Colorado PERA’s Board of Trustees met on Friday, September 11. In the meeting, the Board reviewed a report assessing its governance procedures and heard reports from staff, among other agenda items.

Staff Reports

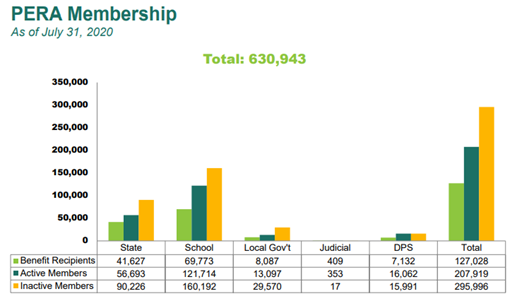

PERA Executive Director Ron Baker noted the continuing ways in which PERA has adapted to a vastly changed environment. Baker shared with the Board up-to-date membership statistics:

PERA’s Chief Investment Officer, Amy C. McGarrity, updated the Board on market conditions and PERA’s portfolio. She noted that the quick recovery seen in public equities has been as much as a surprise as the onset of the global pandemic and swift market decline.

This recovery, however, has been uneven as a few companies account for a significant portion of the recovery while other economic indicators, like employment, still face serious challenges ahead.

She added that, while the investment team did reallocate funds within asset classes in the preceding months, these changes were made within the framework of the Board’s asset allocation policy rather than a tactical move.

Patrick Lane, PERA’s Chief Benefits Officer, shared a report outlining PERA’s service delivery so far this year. The number of retirements through July 31 is nearly identical to 2019. And, despite PERA’s physical buildings being closed to the public since March, PERA counselors have performed nearly as many individual counseling sessions as in 2019. However, PERA has processed nearly 15% more benefit estimates and 20% more applications to purchase service credit compared to last year.

Other details Lane shared include:

- Member savings in PERAPlus 457 plans recently crested $1 billion for the first time.

- The call center has answered 122,976 calls through July 31. The most frequent questions have been about health care, web access, and retirement planning.

- 93,347 people are enrolled in PERACare plans.

- The Field Education team quickly moved their curriculum to online-based webinars and have reached more than 15 times as many people through digital means compared to 2019.

Governance Review

The Board routinely has third parties assess its procedures and operations. Cortex Applied Research, the Board’s governance consultant, analyzed the Board’s governance framework and fiduciary best practices. Their findings included:

- PERA’s Governance Manual “ranks very highly; it is consistent with the published standards in almost all respects and generally meets or exceeds the practices of the peer group.”

- The Manual “is among the most detailed and comprehensive manuals in the Peer Group.”

- “The code of conduct was also particularly strong.”

- PERA’s Governance Manual is held up as an example in multiple industry publications.

Asset classesA category of similar investments. Common asset classes include global equity (such as publicly traded stocks), real estate, and cash.FiduciaryA person who manages money on someone else’s behalf and who has a sworn responsibility to manage those funds in the best interest of the client. Asset allocationAn investor’s mix of stocks, bonds, and other investments. PERA’s strategic asset allocation is set by the PERA Board of Trustees.Asset classA category of similar investments. Common asset classes include global equity (such as publicly traded stocks), real estate, and cash.

I am already retired. Do I need to re-enroll?

Hi Sue,

I’d be happy to help if I can. Can you please be a bit more specific about your question?

You can also always call us at 1-800-759-7372 if you have questions about your account.

Who are ‘inactive PERA members’?

Hi John,

Inactive PERA members are those people who have left PERA employment but are not yet eligible for retirement. Example: You work at a PERA employer from age 30-40, during which time you are an active member. When you leave you become an inactive member until you collect retirement in the future.

I am an inactive member. But active about making Colorado PERA better for future generations.

What does that make me?

How does the 93,347 number of current PERACare participants compare to the current total number of PERA Pension recipients?

Justin, currently PERA has just over 127,000 benefit recipients.

Thank you Colorado Board, for letting me speak for 3 minutes about the Colorado – Thank Your Neighbor Ride, which will raise money for Teachers and School Employees, and fund the liability!

