In this story:

- PERA invests for the long term for its members

- The investment team considers a variety of risk factors when evaluating investment opportunities

- Comparing the risk in PERA’s investment portfolios to the risk found in their respective benchmark portfolios is one way these factors are evaluated

- Because investments contain multiple risks, PERA takes a comprehensive approach, considering the sum of these factors rather than each in isolation

Colorado PERA invests billions of dollars on behalf of its members. It holds investments around the world in a variety of asset classes and industries. This diversified approach to investing helps PERA achieve its investment goal: to maximize risk-adjusted returns for the benefit of members and retirees.

PERA is also a long-term investor. To better understand how an investment might perform in the long-term, PERA’s investment team considers a variety of risks when evaluating investment opportunities.

Risks come in many forms, and they can be considered in isolation or in combination with other risks that can impact an investment decision. Examples can include:

- Interest rate risk: How do interest rates impact valuations and expectations for future growth?

- Competitive risk: Does a company operate in an industry that has highly innovative peers?

- Climate risk: Does a company have a business plan that takes into account potential impacts of climate change?

- Supply chain risk: How dependent is a company on resources that it does not directly control, and what are the risks associated with those suppliers?

PERA considers these and many others as they evaluate investments.

An Example of How PERA Evaluates Risk

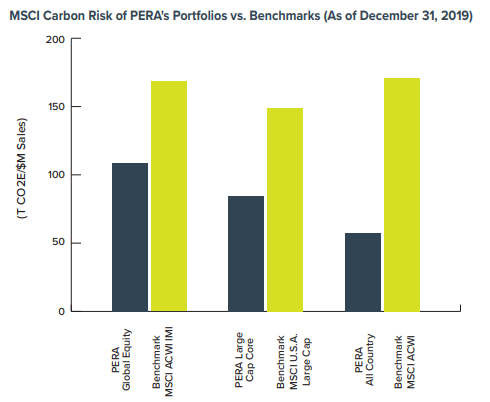

One method PERA uses to evaluate risk is to compare a PERA portfolio to its respective benchmark .

For example, carbon risk is part of environmental or climate-related factors an investor may consider. So it can be helpful to compare the carbon risk in PERA’s portfolio to the carbon risk in the portfolio’s benchmark .

The chart* below shows the carbon intensity of a few PERA portfolios alongside the carbon intensity of each portfolio’s respective benchmark . Lower bars indicate lower carbon intensity .

While PERA does not target specific environmental, social, or governance (ESG) scores when making investment decisions, these factors are part of a much broader mosaic of understanding of a company’s fundamental business.

The Importance of Sustainability

PERA has in place many measures to evaluate its portfolio exposures to various risks and opportunities. Because investments contain multiple risks, PERA takes a comprehensive approach, considering the sum of these factors rather than each in isolation.

Investing is also a dynamic activity. Markets evolve as political, social, environmental, and economic conditions change. Broadly speaking, a company that operates with sustainable business practices may be better able to navigate these changes. How?

- Sustainable business practices can signal the ability to manage risks and seize business opportunities more effectively than competitors.

- Sustainable practices can lead to more efficient operations, which can boost profits.

- Companies that have sustainable business practices also can attract and retain top talent. Top talent can yield innovation that enhances competitive advantages and, thus, returns to investors.

“PERA’s commitment to investing in companies that have strong financials, operations, and opportunities for growth means we have a bias toward higher quality companies in our actively managed portfolios,” said Tara Stacy, PERA’s Director of Investment Stewardship. “These companies are likely to score more favorably among their industry peers in other aspects of their business as well, such as in the management of various ESG risks.”

By focusing on financial sustainability, PERA is able to effectively evaluate and manage investment risks and opportunities across the portfolio in order to provide lasting benefits to its members and retirees.

* This report contains certain information (the “Information”) sourced from MSCI ESG Research LLC, or its affiliates or information providers (the “ESG Parties”). The Information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. Although they obtain information from sources they consider reliable, none of the ESG Parties warrants or guarantees the originality, accuracy and/or completeness, of any data herein and expressly disclaim all express or implied warranties, including those of merchantability and fitness for a particular purpose. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such, nor should it be taken as an indication or guarantee of any future performance, analysis, forecast or prediction. None of the ESG Parties shall have any liability for any errors or omissions in connection with any data herein, or any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.

Asset classesA category of similar investments. Common asset classes include global equity (such as publicly traded stocks), real estate, and cash.StewardshipThe practice of overseeing or managing something entrusted to one’s care. PERA’s approach to investment stewardship is focused on ensuring the financial sustainability of the fund that pays benefits to retirees and beneficiaries.EsgAcronym for environmental, social, and corporate governance factors that can be used when making investment decisions.BenchmarkA tool used to measure performance. For example, an investor can use a stock index as a benchmark to measure his/her own investment performance compared to the market as a whole.Asset classA category of similar investments. Common asset classes include global equity (such as publicly traded stocks), real estate, and cash.

Thankyou for sending this information to me!

What a crock of useless self-promoting disinformation! Why don’t you just come out and say that Representative Sirota (like Romanoff before her and the Save-Darfur-Gang) should NOT use PERA funds to promote their political agendas (the anti-fossil fools investment ban)! There is a difference between “survivability” and “sustainability” and neither PERA Board & Staff (PERA B.S.) nor Sirota know the difference!

Every PERA member needs to listen to Glenn Becks “Comply or Die” you tube video. This is such disingenuous bilge coming from you who have a fiduciary responsibility towards your recipients. So, riddle me this folks who are investing for your PERA recipients, how are you going to get yourself above 50% funded, and with a goal of 6.75% average annualized return, by implementing this garbage? The fact that Morgan Stanley and the big banks are pushing this is certainly not a conflict of interest, is it? What happens to the free market? Why don’t you be more transparent with the PERA recipients and show how exactly these companies you plan to invest in are being ranked. You’ll be diverting PERA dollars to those companies that may not have better innovation, and products and services that truly help. Your actions will pigeonhole and corral PERA recipients into more risky investments. Investments now controlled by big banks and the government. Stop blowing smoke up the peoples orifices. You are being irresponsible.