Colorado PERA’s Board of Trustees met on January 15. The meeting’s agenda consisted primarily of updates on operations from PERA staff, summarized below. It was also the first meeting run by the Board’s new leaders, Marcus Pennell and David Hall.

Legislative update

Executive Director Ron Baker and Public and Government Affairs Manager Michael Steppat presented an outlook on the 2021 legislative session.

The presentation largely mirrored the legislative preview published in PERA On The Issues in early January. The legislative session is on pause until mid-February at the soonest. When legislators return, addressing the COVID-19 pandemic will dominate debate.

Communications update

PERA Senior Director of Communications Patrick von Keyserling shared projects currently underway in the department. Changes members can expect in 2021 include:

- The creation of a new dashboard that displays helpful information after logging in to a member account

- Improvements to copera.org

- A continued effort to transition to digital forms

Update from PERA’s Executive Director

Ron Baker shared some high level statistics with the Board, including:

- PERA paid out $4.7 billion in benefits from January through November

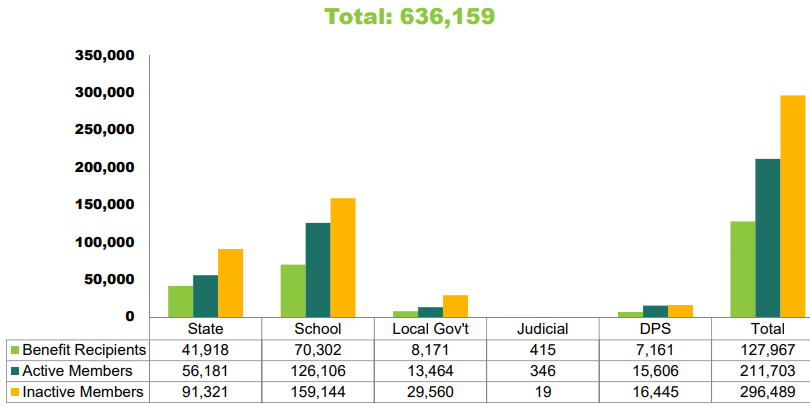

- PERA’s total membership was 636,159. These numbers are broken down by division below.

Investments update

PERA’s investment staff provided an update on each asset class to the Board, as well as a Market and Portfolio Update. These presentations are summarized below.

- Global equities: Overall, PERA is overweight global equities, which means the amount currently in PERA’s portfolio is above the benchmark. As of November 2020, the most recent date for which information is available, global equities made up 59.2% of PERA’s portfolio — higher than the 56.0% policy benchmark weight, but still within the Board-established allowable range of 48%-60%.

- Fixed income: The current environment is volatile, and Treasury yields are near historic lows. Fixed income is a core asset class for PERA, providing long term income and stability, and is an anchor to offset some of the potentially more volatile components of the total investment portfolio. It made up 20.3% of PERA’s portfolio at the end of 2020.

- Private equity: Tim Moore, PERA’s Director of Private equity, described the Private equity environment as being “measured and cautious.” He said that Private equity managers in general are still assessing the impact of COVID-19’s effect on the economic environment and that PERA is poised to take advantage of opportunities when the market normalizes. Private equity made up 7.8% of PERA’s portfolio.

- Real estate: Real estate is undergoing a challenging time as retail, hotels, and office buildings all face difficulties stemming from the pandemic. PERA’s real estate portfolio is overweight toward industrial and multi-family properties and does not own any hotels or leisure properties directly. PERA’s real estate team is taking a long-term view by working with tenants in an effort to preserve rent collection. Real estate made up 8.2% of PERA’s portfolio.

- Alternatives: New investments, including private global infrastructure, royalties, and agriculture, have helped diversify PERA’s portfolio. Alternatives made up 3.8% of PERA’s total portfolio.

A complete, audited report of PERA’s 2020 investment results will be available in the Comprehensive Annual Financial Report, released in June (read more about the CAFR here). Why the wait? While the value of some asset classes, like global equities, are updated on a daily basis, other asset classes, like Private equity, are valued on a less frequent basis.

The Board’s next meeting is on March 19.

