“Your low cost, high service performance is particularly impressive given your ‘tough’ peer group.”

That’s what CEM Benchmarking, an international firm that analyzes pension fund service delivery, noted about Colorado PERA after comparing PERA to its peer group of 13 U.S. pension plans and to a larger universe of 72 plans around the world.

Colorado PERA is included in a peer group of 13 U.S. plans including Ohio PERS, with a membership of 1,065,000 down to TRS Louisiana, with 188,000 members. PERA is in the middle of this group, with 567,000 members as of July 2016.

The range of U.S. pension plans varies from CalSTRS and CalPERS in California to North Carolina RS and Utah RS. Global pension plans studied include ABP and PFZW in The Netherlands to the Ontario Pension Board and the British Columbia Pension Corporation in Canada, Abu Dhabi RPB, and numerous other plans in several countries.

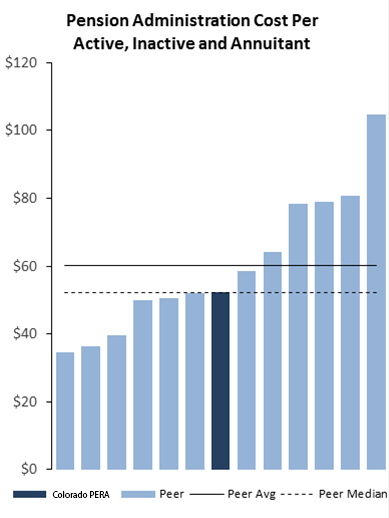

For 2015, PERA’s administrative costs were well below the average of both the 13 funds in its peer group and the 72 pension funds evaluated across the globe. PERA’s annual pension administration costs were $52 per active member per year (or annually), inactive member, and retiree, or $8 below the peer average of $60 per year.

Source: CEM Benchmarking presentation to the Colorado PERA Board of Trustees, September 2016.

The reasons for PERA’s lower than average costs included higher employee productivity and lower costs for information technology and economies of scale. PERA had 3.5 full-time employees (FTE) per 10,000 members, below the peer average of 4.5.

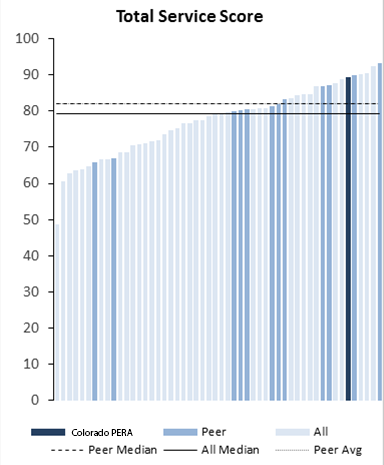

PERA’s overall service score, measuring the customer service PERA provides its members and retirees, was 90 out of 100. Only five funds out of the 72 measured had higher service scores than PERA.

Source: CEM Benchmarking presentation to the Colorado PERA Board of Trustees, September 2016.

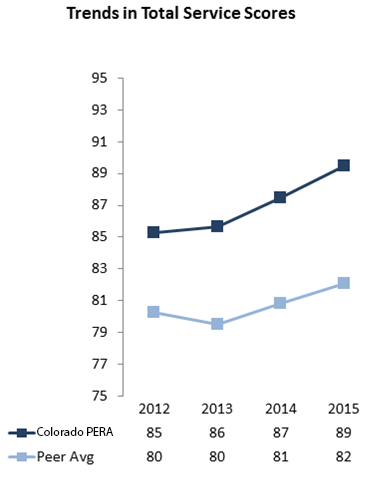

Between 2012 and 2015, PERA’s total service score increased five points.

Source: CEM Benchmarking presentation to the Colorado PERA Board of Trustees, September 2016.

“CEM’s independent, third-party analysis of PERA’s operations confirms what members and retirees tell me about PERA’s customer service delivery. It’s important that Colorado PERA members, policymakers, and taxpayers know that PERA continues to receive high marks when we are compared to our peers in the United States, as well as around the world,” said Greg Smith, PERA’s executive director. “And we do it at a comparatively low cost, too, which is important to everyone’s bottom line,” he concluded.

The results of the CEM Benchmarking study further demonstrate the strong commitment of PERA to deliver exceptional service for PERA members and retirees. PERA provides this level of service at a low cost, protecting the retirement savings of its members and continuing to be one of Colorado’s best investments for members, retirees, and taxpayers across the state.

Tom Scheibelhut, Managing Principal, CEM Benchmarking, presenting at Colorado PERA Board of Trustees meeting, September 2016

BenchmarkA tool used to measure performance. For example, an investor can use a stock index as a benchmark to measure his/her own investment performance compared to the market as a whole.BenchmarkA tool used to measure performance. For example, an investor can use a stock index as a benchmark to measure his/her own investment performance compared to the market as a whole.