In this story:

- Committee members heard from PERA leaders, external auditors and actuarial consultants

- External auditors gave PERA’s 2020 annual report a clean audit with no issues

- PERA gets a “green light” on its funding progress

PERA leaders and actuarial consultants appeared before the Colorado General Assembly’s Legislative Audit Committee on Aug. 18. The purpose of the hearing was to review PERA’s 2020 Comprehensive Annual Financial Report, released earlier this summer, and to review the findings of an external audit of the report. Committee members also heard an update from PERA’s actuarial consultants on PERA’s funded status and had the opportunity to ask questions.

Below is a summary of information presented at the hearing. To listen to an audio recording of the full hearing, click here.

Results of PERA’s annual audit

Every year, the Office of the State Auditor hires an independent auditor to review PERA’s financial status and fiscal controls. CliftonLarsonAllen LLP has been auditing PERA’s annual statements since 2015.

For the year that ended Dec. 31, 2020, the auditors gave the annual report a clean audit, with no significant issues or outstanding recommendations.

Click here to read the full audit report.

PERA gets a ‘green light’

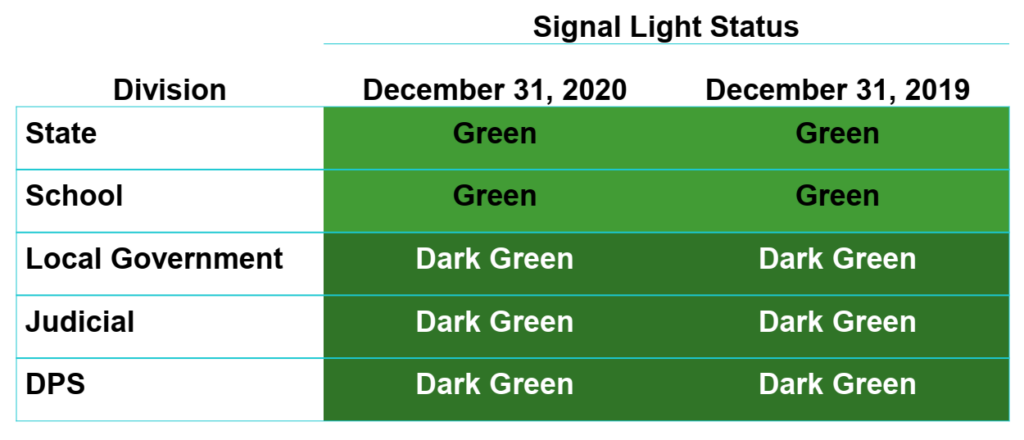

As part of its annual financial reporting, PERA enlists actuarial consulting firm Segal to issue an assessment of PERA’s funding progress called Signal Light Reporting. The report uses a simple color-coded system similar to a traffic signal — shades of green, yellow and red — to give a clear representation of whether PERA is on track to eliminate its unfunded liability.

Segal simulates thousands of possible scenarios to test the effects of different variables — like investment returns and public employer payroll changes, for example — on the likelihood of PERA reaching its target of full funding by 2048. The projected results range from dark green (fully funded ahead of schedule) to dark red (insolvent within 20 years). As of Dec. 31, 2020, all five division trust funds were in “green” or “dark green” status, meaning they are expected to be fully funded by 2048.

Click here to read the full Signal Light report.

The Legislative Audit Committee is one of several legislative committees and subcommittees that PERA reports to regularly. Others include the Joint Budget Committee, Joint Finance Committee, Pension Review Subcommittee, and Pension Review Commission. These regular meetings with lawmakers allow for robust oversight and transparency into the state’s largest public employee retirement system.

Trust fundA fund in which money and/or other assets are held and managed by trustees on behalf of plan participants. PERA maintains trust funds for each of its Defined Benefit Plan divisions (State, Local Government, School, Denver Public Schools, and Judicial).Unfunded liabilityThe difference between the projected amount of money needed to pay benefits earned to date and the amount of money currently available to pay those benefits.