Asset classesA category of similar investments. Common asset classes include global equity (such as publicly traded stocks), real estate, and cash.AlternativesA broad category of investments that don’t fit into traditional categories like stocks and bonds.Private equityA type of investment in which investors purchase shares of a company that is not traded on a public stock exchange.Private equityA type of investment in which investors purchase shares of a company that is not traded on a public stock exchange.Private equityA type of investment in which investors purchase shares of a company that is not traded on a public stock exchange.Fixed incomeA type of investment that pays investors a fixed rate of interest over a set period of time. Bonds are a common type of fixed income investment.BenchmarkA tool used to measure performance. For example, an investor can use a stock index as a benchmark to measure his/her own investment performance compared to the market as a whole.Asset classA category of similar investments. Common asset classes include global equity (such as publicly traded stocks), real estate, and cash.Asset classA category of similar investments. Common asset classes include global equity (such as publicly traded stocks), real estate, and cash.

This report is not helpful;

So is PERA losing or gaining? Solvent or not? Meeting investment goals?

Judge Michaelson,

PERA compiles an audited financial report every June that addresses those questions related to investments. While some asset classes receive frequent valuations (stocks and bonds, for example), others are valued on a less frequent basis.

At the end of 2019, the fund had a fiduciary net position of $51.7 billion, compared to $44.9 billion the year before. The total fund’s investment portfolio returned 20.3 percent, net of fees, in 2019. 2020’s results are currently being compiled.

You can find even more here: https://www.copera.org/sites/default/files/documents/5-20-19.pdf

I have been avoiding taking my social security benefits because they’re taking two thirds of the benefit for the Windfall tax. Please address this issue! I worked for that money and it’s not fair. Please work with the Social Security office on this! I have heard that other states don’t have the Windfall. Why Colorado?

States that deduct Social Security plus retirement from public employee paychecks receive full Social Security. Colorado’s Public Employees did not pay Social Security on their Public Employee income.

I always had to work a second job while teaching my 41 years. I earned Social Security. I paid into it, but of the $1440.00 I should be getting- I am only going to receive half that amount!! That is not right as I paid that money i to my SS and should get it. Because teacher salaries have always been historically low- most teachers work a second job. So why can’t we get all of our SS?

Not right nor fair!! That’s my money and I need it in my retirement years!!!

This WEP needs to be dismantled!

Please!!!!!

Hi Jackie. It boils down to whether or not an employee pays Social Security taxes while employed at a public sector job. Most PERA employers do not pay Social Security taxes. Some states are like Colorado while other states have employees pay pension contributions plus Social Security taxes. In other words, the law is not specific to Colorado, but rather is about the taxes paid.

Agreed. There is no data regarding actual performance, returns and projections thru EOY 2021.

Hi Rod. Data from 2020 is still being compiled and audited. We will share that information as soon as it is available.

Please put the weight of PERA behind legislation to elimate of the “Windfall Tax” that negates PERA retirees from receivingSocial Security benefits from late spouses. Your retirees would be in much better financial condition with the addition of survivor, SS benefits. Please advocate for us. This is an urgent need of PERA retirees, as most have spouses who received Social Security.

Yes!!!

Yes!!

This would help me very much; please push this.

Yes!

I’d like to receive the SS Benefits that I earned prior to & after working as a CO state employee. I should be receiving at least $1,200 mo that I (not a spouse) paid into SS benefits.

I agree totally. Please advocate for us!

NOTE: I am not affiliated with PERA, but I have a lot of experience with this topic. There are 2 Social Security reductions that affect many PERA members. The Windfall Elimination Provision (WEP) can reduce, but not eliminate, your “EARNED” Social Security benefit. The Government Pension Offset (GPO) may reduce, or eliminate, your “SURVIVORS” or “SPOUSAL” benefit. Some pension members in other states are not affected by this because they contribute to both Social Security AND the state pension plan. Sometimes – there are planning strategies that may reduce the impact of WEP. In most cases there is not a lot you can do and PERA has very little control or influence with this. If you’re really interested in why Social Security does this, I can give you their rationale. Contact me if you like: Brad@MiFiGroup.com .

Please advocate for elimination of the GPO as well. It’s tough for a widow to ever retire!

Fully agree. It is a slap in the face for those of us who have put in the time in both private and public employment. We are punished because we planned ahead and worked for an extensive period of time.

yes thank you

That is one of my big concerns. The WEP needs to be reversed. I worked 21 yrs social security income to have my social security reduced by two-thirds when I retired. I don’t see PERA working on this issue very often

Yes please help eliminate the Wind Fall. I just lost my deceased husband’s social security widows benefit because of this!

