Recent research by the National Institute on Retirement Security (NIRS) found that 90 percent of those in the Millennial Generation (born between 1981 and 1996) participate in an employer-sponsored retirement plan when one is offered. This is good news for Colorado’s public employers who offer PERA when it comes to recruiting the next generation of public employees.

Millennials, numbering 83.2 million, are the largest, best educated, and most diverse generation in U.S. history according to the Pew Research Center. And while many millennials entered the workforce during an economically stressful time, NIRS research shows that they are just as motivated to save as older generations, if not more.

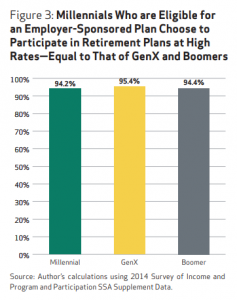

As the report explains, workers who are both offered and eligible for an employer-sponsored retirement plan choose to participate about 95 percent of the time across all generations, and millennials are right in line with that average, with a 94.2 percent participation rate.

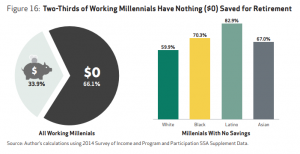

Despite their high rate of participation in retirement plans when eligible, many millennials worry about their retirement security, and for good reason. NIRS notes that nearly half of millennials are concerned that they will not be able to retire when they want to, while two-thirds are concerned about outliving their retirement savings.

But because many millennials are not eligible to participate in employer-sponsored retirement plans, even when they are offered to certain employees, only about one-third (34.3 percent) of millennials actually participate in an employer’s plan.

According to NIRS, “nearly half of millennials that do not participate in an employer-sponsored retirement plan cited part-time work or lack of tenure with their employer as a reason for not participating in a plan, rather than economic reasons such as student debt.”

However, millennials who work for an employer that offers PERA or similar public employee defined benefit plans, are automatically starting to save toward retirement – and have the option to save even more by contributing to the PERAPlus 401(k) or 457 Plans. These plans require no minimum contribution amount and vesting is 100 percent from day one.

For those millennials who do not have access to an employer-sponsored retirement savings plan, the news isn’t so good. NIRS says that two-thirds of the millennial generation have nothing saved for retirement.

NIRS: Millennials and Retirement: Already Falling Short

Millennials have longer tenure in their first jobs than did previous generations.

The NIRS report also debunks the common myth that millennials are loathe to stay in a job for very long. When different generations are compared on the aspect of job tenure, millennials actually spend more time in jobs early in their careers than Generation Xers or Baby Boomers. A study conducted by the U.S. Bureau of Labor Statistics tracking Boomers throughout their work-lives found that Boomers held short tenures with their employers during their younger years. Specifically, it found that, of the jobs that Boomers began when they were 18 to 34, 69 percent ended in less than a year and 85 percent ended in fewer than five years. The NIRS research concludes that “millennials are job-hopping at similar or even lower rates to their Gen X and Boomer predecessors.”

PERA’s hybrid defined benefit plan is a particularly strong recruitment and retention tool because of the value it offers to employees regardless of the length of their career. PERA’s plan design has evolved to serve both long-service employees as well as those who only work for a short time in public employment. This benefits Colorado’s public employees, their employers and the valuable services delivered to Colorado taxpayers.

Hybrid defined benefitPERA’s Defined Benefit (DB) Plan is “hybrid” in that it combines features of a traditional DB plan with some of the features of defined contribution (DC) plans, such as portability.Defined benefitAlso known as a pension, this is a type of pooled retirement plan in which the plan promises to pay a lifetime benefit to the employee at retirement. The plan manages investments on behalf of members, and the retirement benefit is based on factors such as age at retirement, years of employment and salary history.