The year has gotten off to a rocky start in the stock market, as concerns about the economy, inflation, and the Russia-Ukraine conflict have led to a series of ups and downs in the major stock indexes.

PERA’s investment staff, led by Chief Investment Officer Amy C. McGarrity, manages a portfolio of more than $60 billion (as of Sept. 30, 2021) on behalf of PERA members and retirees. While staff monitor market activity and trends, PERA’s investment focus is on the long-term.

McGarrity recently participated in a discussion with other CIOs at the Council of Institutional Investors’ spring conference, where she and the other panelists spoke about the challenges of investing in today’s market environment and the importance of a strategic, diversified portfolio.

“We are in the business of providing retirement security, so we invest strategically,” McGarrity said. “We don’t try to predict what the markets will do from day-to-day, but instead we remain invested in our primary asset classes throughout the market cycle, with a focus on long-term returns.”

Strategic asset allocation

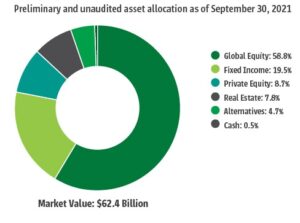

asset allocation as of Sept. 30, 2021: 58.8% global equity, 19.5% fixed income, 8.7% private equity, 7.8% real estate, 4.7% alternatives, 0.5% cash" class="wp-image-4939"/>

asset allocation as of Sept. 30, 2021: 58.8% global equity, 19.5% fixed income, 8.7% private equity, 7.8% real estate, 4.7% alternatives, 0.5% cash" class="wp-image-4939"/>The PERA Board of Trustees sets PERA’s strategic asset allocation, which dictates how the fund’s portfolio should be split between various types of investments like stocks, bonds, and real estate. Those investments carry different levels of risk (potential for loss in value) and potential return (gain in value). For example, stocks can generate strong returns but often come with a higher level of risk, while bonds typically generate lower returns but also have a lower level of risk.

The result is a diverse mix of investments with varying levels of risk that can help protect the overall portfolio during times of market volatility.

While the stock market may go up or down in a given year, PERA’s strategic asset allocation was developed with the goal of ensuring PERA’s investments will generate value over the course of several decades, regardless of what happens in any one year.

Focusing on the long-term

Being invested for the long-term means being exposed to the ups and downs of market cycles. Downturns are expected, and the swiftness with which they can occur often overshadows the rise in markets, even though positive market environments typically outweigh the negative impact of historical downturns.

For example, in early 2020, global equity markets saw steep losses as COVID-19 spread around the world. By the end of the year, the markets had rebounded and even posted gains.

PERA’s assumed rate of return — one of the key numbers PERA uses to forecast how much money the fund will have on hand to pay benefits in the future — is 7.25 percent. While the actual return in a given year may be higher or lower than 7.25 percent, the goal is to meet the assumed rate of return over a period of 30 or more years. PERA’s annualized return over the past 10 years is 9.4 percent. By maintaining a well-diversified portfolio of assets and a focus on long-term returns, PERA is well-positioned to weather ups and downs in the markets and continue providing lifelong monthly benefits to current and future retirees.

Global equityA type of investment that includes publicly traded stocks in companies based in the United States and abroad.Asset classesA category of similar investments. Common asset classes include global equity (such as publicly traded stocks), real estate, and cash.AlternativesA broad category of investments that don’t fit into traditional categories like stocks and bonds.Assumed rate of returnThe investment return a pension plan expects to achieve or beat over the long term. This rate is key to estimating how much money the plan will have on hand to pay future benefits.Asset allocationAn investor’s mix of stocks, bonds, and other investments. PERA’s strategic asset allocation is set by the PERA Board of Trustees.VolatilityA state of unpredictable activity in financial markets, during which prices can experience significant and/or unexpected swings in either direction. Private equityA type of investment in which investors purchase shares of a company that is not traded on a public stock exchange.Fixed incomeA type of investment that pays investors a fixed rate of interest over a set period of time. Bonds are a common type of fixed income investment.Asset classA category of similar investments. Common asset classes include global equity (such as publicly traded stocks), real estate, and cash.

Is PERA of Colorado involved with the Russian Stock Market?

On February 24, Governor Polis made a request to the PERA Board that is consistent with what has been included in the federal mandates pertaining to sanctions on Russian-owned assets. U.S. sanctions remain fluid and include a combination of freezing assets, divesting of assets and not investing additional funds in Russian assets. PERA is reviewing and preparing to implement the federal mandates within the required time specifications. As of February 24, PERA has $8 million in total invested in Sberbank, OGK-2, Gazprom, Mosenergo, and Rosneft Oil.

Please answer the question listed before

Yes thanks PERA. Stay the course is great advice for long term investors. Mr. Market has his fits every so often, but successful long term investors know to ignore the panicky types.

Volatility equals Opportunities, and stomach aches!

Does PERA have a money market I can invest in?

Diversification is the best way to reduce risk and with over 58% in Global Equity how diverse is the equity portfolio? With political/economic uncertainty in other countries, the risk is higher if only a small portion is in domestic equities. U.S. economy is strong invest in USA!

Hi Raymond, global equities includes investments in U.S. companies and the majority of assets currently accounted for under global equities are U.S. companies. You’ll find more information on our website here: https://www.copera.org/asset-classes