Please support eliminating the Windfall elimination. It unfairly penalizes us especially those of us not receiving a full retirement.

Yes please

Please do support elimination of the “Windfall Tax”!!!

I called and found I would only get a minimal amount of my

husbands SS

Hear hear!

Agreed. Well stated.

Totally agree! The WEP eats the lion’s share of my Social Security benefit. Congress has pushed the WEP/GPO issue off of the agenda for years. Time for that to stop! Get in touch with your Representative and Senators about this. And don’t forget AARP!

I agree. It really sucks to have lost my husband only to learn that 2/3’s of my PERA benefit will be taken away from his SS benefit due to the Government Pension Offset (GPO). I paid into SS also. Take it away from my SS benefit, but leave his alone – how am I supposed to survive as a widow when I retire? Anybody want to adopt a grandma? Or maybe rent one so I can supplement my meager PERA amount and my dead husband’s reduced SS?

This is a poor performance report. What were the returns for each segment of the portfolio (and for portfolio as a whole)? Comparison to standard benchmarks would be helpful too.

Hi Lori,

A report of PERA’s 2020 investment results won’t be available until the Comprehensive Annual Financial Report (CAFR) is released in June. While the value of some asset classes, like global equities, are updated on a daily basis, other asset classes, like Private Equity, are valued on a less frequent basis.

The presentation to the Board this story referred to centered around the economic conditions of PERA’s various asset class rather than performance results, which aren’t yet available. When information about PERA’s investment performance does become available, it will be shared here.

In the meantime, you can reference performance and benchmarks from the most recent CAFR here: https://www.copera.org/resources/forms-publications/2019-cafr

In the table you provided on total membership, the statistics for Judicial are very low and I’m not sure how to interpret them. Can you please provide some information to clarify?

Hi Tony. The judicial division is made up exclusively of judges, which is why it is so small relative to the other divisions. (employees of the judicial department who aren’t judges are members of the State Division.)

Thank you

Please support elimination of the “Windfall Tax”!!!

So true how is a person suppose to live on 1 income in retirement.

Windfall needs tp go away! Our spouses worked for their social security many years and we as spouses deserve to have access to that .

I agree with the previous request to have PERA actively work to eliminate the Windfall Tax on deceased spouses Social Security benefit. This is an unnecessary burden on the surviving spouse.

Can you tell us how many members have been lost; whether there is a spouse to collect benefits or no family members as survivors – what will happen to the benefits.

Hi Kathy. If a member passes away while working, survivor benefits pay qualified survivors. If there are no qualified survivors, the account goes to the member’s named beneficiary (a person, persons, or an entity of the member’s choice).

Retirees are a bit different. At retirement, PERA members can elect to choose an Option 2 or Option 3 benefit. With these, they can choose one person, called a cobeneficiary, to receive a benefit after the member passes away. If the retiree chooses an Option 1 benefit, in which there is no cobeneficiary, or if the cobeneficiary passes away first, the monthly benefit stops. If the member has any money left in the account, it goes to the estate. Most member accounts are depleted about 5 years into retirement.

That is a high level overview. There are other details to consider, especially if you are thinking about a particular account. Please don’t hesitate to contact us if you have additional questions.

These reports are unhelpful. There is no analysis available? Really?

The Windfall tax needs to be addressed. Is no one from PERA lobbying about this?

Please support the elimination of the Windfall tax. You can take this to legislation. We have taken many income hits from PERA to include a reduction in our yearly increase and the continued increase in are medical costs. I believe it is your job to protect and advocate for our welfare, since we were lead to believe this was such a great retirement. How great is this retirement if every year our retirement will decrease and we can’t access the money we put into Social Security or get our deceased spouses Social Security Benefits. Come on PERA step up to the plate and advocate for your members.

Yes, the Windfall Elimination Tax must be addressed. As others have said our yearly increase in PERA retirement has been cut. The percentage is much lower than what I had planned on before retiring. If we could access the full amount of our Social Security benefits, it would offset that penalty that we are now in the midst of.

Yet another “end the Windfall Tax” comment to add to all the rest. But years of complaints have failed to produce any results. Have you even tried? It is truly crippling. and certainly unfair. You really need to focus on its elimination!