Does Colorado PERA have a response to this? Thanks!

Currently, the school Division is not permitted to elect into a DC plan. The other divisions are allowed to elect the DC plan instead of the DB plan. I find this troubling. State Workers and the Judicial system have choice, while Teachers and School employees do not. Let’s fix that! I believe Equal Choice is very important.

Hi Ryan- the State Workers and Judicial should have their “Equal Choice” as you describe it eliminated. It’s proven those that chose a defined contribution (401K) plan end up with less benefit even with a few years of service to a full career. It’s not fair or ethical to market “Equal Choice” to those state workers knowing they will receive sub-standard benefits.

Please be honest, with data.

How much will Taxpayers have to pay in perpetuity for the propaganda responses coming from the system which we pay into. All generations are your members! This is the USA!

Dave I agree with you. I would be trying to find a job in this market just to make bills if I had had a DC plan.

I appreciate my defined benefits now that I am retired and understand that it is life long, not just until my 401k runs out.

I did not know enough about DB vs DC to choose when I was teaching. Without understanding that could have been a life long mistake for me.

I would love to tour with PERA marketing to give both sides of the story.

I don’t tell stories much, but I love interpreting and llustrating data!

Ryan Christy – I ‘m sorry that once you see your point of view on data and facts does not hold up with high level analysis, you refer to it as “propaganda”. It appears that it is you, my friend, who has been propagandized by believing a defined contribution system returns more to the individualized investor. And thinking that this 217 page report, directed by the Colorado State Auditor and completed by a leading, nationally respected firm is propaganda, than it is impossible to have a productive discussion with you. This report is definitive and the case is closed on your point: Defined Benefit plans return more to Pera Members than do defined contribution plans. Your homework is to READ THE REPORT and then ask relevant questions regarding the report.

As a CFA, this report should be accessible to you. Good luck! Here it is:

https://www.copera.org/sites/default/files/documents/grsstudy.pdf

Look where the laws have gotten us? This is my point. I just want to do something about it. I’m trying.

Luckily, we have proof that laws can change.

Let’s change them for the better.

Let’s grab lunch. We’ll get somewhere.

303-505-3977

Hi Ryan. State law determines which employers have PERA Choice eligibility. PERA implements the decisions made by the legislature.

Someone needs to give good advice! Someone needs to take responsibility!

Pera gives excellent advice and is extremely responsible with the funds they are managing.

You also mentioned changing the interest rate that members receive on funds that they have paid into the PERA system. That rate is currently 3%. You said you don’t anticipate needing to change it, but want to have the flexibility.

What would make you use that flexibility, once you’ve gained it?

I count on that 3% in my personal financial planning for me and my daughters.

Hi again Ryan- the Fed announces today it plans to ignore higher inflation and keep interest rates low for a long time. 3% interest is probably too high to guarantee. You see Pera is changing asset allocation to reflect lower returns in the Bond market. Just like the COLA is not guaranteed, the 3% interest rate will need to be revisited.

So, you can change what you promised? I give you years of service, you take away benefits.

I understand, I think..?

Hi Ryan – retirees filed a class-action lawsuit regarding the COLA changes some years ago. The basic benefit is protected but the COLA is not, per the CO state Supreme Court. The 3% would fall under the same umbrella as the COLA. I don’t like it either, but it is settled law, my friend.

Look where the laws have gotten us? This is my point. I just want to do something about it. I’m trying.

Luckily, we have proof that laws can change.

Let’s change them for the better.

Let’s grab lunch. We’ll get somewhere.

303-505-3977

COLA is not guaranteed, but inflation is guaranteed. Every year once you retire it will get harder and harder to live on what you retired on.

It should be noted that this was completely vaguest negligent when presented to the Colorado PERA Board of Trustees.

*vague and negligent

Sorry, ugh

Pera gives excellent advice and is extremely responsible with the funds they are managing. The Pera board is not in any way negligent. Please stop using this platform to disinform readers.

