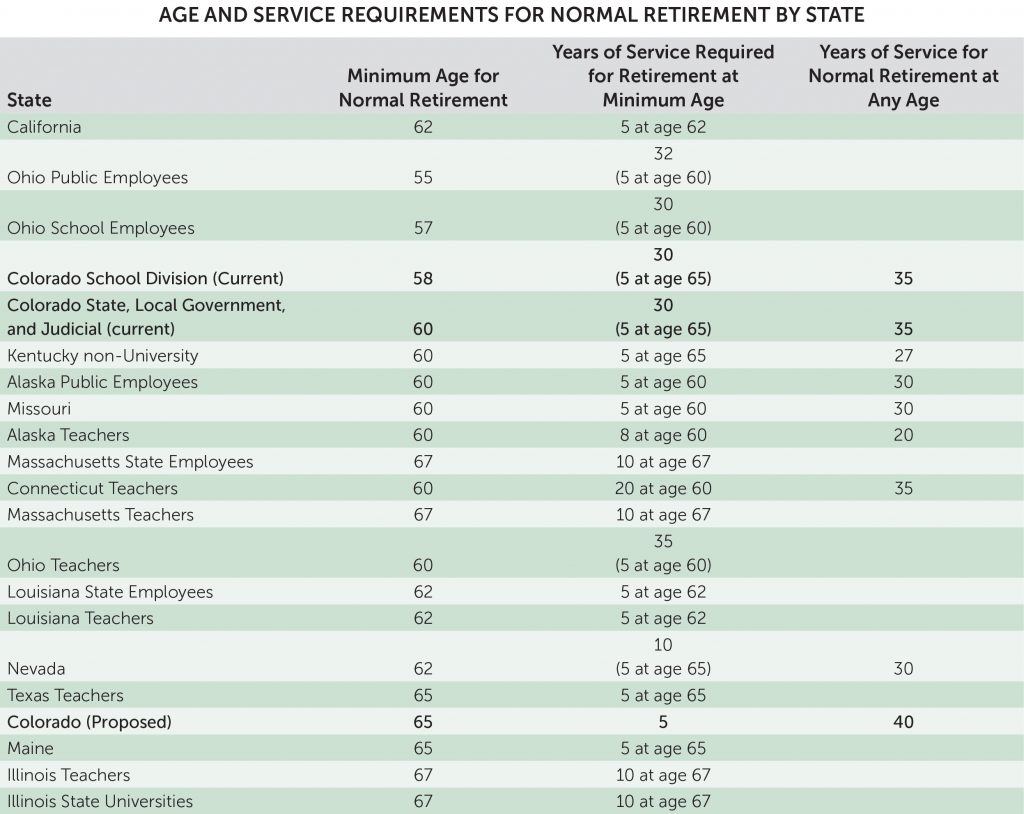

Looking at various features of similar public pension plans across the United States – that is, large public plans with members who, for the most part, do not participate in Social Security – Colorado PERA currently falls in the middle of the pack for retirement age requirements.

The minimum age for a normal PERA retirement is 58 for the most recent hires in the School Division and 60 for the most recent hires in other divisions not including Troopers, giving Colorado one of the lower – but not the lowest – retirement ages in this comparative group. Under the proposed legislation, Colorado’s retirement age of 65 would be one of the higher – but not the highest – retirement ages. And the retirement age would still fall lower than that of Social Security.

Many of the plans with a lower retirement age are making trade-offs elsewhere. For example, Ohio Teachers has a retirement age of 60 but just reduced its cost of living adjustment or COLA to zero. In Kentucky, a number of changes are currently pending in the legislature that would reduce the COLA to 0.75%.

The chart below shows how Colorado’s retirement age requirements compare to this group, reflecting normal or full retirement eligibility requirements for the most recent hires or newest retirement tiers, where applicable.

(It should be noted that the data presented here are simplified for purposes of this discussion and caution must be used in interpreting the information. For example, in Colorado, State Troopers pay a higher employee contribution and have a lower minimum retirement age. While a few of those exceptions are noted, in most cases the most common or average for a given plan is used. Our sources include data compiled by PERA staff in February 2017 and comparison data from the Wisconsin Legislative Council from December 2016.)

ColaAcronym for cost-of-living adjustment; a type of annual adjustment meant to prevent a person from losing buying power due to inflation.Actuarial assumptionData such as demographics, mortality rates, and investment returns that retirement plans use to calculate future assets and liabilities.

When is the Social Security Fairness Act Bill # S915/H.R 1205 going to the floor? It is critical for this bill to be repealed for we people who have 20 years or more paid into Social Security in the private sector. That is OUR money we have paid in!! Please repeal WPA and GOP!

I agree! This an outdated concept and is unfairly punitive! Would like an update on the Social Security Fairness Act Bill.

Dear Ms. Hall,

PERA does not have any updates on the Social Security Fairness Act of 2017. When we have new information, we will be sure to share it.

Dear Ms. Kitsmiller,

The Social Security Fairness Act of 2017 is federal legislation so you should express your thoughts on the WEP/GPO repeal to your representative in Congress.

Yes, I agree with Sherry Kitsmiller and with this proposed Social Security Fairness Act Bill #S915H.R 1205. I also worked in private sector in Honolulu, Hawaii from Jan. 1968 through Sept. 7, 1985. I paid into Social Security. I would like to be compensated. It is very vital and important.

Is there a reason you only identified the COLA’s for 2 states? It would be nice to take a look at the COLAs for all state retirement plans so we could see how the PERA proposal to cut the COLA to Zero in 2018 and Zero in 2019 stacks up. And then how it stacks up in 2020 when the PERA Cap for the future will go into effect.

Dear Mr. Pluta,

We have written about the variances in public retirement system benefits here: https://peraontheissues.com/index.php/2017/11/01/colorado-pera-plan-design-compared-to-other-non-social-security-public-employee-retirement-plans/

In this article, you will find a listing of annual increases for retirees of public systems in non-Social Security states like Colorado.

The issue of retirement eligibility needs re-thinking. Setting an age of 65 or 67 is ridiculous. Teachers who serve up to that age have little left except misery and death. Instead, a period of service should be the determinant. 30 years is reasonable. A teacher beginning her career at 25, would be eligible for full retirement at 55, one who starts at 35, could retire at 65. Considering the difficulty of the teaching environment, 30 years is plenty. This reality is underscored by the fact that some teachers have to work a second job to make ends meet, and instead of taking their well-deserved time off in the summer, they work to supplement their budgets.

The alternative could be to increase Colorado teachers’ pay by 15 to 20%. In that case, teachers would be able to take off a year to rehab and re-energize, thereby adding to their effectiveness and longevity in the classroom.

With SB -200 teachers and teachers’ unions need to grab the bull by the horns. If politicians don’t want to recognize the financial needs of teachers, we need to follow the example of teachers in other states-STRIKE. At a time when the state is flush with money, and the cost of living in Colorado is skyrocketing, it’s time to face the music.

Where are the other states? For example, Utah provides a plan plus Social Security. How about showing us how that one compares to the Colorado PERA plan? It seems to me that we were clearly shortchanged with PERA cutting us out of Social Security. We would have gladly paid our part of Social Security to have a living retirement.

Dear Ms. Spengler,

In the states where public employees and their employers contribute to Social Security, the defined benefit portion usually has a lower multiplier. For example, the PERA plan uses 2.5% times years of service credit to determine the percentage of Highest Average Salary. In Utah, the defined benefit plan multiplier is 1.5%. The average PERA retirement benefit is $3,161/month. The average Social Security benefit is $1,404/month.