Year in and year out it seems PERA is in dire straits when the legislature is in session but as soon as they adjourn I’m told PERA is in fine shape. Which is it?

As a follow up to my initial question, what about this story?

https://pagetwo.completecolorado.com/2021/09/09/sharf-audit-finds-issues-with-colorado-pension-plans-assumptions/

In PERA’s defense, the author of the above story fails to make mention of the legislature (democrats and republicans) failing to pay the $200 million they owed to PERA from a prior year. This past legislative year the state was flush with money and should have back paid the money obligated. Moreover, PERA management should not have swept this debt owed under the legislative rug. If you don’t collect the debts owed you, how will you ever achieve full funding by 2048?

I agree with Pixel Chi. We got a minimum cost of living increase this year because “PERA had a losing investment year in 2020 (or was it 2019?). Now just a few months later we are told much of PERA is in the DARK GREEN category and the rest in the GREEN. How can these two assessments be reconciled? Inflation is now rampant and we are getting next to nothing to keep up!

Hi Marv, it’s because of those automatic adjustments to member and employer contributions and annual increases that PERA remains on track to meet its long-term funding goals. We know the changes are difficult for everyone, but they’re important for keeping us on track so current and future retirees can continue to count on PERA to provide a source of income in retirement they can’t outlive.

And the automatic adjustment applicable to 2022 has already been determined and the “Annual Increase” for 2022 will be ZERO, Correct?

Hi Paul, the July 2022 annual increase paid to most eligible benefit recipients will be 1% (lowered by 0.25%). We have more information on the AI at https://www.copera.org/retirees/annual-benefit-increases.

Thanks for clarifying.

You can call them changes. I’ll call them broken promises.

According to PERA we are on track for pensions to be fully funded by 2048. The fund did quite well in 2019 up 20.4% and 2020 up 17.1%. The loss to investments was (3.3)% in 2018. Retirees received an annual increase in July 2020 and July 2021of 1.25%, if you were eligible. Zero annual adjustments in 2018 and 2019. The U.S. CPI increase for 2020 was 1.4%. I think we will see a high rate of inflation for 2021. Last few years we have experienced low rates of inflation. I think you are right for 2021 as PERA annual increase will not keep up with inflation this year.

I agree – which is it? If the fund is doing so well, why aren’t the recipients?

Hi Kathleen, it’s because of automatic adjustments to member and employer contributions and annual increases that PERA remains on track to meet its long-term funding goals. We know the changes are difficult for everyone, but they’re important for keeping us on track so current and future retirees can continue to count on PERA to provide a source of income in retirement they can’t outlive.

Of course, PERA is in the GREEN as investment returns have been very profitable. So why the miserable COLA raises, especially this year? I know people are living longer, but that is not that much. Yes, PERA employees retired earlier recently, but that also means retiring at a lower percentage. These lower COLA adjustments from the last four years are eroding our retirement exponentially.

How many more years will it be before retirees get an annual increase that has any possibility of keeping up with inflation????? It has now been several years since we got an adequate annual increase .

It will never happen. Pera won’t support it much less anyone in the legislature. IMO.

Dark green at a significant cost. Employees are paying 100% for their retirement “benefit”. SAED and AED which were supposed to be temporary are like an old scar that nobody remembers and are hidden in the employer contribution side of the ledger even though one was supposed to be from dollars that would normally go for employee raises. New employees are the real victims having to work many more years to gain the same retirement benefit. Current employees have their cost of living raises halved by the increase in contributions every year. It is a little early for PERA to be patting itself on the back for a clean audit.

I recently retired ahead of schedule and below my goal. It Is wonderful to have a personal story of stability to fall back on.

My step-father passed at age 64, after receiving three times the contributions he had deposited. Most would wonder about their mother’s wellbeing as she was widowed at age 62. I never had to wonder. In her monthly option 3 benefit, she has now drawn another four times those contributions and participated in subsidized health care. Bad investment? I think not.

Everyone must also recognize they should be supplementing their retirement income from PERA with some other fund from which to keep up with inflation. Take charge of your own retirement and plan accordingly along the way.