Recruiting, retaining, and providing for great workers: How PERA portability makes it a good deal for employees at any point in their careers

Retirement plans have modernized over time to attract and retain valuable human capital assets.

Employee turnover is a statistic that is used to gauge the desirability of a work environment. Employers like to retain good employees because it’s expensive to recruit and train new employees. Benefits, such as paid time off, health care packages, and even retirement plans play an important role in attracting and retaining great employees, which reduces employee turnover. Improving the efficiency and effectiveness of the workforce by having loyal and productive employees ultimately improves the employer’s bottom line, or in the case of public employers, the delivery of public services.

Because retirement savings are accrued over the course of a career but are actually used after a career is over, employers have to consider both the current value of the retirement benefit to today’s employees as well as the value it will provide in the future, when employees have long since stopped working and come to depend on retirement savings for income. This is true regardless of whether an employee plans to quickly gain experience and then advance to a new position or hopes to stay with the same employer for decades.

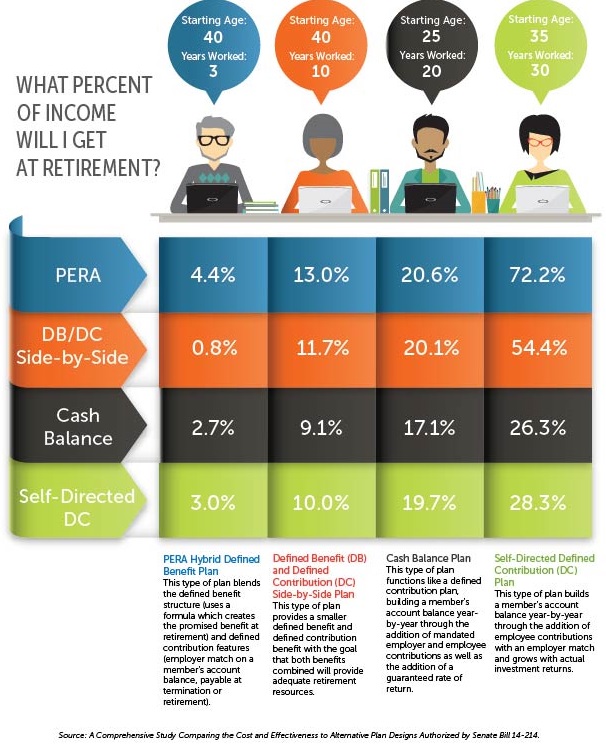

PERA’s hybrid defined benefit plan is a particularly strong recruitment and retention tool because of the value it offers to employees regardless of the length of their career. While some critics claim that retirement plans like PERA shortchange employees who do not work a full career, if they look closely at PERA’s plan design, they will see how PERA has evolved to serve both long-service employees as well as those who only work for a short time in public employment. That’s not according to PERA, but what an independent, third-party firm reporting to the Colorado General Assembly’s Legislative Audit Committee found.

A recent analysis of the PERA Hybrid DB Plan design was conducted by an independent actuarial firm at the direction of the General Assembly’s Legislative Audit Committee. This review, performed by the firm Gabriel, Roeder, Smith & Company (GRS) and the Office of the State Auditor, found a high degree of portability and value in the PERA Hybrid DB Plan, noting, “This study could find no plan that provides a more effective level of benefits than the PERA Hybrid Plan.”

The Colorado PERA defined benefit (DB) Plan has changed over time to meet the needs of Colorado’s public employers. In the 1990s, PERA employers were competing for employees who often went to work for employers who offered defined contribution (DC) plans where employees immediately vested in both their and their employer’s contributions to a DC retirement account. One of the key features of DC retirement accounts was their portability – that is, employees could take the savings from their retirement accounts with them when they changed employers and presumably continue to grow their retirement savings in a new job.

Because it was difficult to retain a talented public workforce when competing with private sector employers during this time, the Colorado General Assembly modified the PERA DB Plan design to allow for similar rights to employer contributions that were in DC plans. Today, because of these and other changes made by the Colorado Legislature over the years in response to Colorado’s changing public workforce, the PERA DB Plan is the lowest cost way of providing retirement savings for public employees – no matter the length of their career.

The GRS report illustrates these findings.

portability" width="606" height="747" />

portability" width="606" height="747" />

According to the National Institute for Retirement Security (NIRS) in its report, “Preserving Retirement Income Security for Public Sector Employees,” when it comes to financing retirement, Americans have two key concerns, “a steady and adequate retirement income that won’t run out, and the ability to move retirement plans from job to job.”

NIRS goes on to document how nearly all state retirement systems allow for the preservation of retirement income benefits even for employees who change jobs. But the GRS study shows that in Colorado, a member who earns PERA retirement benefits for even just three years will accrue more savings than another type of retirement savings plan would provide.

Retirement savings plans are just one component of an employee’s total package of salary, leave, health care, and other benefits. But it’s a critical piece in attracting great employees to public service and keeping them on board for successful careers.

PERA on the Issues posts are written and compiled by the staff of Colorado PERA under the direction of Executive Director Greg Smith and the PERA Board of Trustees.

We encourage you to comment with your thoughts and feedback.

PortabilityThe ability to take an existing retirement plan with you when you change employers.PortabilityThe ability to take an existing retirement plan with you when you change employers.PortabilityThe ability to take an existing retirement plan with you when you change employers.Hybrid defined benefitPERA’s Defined Benefit (DB) Plan is “hybrid” in that it combines features of a traditional DB plan with some of the features of defined contribution (DC) plans, such as portability.Defined benefitAlso known as a pension, this is a type of pooled retirement plan in which the plan promises to pay a lifetime benefit to the employee at retirement. The plan manages investments on behalf of members, and the retirement benefit is based on factors such as age at retirement, years of employment and salary history.Defined benefitAlso known as a pension, this is a type of pooled retirement plan in which the plan promises to pay a lifetime benefit to the employee at retirement. The plan manages investments on behalf of members, and the retirement benefit is based on factors such as age at retirement, years of employment and salary history.Defined contributionA type of individual retirement plan in which an employee saves a portion of each paycheck (along with a potential employer match) and invests that money. The employee’s retirement benefit is based on their account balance at retirement. A 401(k) is a type of defined contribution plan.