In this story:

- Four PERA Trustees were reelected to the Board

- The Board will also gain a new Trustee, Ashley M. Smith

- The 2020 Annual Report was approved and released by the Board

- Investment returns topped 17% last year, exceeding the fund’s benchmark

- The Annual Report announced that the automatic adjustment provision will go into effect in 2022

PERA’s Board met on June 18. The meeting included the announcement of results from the recent Board election as well as the approval and release of the 2020 Comprehensive Annual Financial Report (Annual Report).

Board Election Results

Four PERA Trustees have been reelected to PERA’s Board. PERA’s Board announced the following results at their meeting on June 18:

- Suzanne E. Kubec was reelected to represent the State Division

- Tina Mueh and Marcus A. Pennell were reelected to represent the School Division

- Julie Friedemann was reelected to represent retirees in the School, Local Government, and Judicial Division

Each Trustee was elected to serve a four-year term, ending in June 2025.

In addition to the above results, Ashley M. Smith was appointed to represent the State Division. Smith fills the seat vacated by Dave Hall’s departure from the Board.

Annual Report Released

Every year, the Board releases a report that summarizes PERA’s investment performance, funded status and membership information for the year before. The Annual Report the Board released last week covers the 2020 calendar year.

The Annual Report showed that PERA had a strong investment year, returning 17.4%, net of fees. This beat the fund’s benchmark of 14.1%. The total fund was valued at $58.3 billion, up from $51.7 billion at the end of 2019.

The Annual Report also announced that the automatic adjustment provision will go into effect in July 2022. While 2020’s investment returns were positive, it is one of many factors used to calculate a plan’s funded status. Changes to PERA’s actuarial assumptions and the impact of the pandemic on PERA’s membership increased PERA’s liabilities.

You can read more about the Annual Report here.

Other Updates

- The Board elected Suzanne E. Kubec to serve as Vice Chair, filling the seat vacated by David Hall following his departure from the Board.

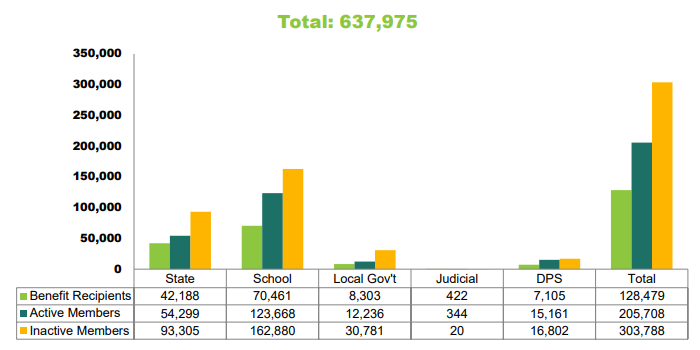

- The following updated membership statistics were shared with the Board:

Actuarial assumptionData such as demographics, mortality rates, and investment returns that retirement plans use to calculate future assets and liabilities.BenchmarkA tool used to measure performance. For example, an investor can use a stock index as a benchmark to measure his/her own investment performance compared to the market as a whole.

What does it mean that the “automatic adjustment” will go into effect in 2022? I hope it doesn’t mean that in spite of 17% gains retirees won’t get even the small increase currently allowed.

It means that those that are currently working and the employers will pay more and retirees will get less.

“Beginning July 1, 2022, employer and member contributions will increase by 0.50 percentage points of salary. The annual increase will be reduced by 0.25 percentage points.”

Fred,

If you were a average wage employee, you are getting screwed big time!!

Just wait until PERA Board & Staff (PERA B.S.) posts some self-promoting article about the June 23rd “Townhall” dog & pony shows via this PERA On The Issues (P.O.T.I.) site…

They’ll further obfuscate about the reasons they’re just sitting by as the legislature steals our money! For example they want to claim that PERA recipients are living longer, which of course would be the fault of the actuaries, or probably just predicated upon old pre-pandemic data so the opposite is more likely to be true (nice try at ripping off the old folks, who let’s face it… the legislature would prefer simply die, which may also explain the horrible health care plans we get).

However, it is fun to vent on this silly site but I’d rather see PERA members organize and change the laws by writing their lawmakers!

NBC news report, link: https://www.msn.com/en-us/news/us/us-life-expectancy-decreased-by-an-alarming-amount-during-pandemic/ar-AALn0oL?ocid=mailsignout&li=BBnb7Kz

The Colorado State joint budget committee is responsible for the reduction in PERA fund. I did contact the four leads on this committee and was not given a viable reason why PERA funding was not fully funded this year. I completely agree that PERA members should work together. The State should provide the support they agreed to provide the fund and PERA should stand up for their members. Hopefully, a member group will come together before the next legislative session

From 2016 to 2022 what will the

AVERAGE yearly increase be for PERA retirees?

Looks to be about 1.2% average for those years. Significantly less than it used to be.

Please tell me what the Actuarial Assumption Rate was for 2019 -2020 – 2021 and what will it be in 2022?

Seeing members complain about not getting an increase shows a “self serving” approach. Maintaining a sustaining approach to assuring funds available for the long term should be all members’ concerns.

Mr. McGannon,

Thank you for your thoughtful reply.

Dear Mr. McGannon, Others of a Similar Persuasion, and PERA Board & Staff (PERA B.S.):

“Complain?” “Self-serving?” “Assuring funds available for the long term?”

The Annual Increase (A.I.) was meant to compensate for inflation. The “I” in I.A. stands for “increase,” but zero is NOT an increase, and after years of zero (while inflation exceeded 2%) the result is our monthly benefits have decreased in value! I hardly see complaining about theft as being self-serving (it’s alarmingly true); and in the long term, we’re all dead; although I’m sure many wish is was earlier for PERA members (but such thinking post pandemic, would expose mortality tables employed by PERA B.S., that in part triggers the Automatic Adjustment, as another bogus way to rob retirees).

Seeing lawmakers violate the contract clause of the US Constitution (by reneging on the promise to protect retirees from inflation), and do so simply to raid the state pension fund, should be of great concern to all citizens!