I agree with everyone on the WEP reduction. I have put 20years into social security and I am still contributing. Yes, I worked for a school district, but in order to survive, I need my full ss distribution. I earned it, just like I earned my Pera retirement. Please advocate for all of us who are entitled to that money.

That is one of my big concerns. The WEP needs to be reversed. I worked 21 yrs social security income to have my social security reduced by two-thirds when I retired. I don’t see PERA working on this issue very often

I agree with everyone on the WEP reduction. I have put many years into social security and I still am. Please advocate for all of us who are entitled to that money.

Maximum windfall reduction in SS benefits was $309.00 in 2003 when I retired, its now $480.

It increases a bit each year (Adjusted for inflation ) The amount you SS benefits may be adjusted depends on how many years you did substantial work under SS or if the full amount applies to you or not.

See short explanation here:

https://www.forbes.com/sites/tomhager/2020/08/27/social-securitys-windfall-elimination-provision-wep-a-common-sense-explanation/?sh=46baabe370ff

The maximum WEP is calculated the the year you turn 62. So if you are older than 62. You know what it is. If younger, yes it goes up every year until you turn 62.

Social security is a negative 4% return. For every dollar you and your employer put in you get 96 cents back.

Then with the WEP much much lower than that. For me its close to 50 cents, for the 20 years I paid into SS.

Oh well I guess it went to pay the numerous folks on disability, or the numerous folks that did not pay in but get a benefit in their old age. The governmnent safety net. Somebody has to pay for it.

Very disappointed to read another “puff-piece” from PERA Board & Staff (PERA B.S.).

The new member-elected Chair & Vice Chair are not to blame (they’re just decoration anyway, but maybe they’ll ask the professional PERA B.S.-ers about outside management fees and performance?).

Speaking of outside management fees (hedge funds) how appropriate that the next Board meeting is scheduled for the third Friday of the final month of the first quarter… that’s when the true damage of PERA’s secret investment firm deals will be known after the Robinhood-types’ Wall Street revolt and maybe this Game Stops!

In closing… at least I have my lost decade of COLAs to console me.

I worked 2 jobs, 7 days a week, for 28 years.one with school district and one doing handyman work. paying Pera and social security. For the last 3 years WEP has taken $435 per month from my social security!we must eliminate this old law asap! it’s my understanding Colorado is one of only 4 states still hanging on to this outdated law.it needs to end now!

Dear Mr. Cox,

I doubt PERA Board & Staff (PERA B.S.) will respond timely or accurately, but I’m glad to clarify it’s a federal law that reduces social security due to your PERA…BUT THE ONLY REASON THAT HAPPENS IS BECAUSE COLORADO IS ONE OF THE STATES THAT DOESN’T PAY INTO SOCIAL SECURITY! Many states pay into both a state pension as well as federal insurance contributions act (FICA) for Social Security. The taxpayers of Colorado have been relieved of a huge labor cost while the state only pays into it’s own private slush fund called PERA. The savings that taxpayers have enjoyed for generations is not enough for greedy politicians who really believe public employees’ pensions are their personal slush fund. PERA B.S. are the hand puppets of politicians who neither care about taxpayers nor public servants. It’s sad that retired public servants are at the mercy of the politicians and that PERA B.S. represents politicians and corrupt lobbyists who control the politicians.

If you want to slander PERA, maybe you should include references in your comment to support your statements.

Maybe I could slander PERA (Board & Staff) B.S.; maybe I could continue supplying tomes of information; but it never deters PERA from their B.S.

More importantly, I pay the salaries of the PERA B.S.ers, so I don’t need to do anything (except to pay for the pleasure to make these comments).

Only an idiot would fail to see what’s happening, and maybe I’m tired of trying to convince idiots to open their eyes.

Have a nice day –

Very poor report. Focus on the performance of the portfolio. Did we gain ? Lose ? How much? What is the state of solvency? Those are the critical issues

How is PERA and the PERA Board trying to help with the increase of the cost of PERA Care? My cola increase last year only covered 1 1/2 months of premiums due to the increase in premiums again. The $6,000 deductible, $16,000 out of pocket is ridiculous.