How is PERA protecting PERA retirees from unfair increases in health care premiums? We got a tiny raise after many years and I fear that it is jeopardized by a projected increase in insurance premiums. Who negotiates with the insurance companies on behalf of the retirees? Are there any retirees on the board or committee that makes the decisions?How are members represented?

I would like the answer to this also. With the frozen cost of living for 2 years then get only 1.5 percent . I am currently bringing home less then when I retired 5 years ago. Due to the high insurance cost that makes no sense after you have given 32 years. Hope we can get some help.

Hi Betty,

Rising health care costs are a primary concerns for PERA retirees, along with retirees nationwide. We understand the concern. PERA On The Issues recently has published stories that illustrate the issues faced in negotiations, drug prices, along with work being done to address them. You might find them helpful:https://peraontheissues.com/can-these-ideas-control-health-care-costs/

https://peraontheissues.com/can-an-executive-order-bring-down-drug-prices/

While PERA’s Board is not involved in the day-to-day operations, they do oversee all of PERA’s operations, including PERACare. Ten Board members are elected by members and another two are elected by retirees. You can find more information about the Board here: https://www.copera.org/about/board-trustees

I guess the quoted statement farther below from the Board recap is the fancy way of saying that PERA did not come close to achieving the same percentage of investment returns during the run-up as did the market itself. Absurd. Why not just move all the money to a safe allocation between 2 funds: S&P 500 stock index fund and a reputable bond index fund? — Arguably, it would result in the lowest possible expense ratios due to passive management. There’s no need for active management regardless of how favorable you believe the fees are given the so-called leveraging power PERA has with the amount of money to be managed. At least with respect to an S&P 500 fund, it has long been advocated by Warren Buffett and Peter Lynch. In the long run, it’s almost impossible for a given fund to beat the market….courtesy of fees.

———————

This recovery, however, has been uneven as a few companies account for a significant portion of the recovery…She added that, while the investment team did reallocate funds within asset classes in the preceding months, these changes were made within the framework of the Board’s asset allocation policy rather than a tactical move.”

How much did Cortex get paid for the work they presented to the Board, and can we see the communication between Colorado PERA and Cortex prior to the report?

Do you ming auditing the Private Equity Benchmark? I’m not sure that is computed consistent with the Long Nichols approach which is defines itself as being compliant with.

Sorry, *mind and *it.

So excited to have discussion, so excited!!!

Let’s do more of this, my friend! -Ryan Christy

This also happened at the Colorado PERA Board meeting!

https://www.linkedin.com/posts/ryan-christy-cfa-a8165a14_teachersandschoolemployees-cfainstitute-millennialsandbeyond-activity-6712072071553384449-_2wo

For the members! Maxima Utilidad!

This is good info on Colorado PERA’s Investment Benchmark.

I will continue to provide data and education for retirees in pursuit of a solid financial future for Teacher and School employees of future generations.

I’m a Colorado PERA Member.

https://www.linkedin.com/posts/ryan-christy-cfa-a8165a14_cfainstitute-teachersandschoolemployees-frozen2-activity-6712140681802076160-Dk3a

Ryan Christy – one suggestion I have for you is that if you no longer work for Pera, withdraw and close your account into an IRA. Feel free to invest your money or spend it how you choose. Then you will be free from the Pera Board and Pera and will have no need to second guess the laws that govern them and the decisions they make.

I hear you David. I have aspirations to be a teacher.. so stuck between a rock and a hard place.

Thanks for your passion! It is much respected.

If I retired from Colorado Pera, when I move out of state for health reason, I could no longer get Pera Care.

Anthem coverage is available nationwide. So you could retire from PERA, move to any other state or US territory, and receive your PERACare benefits through Anthem. If you are in Kaiser, after retirement you can continue in Kaiser in CO or Kaiser is offered through PERACare in 7 other states as well. You could change to Anthem during open enrollment any year and get Anthem anyplace in the US. PERA is hosting Open Enrollment Virtual Meeting Opportunities starting Oct. 6, check out at http://www.copera.org/PERACareMeetings