Conversation about PERA’s long-term financial health ongoing

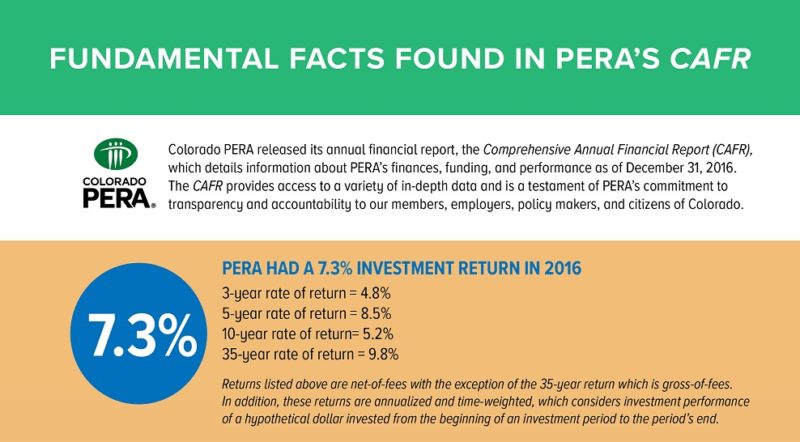

Colorado PERA announced a 7.3 percent investment return, according to its 2016 Comprehensive Annual Financial Report (CAFR) released last week. The total fund—the combined assets of all five PERA member divisions—has now matched or outperformed the policy benchmark set by the PERA Board of Trustees for the one-, three-, five-, and 10-year time periods, net of fees. The long-term investment return for 35 years is 9.8 percent, gross of fees. (For more information on the Board’s responsibilities, including how it oversees PERA’s investment program, see this PERA on the Issues post.)

Those who have been following along with this year’s PERAtour effort are likely aware that the PERA Board and staff are currently soliciting feedback from PERA members, retirees, employers, and the general public on ways to help reduce PERA’s overall risk profile going forward. In 2016, the PERA Board lowered the long-term investment return assumption to 7.25 percent from 7.5 percent, reflecting their expectations for future market performance. Additionally, the Board conducted an experience study which showed that PERA members are living longer—meaning that PERA must pay benefits for a longer period of time than previously expected. The numbers reported in this year’s CAFR reflect these changes.

PERA is required by statute to undergo an annual financial audit overseen by the Office of the State Auditor, and conducted by an external audit firm. On June 22, 2017, the external auditor, CliftonLarsonAllen, reported to the PERA Board’s Audit Committee that they anticipate an unmodified “clean” opinion that the financial statements are presented fairly, in all material respects, for the seventh straight year.

In addition to the annual financial audit, the CAFR has consistently been recognized by the Government Financial Officers Association (GFOA) for excellence in the area of governmental accounting and financial reporting. PERA’s CAFR received this recognition for the 31st straight year in 2016. PERA’s annual CAFR is a wealth of vital information regarding the fund, including details on financial, investment, actuarial, and statistical facts. Below is an infographic highlighting some of the important pieces of information that can be found within the report.

BenchmarkA tool used to measure performance. For example, an investor can use a stock index as a benchmark to measure his/her own investment performance compared to the market as a whole.

Hi—Was the writeup in the DP on Wed accurate? It kinda scared me! I’m 80 and a long time member of PERA, retired. I plan to live a few more years, and would like to feel a little more secure.

Mr. Adams,

Thank you for the opportunity to clarify the recent headlines. PERA isn’t running out of money. But, the time it will take to reach full funding has grown. That’s why we created PERAtour.org, a website where those interested in factual information can learn more and submit their ideas to reduce PERA’s risk profile.

When talking about the unfunded liability issue many people and legislators like to raise alarms and demand major cuts and changes to PERA’s structure. They fail to understand that PERA’s membership, unlike private industry, is government based and therefore not at risk of failure because Colorado’s government is highly unlikely to ever go bankrupt or go out of business thus leaving the citizens of Colorado holding the bag. This important factor is why the legislative gloom and doom about needing to radically close the gap in the unfunded liability is not valid. This aspect needs to be promoted better to both the public, members and the legislature.

There is a constant drumbeat of panic and catastrophe pushed by people like W.Stapleton and Vincent Carroll and their pals when they write about PERA. More should be done to combat this negative view, for all citizens. My feeling is that ordinary people do not understand our retirement and feel like they are paying for an “easy” life for us when many of them cannot afford to put money aside for their own retirement or afford many things they need day to day. The atmosphere is getting really ugly in this country and now in this state.