Even short-term public employees benefit from PERA’s unique plan design.

As the state’s largest retirement plan, Colorado PERA sees its fair share of news headlines. But to make sense of the issues affecting PERA, it’s often important to go beyond the headlines and understand how PERA works for its members, retirees, public employers, and Colorado taxpayers.

In July, the Colorado Office of the State Auditor released an independent evaluation of PERA comparing the costs and effectiveness of PERA’s defined benefit plan to alternative plans in the public and private sector.

Nationally recognized actuarial firm Gabriel, Roeder, Smith & Company (GRS) looked specifically at PERA’s hybrid defined benefit (DB) Plan and compared it to alternative plans in the public and private sectors. Their evaluation came to the overall conclusion that “Colorado’s largest public employee pension system is the most efficient and effective a state could have,” as GRS officials told members of the Legislative Audit Committee in July of 2015.

The GRS report includes information on PERA’s membership as well as the costs to members and employers. It also outlines the benefits that members receive including a monthly retirement benefit as well as ancillary benefits like disability and access to health care for retirees.

Colorado PERA offers the retirement plan of choice for the state’s public workers. At its core, PERA acts on behalf of its 500-plus employers who have opted to offer their public employees a hybrid defined benefit retirement plan rather than Social Security. A smaller number of PERA members also have an option to choose the PERA Defined Contribution (DC) plan instead of the hybrid defined benefit Plan. Like Social Security, the PERA hybrid plan design includes disability and survivor benefits. All members contribute at least 8 percent of every paycheck to their own unique accounts which currently earn 3 percent interest. Members who leave PERA-covered employment before retirement receive employer matching contributions under applicable vesting schedules, which is very similar to many Defined Contribution plan designs.

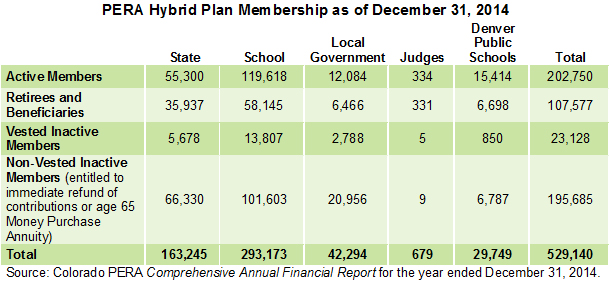

The PERA hybrid defined benefit Plan had over 529,140 total members as of December 31, 2014 The chart below breaks down PERA membership by active members, retirees and beneficiaries, inactive vested members (with five years of service or more) and non-vested inactive members (with less than five years of service).

PERA offers a monthly benefit, for life, at retirement. Participants in the PERA hybrid defined benefit plan are eligible for a monthly retirement benefit once they reach age 65, regardless of how long they worked for a PERA employer. Participants are not required to have at least five years of service before earning eligibility for a monthly retirement benefit, a common misconception. For example, a 25-year old teacher who works for a year can leave his or her account at PERA until turning 65, and then receive a guaranteed monthly lifetime benefit. This is in contrast with a 401(k) plan participant who could withdraw from an account until there is no balance remaining. With a defined benefit plan, a monthly benefit will be paid for life.

Benefits for retirement-eligible members are calculated in one of two ways. The Service Retirement Formula is based on a member’s years of service and highest average salary, while a Money Purchase Annuity is based on a member’s account balance including an employer match and interest. Like with an Annuity, the average life expectancy is also part of the calculation.

Retiring members who have reached retirement eligibility age receive whichever calculation is greatest. For members at age 65 with less than five years of service, the Money Purchase Annuity calculation is used.

PERA benefits go beyond a traditional pension payment. PERA is much more than a hybrid DB plan. A summary chart of PERA hybrid defined benefit Plan provisions and benefits for all employees hired on or after January 1, 2011, is below. (Benefits for PERA members hired before 2011 are similar but vary based on an employee’s first date of hire.)

PERA retirees can access PERACare, PERA’s health benefits program. Even as the Colorado and U.S. health care markets evolve, this benefit allows access to group insurance rates for a variety of health care plans offered by recognized providers. The cost of premiums in PERACare is offset based on the number of years a member worked for a PERA employer. Disability and survivor benefits are also available for many members.

Those critical of public defined benefit plans in general, and of PERA in particular, should recognize the independent findings of GRS as presented to the Colorado General Assembly’s Legislative Audit Committee.

Stay tuned for more on PERA’s portability provisions from the GRS study.

PortabilityThe ability to take an existing retirement plan with you when you change employers.Hybrid defined benefitPERA’s Defined Benefit (DB) Plan is “hybrid” in that it combines features of a traditional DB plan with some of the features of defined contribution (DC) plans, such as portability.AnnuityA type of financial contract in which a person pays a lump sum or a series of payments in exchange for a guaranteed stream of income for the rest of their life.AnnuityA type of financial contract in which a person pays a lump sum or a series of payments in exchange for a guaranteed stream of income for the rest of their life.Defined benefitAlso known as a pension, this is a type of pooled retirement plan in which the plan promises to pay a lifetime benefit to the employee at retirement. The plan manages investments on behalf of members, and the retirement benefit is based on factors such as age at retirement, years of employment and salary history.Defined benefitAlso known as a pension, this is a type of pooled retirement plan in which the plan promises to pay a lifetime benefit to the employee at retirement. The plan manages investments on behalf of members, and the retirement benefit is based on factors such as age at retirement, years of employment and salary history.Defined contributionA type of individual retirement plan in which an employee saves a portion of each paycheck (along with a potential employer match) and invests that money. The employee’s retirement benefit is based on their account balance at retirement. A 401(k) is a type of defined contribution plan.Defined contributionA type of individual retirement plan in which an employee saves a portion of each paycheck (along with a potential employer match) and invests that money. The employee’s retirement benefit is based on their account balance at retirement. A 401(k) is a type of defined contribution plan.