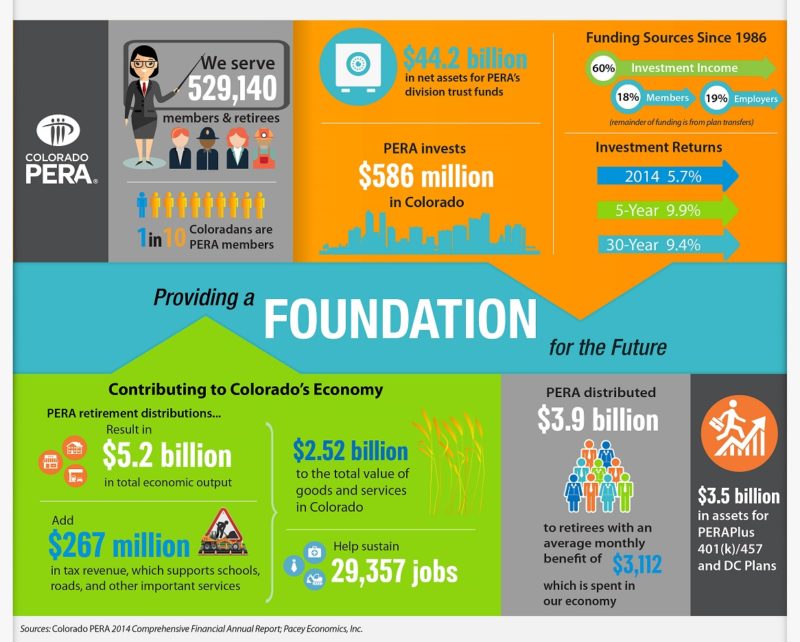

PERA continues to be one of Colorado’s best investments pumping more than $5 billion into Colorado’s economy. “Our distribution of retirement dollars to those who spent careers teaching our children, keeping our roads safe, maintaining our wilderness areas, and helping to build strong communities means that PERA works for Colorado’s small businesses where our economic impact is felt in local communities throughout the entire state of Colorado,” said Colorado PERA Executive Director Gregory W. Smith. “At PERA, we work for our members and retirees to ensure they have a foundation for the future that includes a secure and stable retirement.” Read more here.

Inside Colorado PERA

2014 PERA Financials Released

Touting $5 billion going back into Colorado’s economy is all well and good. But is PERA as underfunded as its critics keep saying so very publicly in the media? If not, use that as your talking point.

Hello Teresa,

Thanks for your comment. PERA’s unfunded liabilities are scheduled to be paid off over time as a result of the reforms in 2010’s Senate Bill 1. Not all benefits are due and payable today, so like a mortgage, these liabilities will be paid down over time. PERA’s unfunded liabilities for current and future retirements totaled $24.5 billion at the end of 2014 (based on the market value of assets). However, PERA’s actuaries project that the division trust funds will be fully funded in approximately 30 to 40 years.