The Colorado PERA Board of Trustees approved the 2019 Comprehensive Annual Financial Report (CAFR) on June 19. The CAFR contains information about PERA’s investments, funded status, membership, and more.

A Snapshot in Time

PERA releases this report every June. However, the information included in the CAFR actually changes on a daily basis. People start PERA jobs and leave them. People retire. The value of PERA’s investments fluctuate. Contributions come in, and payments go out. Compiling and analyzing all this data and having it audited by an outside firm takes a significant amount of time, too.

As a result, PERA follows the industry standard of compiling this data as it exists on a single day—in this case December 31, 2019. While the report is released in 2020, the 2019 CAFR doesn’t take into account any developments since December 31, 2019; they will appear next year in the 2020 CAFR.

Strong Investment Returns in 2019

PERA experienced a positive investment year in 2019. At the end of the year, the fund had a fiduciary net position of $51.7 billion, compared to $44.9 billion the year before.

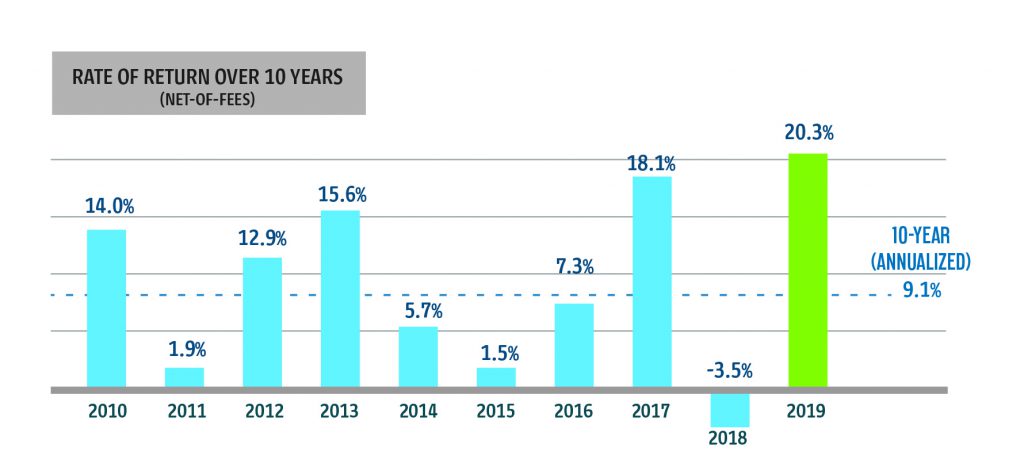

The total fund’s investment portfolio returned 20.3 percent, net of fees. Returns for the past 10 years are shown below:

PERA’s Improved Funded Status

The CAFR also contains information about the projected time for PERA to reach full funding. Funding levels take into account many variables and assumptions, including investment performance and demographic information.

The projected time needed for each division to reach full funding is listed below:

The CAFR and the Automatic Adjustment Provision

The Automatic Adjustment Provision (AAP) modifies employer and employee contributions, the retiree annual increase, and the state’s direct distribution based on PERA’s progress toward its funding goals. This calculation is performed once a year, in conjunction with the CAFR’s release. The AAP was not triggered following the release of the 2019 CAFR.

When the AAP is triggered, the implementation of those changes are delayed for one year. The 2018 CAFR, which was released in June 2019, did trigger the AAP As a result, those changes are going into effect on July 1, 2020, following the one-year delay. Member contributions for most Divisions will increase by a total of 1.25 percent to a total of 10 percent of pay. Employer contributions to PERA will also increase by 0.5 percent and will range from 14.2 percent to 23.6 percent of payroll. The annual increase paid to retirees will be restored this year at 1.25 percent for most eligible benefit recipients.

Learn Even More About PERA’s Finances

At 275 pages, the 2019 CAFR is longer than most people care to read. However, making this information available and accessible is a core tenant of PERA’s commitment to transparency. You can learn more about this report by exploring an interactive, digital overview of the CAFR.

Another available resource is the 2019 Popular Annual Financial Report. This 12-page report condenses and presents the information in a more traditional layout, similar to a popular annual report a corporation might release to shareholders.

Note: This story was updated on June 30, 2020.

FiduciaryA person who manages money on someone else’s behalf and who has a sworn responsibility to manage those funds in the best interest of the client. Automatic adjustment provisionA provision of Colorado law that automatically changes PERA contributions (from employers, employees, and the state) and annual benefit increases based on PERA’s funding progress.AapA provision of Colorado law that automatically changes PERA contributions (from employers, employees, and the state) and annual benefit increases based on PERA’s funding progress.AapA provision of Colorado law that automatically changes PERA contributions (from employers, employees, and the state) and annual benefit increases based on PERA’s funding progress.

Many thanks to all who respond to the challenging task of balancing the PERA budget and tirelessly work to obtain the best returns for us retirees. It is surely complicated!!!

When I retired in 2006, my decision was based on receiving an annual increase of 3% guaranteed. Since then, I have had 4 years of “0” increase, and all but a few years less than half that percentage.

To resolve the inequities that have taken place maybe there should be a look at no state tax and a return to 3%. What is really bothersome, is that the social security increase has out distanced our pension increase. Remember we’re not intitled to social security checks (possibly$300.00 for years of other work experience) or survivor benefits. Keep in mind, that you have educators that pay for their mandatory professional growth while company’s provide that for their employees. When starting our careers, my Husband was making almost 4 times as much as I did. My salary was at poverty level, thank goodness I wasn’t the primary wage earner. I would appreciate a response as to where to direct my concerns to promote change.

2020 should prove to be an interesting year.

Hopefully we will receive our COLA in July 21.

Thank you for this easily understood explanation !

GOOD JOB ON INVESTMENT PERFORMANCE LAST YEAR. MY COMPLIMENTS TO YOUR INVESTMENT TEAM, BOARD AND MANAGEMENT.

Incorrect , the delay on retirees cost of living has been delayed 2 years and thought we would get 1 1/2 % now it is only 1 1/4. I bring home less now than when I retired due to health insurance going up hundreds of dollars each year and no cost of living yet people working are still getting cost of living. So unfair for people that have given 32 years of service to be paying ridiculously high health insurance rates

Thank you for filling us in on our status. You are all working hard for us.