A recent study from the National Institute on Retirement Security found that defined benefit (DB) pensions like Colorado PERA’s continue to offer substantial cost savings over defined contribution (DC) accounts like 401(k)s.

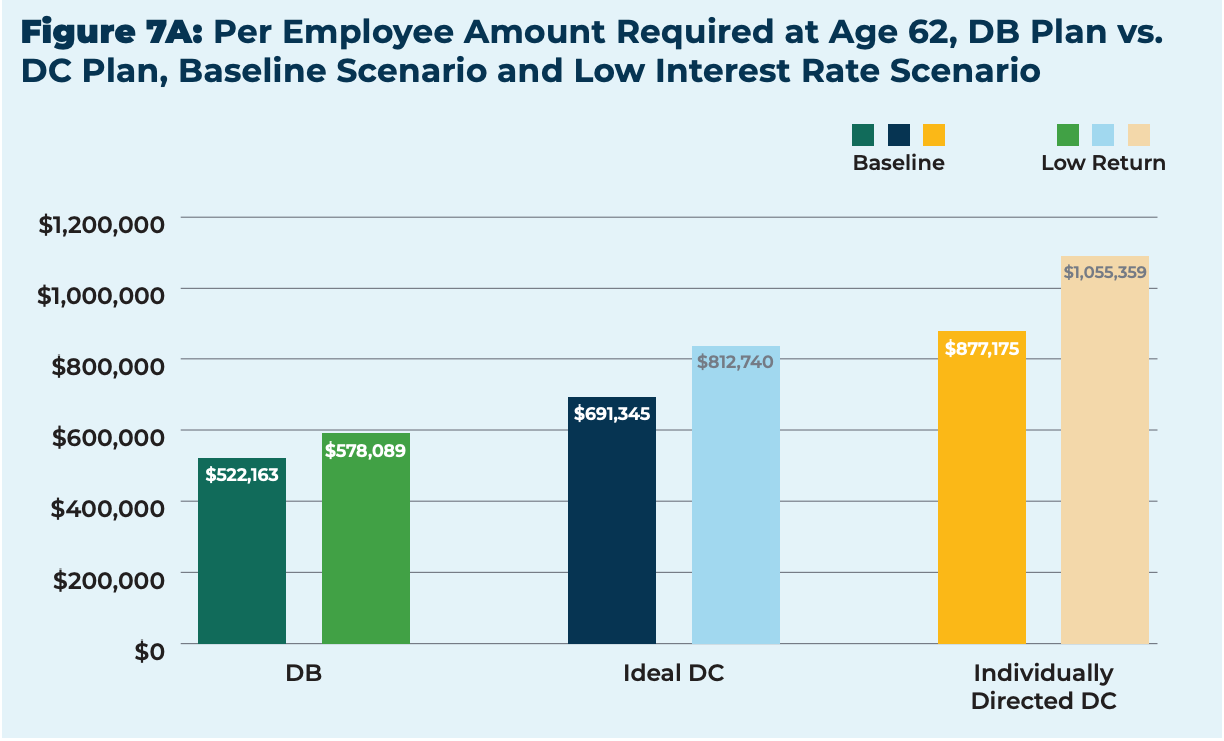

The research affirms NIRS’s findings from 2008 and 2014 that DB plans can provide retirement benefits at about half the cost (49 percent) of the typical DC plan.

The cost savings come from key differences in how DB and DC plans work, the authors state. In particular, they highlight the following three advantages of DB plans:

- Longevity risk-pooling: defined benefit plans cover a large number of people, with each person’s benefits coming from the same trust fund. For that reason, DB plans only have to accumulate enough money to fund benefits for the average life expectancy of the group. An individual in a defined contribution plan, on the other hand, has to accumulate enough funds to cover their expenses for the rest of their life, including the possibility of living longer than their life expectancy. That means a DC account needs to have a higher balance at retirement in order to provide the same level of benefits as the DB plan.

- Maintenance of portfolio diversification: Individuals in DC plans are typically encouraged to shift their portfolio to a more conservative, or lower-risk, mix of investments as they get older to protect their balance from drops in the stock market. A DB plan, with its shared trust fund. can maintain a well-balanced portfolio over the long term and weather short-term risks in the stock market, ultimately earning higher returns.

- Lower fees and professional management: Because of the pooled nature of DB plans, the fees for managing investments are shared by the group and are lower than the typical DC plan, in which each individual pays fees on their account. In addition, DB plan investment managers have a fiduciary duty — they must make decisions to ensure the longevity of the fund — while individual investors in DC plans may not have the expertise to make the right decisions.

Simply put, a person saving for retirement in a DC plan needs to save more money than the typical DB plan. Overall, the authors conclude that it is about twice as expensive to save for retirement under a DC plan like a 401(k) than it is with a DB pension plan.

Both DB and DC plans have their advantages, and Colorado PERA offers both, with some members having the ability to choose whichever plans works best for them. PERA offers all of its members a hybrid defined benefit plan that gives members increased flexibility and additional options, whether through a monthly lifetime benefit or complete portability to another retirement plan. PERA members can also supplement their retirement savings with a 401(k) or 457 plan.

It’s a powerful retirement tool that adapts to the many different paths people take in public service: whether working part-time or full-time, whether planning on a long tenure or a short one, and whether near retirement or far from it. Click here to learn more about PERA’s defined benefit plan.

Trust fundA fund in which money and/or other assets are held and managed by trustees on behalf of plan participants. PERA maintains trust funds for each of its Defined Benefit Plan divisions (State, Local Government, School, Denver Public Schools, and Judicial).Trust fundA fund in which money and/or other assets are held and managed by trustees on behalf of plan participants. PERA maintains trust funds for each of its Defined Benefit Plan divisions (State, Local Government, School, Denver Public Schools, and Judicial).PortabilityThe ability to take an existing retirement plan with you when you change employers.Hybrid defined benefitPERA’s Defined Benefit (DB) Plan is “hybrid” in that it combines features of a traditional DB plan with some of the features of defined contribution (DC) plans, such as portability.FiduciaryA person who manages money on someone else’s behalf and who has a sworn responsibility to manage those funds in the best interest of the client. Defined benefitAlso known as a pension, this is a type of pooled retirement plan in which the plan promises to pay a lifetime benefit to the employee at retirement. The plan manages investments on behalf of members, and the retirement benefit is based on factors such as age at retirement, years of employment and salary history.Defined benefitAlso known as a pension, this is a type of pooled retirement plan in which the plan promises to pay a lifetime benefit to the employee at retirement. The plan manages investments on behalf of members, and the retirement benefit is based on factors such as age at retirement, years of employment and salary history.Defined contributionA type of individual retirement plan in which an employee saves a portion of each paycheck (along with a potential employer match) and invests that money. The employee’s retirement benefit is based on their account balance at retirement. A 401(k) is a type of defined contribution plan.

Thank you so much for this excellent description. I am so happy and relieved that I was able to invest in PERA and count on it. Retirement now has been great. I know that people in jobs today rarely have this option. I wish that there was a way for young people to invest in a system like this rather than depending on their own 401 savings, regardless of the jobs they had.