Hi Nancy. PERA’s Director of Insurance recently shared thoughts on this matter in these two stories:

https://peraontheissues.com/can-these-ideas-control-health-care-costs/

https://peraontheissues.com/multiple-approaches-to-keeping-prescription-drug-prices-down/

Hey PERA! There have been a lot of comments to PERA about eliminating the windfall tax. It would certainly be refreshing if someone from PERA could provide a detailed response as to what is being done by PERA, if anything, to address this obviously unfair situation for retiring teachers. Anyone home?

I do not believe PERA can be our lobbyists to the federal government to eliminate the WEP. Not exactly their mission. Their mission is to ensure we get our PERA pension when we need it, per the plan.

I believe the best way to get it eliminated would be to form a non-profit that could represent all the Americans that are subject to this unfair mess the WEP. And have them represent us in Washington to get it changed.

Democrat House, Senate and Executive branch, nows the time, who knows maybe an Executive order could do it?

Can staff provide a report to us on actions taken toward eliminating WEP? Some of us paid into SS for 20 years before beginning PERA employment and we’re greatly affected by WEP. Please tell us who we need to address in order to see action on the behalf of a large portion of PERA members? I would venture to guess that all of those commenting here would be happy to reach out to others to make our concerns known. Perhaps I am unaware, but it feels to me that this situation has been ignored. Why won’t you advocate for members on this issue?

I doubt PERA Board & Staff (PERA B.S.) will level with you, so excuse me for posting a reply here.

You bring up a legitimate and simple request about what’s happened and what can be done about it; the history is, since the 80’s, Congress has balanced Social Security funding on the backs of government workers with a separate government pension; but the solution is to write every member of your federal delegation (Senators and Representatives), and tell them your story, and what you want done about it (repeal the WEP!).

FYI: Diana DeGette, Congressional District 1, Denver has ignored state employees for decades (because she’s from a safe Democratic seat, she takes government workers for granted). Except for former Congressman Tipton, the Republicans just despise government so they don’t care either.

Support and advocate for the elimination of the windfall affecting rightfully earned social security benefits.

Please help work on eliminating WEP.

Thank you for providing an update on the PERA investment effort. Based on so many comments, I wonder IF most realize just how difficult it is to invest such A LARGE amount given the l guidelines that you are required to follow. Add to that the pressure building to social engineer investing too. Might be good to clarify at the outset what this REPORT is about versus what some must ASSUME it is suppose to be about. Think there is confusion over RETURNS/RESULTS and PORTFOLIO guidelines or as you refer to the BENCHMARKS.

I agree with all the above comments. This report certainly has no substance and seems as if it is an attempt to placate members. I also agree fully with the lack of PERA’s effort to eliminate the WEP. If I had passed before my spouse, he would have fully benefited from my PERA retirement and yet I received a $500 ‘death benefit’ and nothing else from my husband’s SS. If our State/national governments want to help prevent the poverty numbers for seniors, then eliminating the WEP is the moral thing to do.

The topic of the Windfall Tax elimination, yes, needs to be addressed…by us. I had written to the former Senator Gardner, who wrote back. It is clear he (actually a staffer, probably) did not understand the issue at hand. In addition, he said, since Soc. Sec. is underfunded, he would not vote for … any new benefits (paraphrased). Asking PERA to lobby for the elimination of the Windfall Tax, is really not their job. It is Federal Legislation, therefore we, the patrons, need to take out our pen and paper, emails, and write to our US Senators and Congressmen-women. Sure, PERA could explain the Windfall Tax provision, and its effects on people. But their dictum is the governing of PERA, not Federal legislation…I think the reality is, which I hate to say it, is other fiscally-conservative senators, be Democrats or Republicans, will probably balk at spending anything more out of Soc. Sec. Despite the fact we paid for it by working other, non-PERA jobs, self-employment income, etc. Please, write to your Federally elected reps; that is where your energies should be directed. It’s not PERA’s dictum. I would suggest PERA already agrees with us.

I agree. It really sucks to have lost my husband only to learn that 2/3’s of my PERA benefit will be taken away from his SS benefit due to the Government Pension Offset (GPO). I paid into SS also. Take it away from my SS benefit, but leave his alone – how am I supposed to survive as a widow when I retire? Anybody want to adopt a grandma? Or maybe rent one so I can supplement my meager PERA amount and my dead husband’s reduced SS?