One of the most popular topics discussed on PERA on the Issues is Social Security. From federal proposals to repeal the Windfall Elimination Provision (WEP)/Government Pension Offset (GPO) to updates on the OASI Trust Fund depletion date, there is a lot of information to digest. For most Colorado public employees, Colorado PERA serves as a substitute for Social Security and may therefore affect anticipated Social Security benefit amounts.

History of PERA and

Social Security

When Colorado PERA was established in August of 1931, Social Security did not exist. After hearing from a group of state employees who wanted a way to plan and save for retirement, the Colorado General Assembly acted to create the State Employees’ Retirement Association (SERA). At first, only state employees were covered by SERA. Voluntary coverage under the plan was offered to school districts and local governmental entities in the 1940s and SERA was renamed the Public Employees’ Retirement Association to better reflect the broader membership in the association.

When the Social Security Act was passed by Congress in 1935, state and local governmental entities were specifically excluded from participating in Social Security. Congress questioned whether it could compel the states and their political subdivisions to include their employees in the system. Consensus thought at the time was that by requiring the states to participate, it may be considered unconstitutional under the Tenth Amendment to the U.S. Constitution as a levy of taxes on states and localities.

What is FICA? FICA is a U.S. federal payroll tax (most PERA members only pay the Medicare tax). It stands for the Federal Insurance Contributions Act and is deducted from each paycheck. FICA helps fund both Social Security and Medicare programs, which provide benefits for retirees, the disabled, and children. The money you pay in taxes is not held in a personal account for you to use when you get benefits. Today’s workers help pay for current retirees’ and other beneficiaries’ benefits. Any unused money goes to the Social Security trust funds to help secure today and tomorrow for you and your family. Source: Social Security Administration.

In 1951, Congress added Section 218 to the Social Security Act, which allowed a state to independently decide whether or not to include some or all of its public employees in Social Security. Colorado executed a Section 218 agreement but narrowly defined the employees who would participate in Social Security. That same year, all school districts other than Denver Public Schools (DPS) were required to participate in PERA. (This was because DPS had their own separate retirement system at the time.)

Still today, most public employees in Colorado do not participate in Social Security (although a few Local Government Division employers participate in both PERA and Social Security). PERA serves as a substitute for Social Security; instead of paying the 6.2 percent FICA tax (made up of 5.3 percent for Old-Age and Survivors Insurance and 0.9 percent for Disability Insurance), most PERA members currently contribute 8 percent of pay to PERA (although provisions in Senate Bill 18-200 will increase member contributions) that provide retirement, survivor, and disability benefit coverage, just like Social Security does.

Two separate federal provisions are in place today that may reduce a public employee’s or retiree’s Social Security benefit: the Windfall Elimination Provision and the Government Pension Offset As a result, an anticipated Social Security benefit may be reduced due to participation in PERA. A PERA benefit, however, will not be reduced by any Social Security benefit received.

Windfall Elimination

Provision (WEP)

In order to qualify for a Social Security benefit, workers must earn 40 credits (typically, working in a Social Security-covered job for 10 years). PERA members with at least 40 credits in Social Security, however, may have their worker benefit reduced by the WEP as a result of not contributing to Social Security while working for a public employer.

According to the Social Security Administration, Social

Security benefits are intended to replace only some of a worker’s

pre-retirement earnings, and lower-paid workers receive a greater replacement

percentage of career average earnings than higher paid workers. Prior to the

WEP being enacted in 1983, non-Social Security government workers had the

advantage of receiving a Social Security benefit representing a higher

percentage of their actual earnings. Congress passed the WEP to remove the

advantage because these workers also qualified for a pension from a job for

which they didn’t pay Social Security taxes.

Social Security and You: Because most PERA members do not participate in Social Security while working for a PERA employer, their anticipated Social Security benefit may be affected by the Windfall Elimination Provision and the Government Pension Offset. More details about PERA and Social Security can be found here, and online Social Security benefit reduction calculators are available for the WEP and GPO. There is also a website and video explaining Social Security reductions for PERA members.

The law protects non-Social Security workers who receive a

low government pension from having the WEP result in a smaller combined benefit

by guaranteeing that the WEP will not reduce a Social Security benefit by more

than one-half of the non-Social Security pension (so a PERA member would never

end up with less overall as a result of the WEP). Furthermore, the maximum WEP

reduction to a Social Security benefit in 2019 is $463, and the WEP does not

apply to an individual with 30 or more years of substantial Social

Security earnings (and it is prorated for 21-29 years of substantial

earnings).

Government Pension

Offset (GPO)

The GPO applies to PERA retirees who also receive a Social Security spousal or widow(er) benefit, and reduces the Social Security benefit by two-thirds of the PERA benefit. “Dependent” benefits were established in the 1930s to compensate spouses who stayed home to raise a family and were financially dependent on the working spouse. According to the Social Security Administration, now that it is common for both spouses to work, the GPO requires the “dependent” benefit to be offset by the dollar amount of their own retirement benefit, and it ensures the benefits of government employees who do not pay Social Security taxes are treated the same as workers in the private sector who pay Social Security taxes. Because the average PERA benefit is usually larger than the average Social Security spousal benefit, an “average” PERA member’s spousal benefit may be eliminated by the GPO.

PERA and Social

Security Comparison

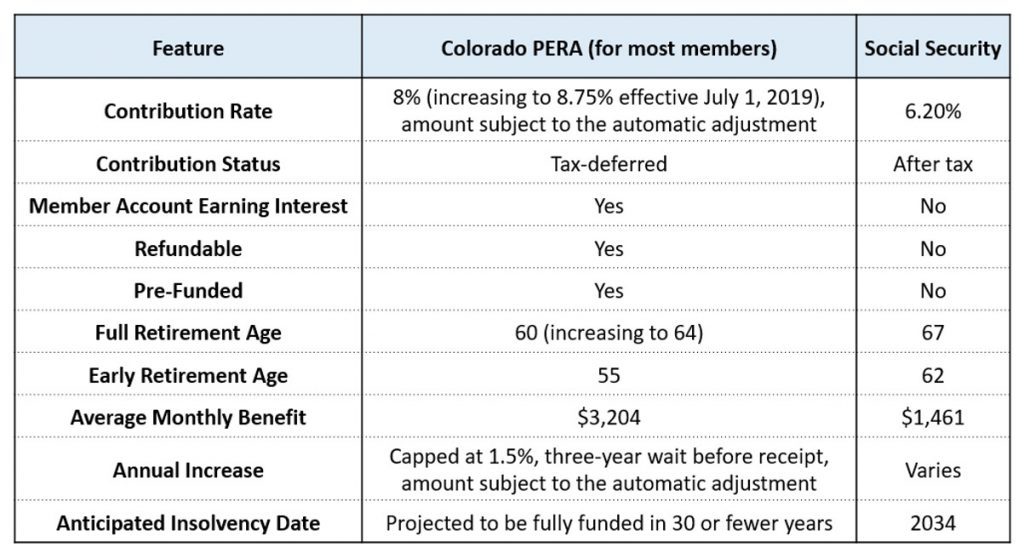

While the Social Security spousal benefit will most likely be completely offset by the GPO, and a worker benefit may be reduced by the WEP, the typical PERA benefit will be far greater and more than make up for any offsets to an anticipated Social Security benefit. Here’s a comparison chart of PERA and Social Security:

Windfall elimination provisionA provision of federal law that may reduce Social Security benefit payments to retirees who receive a pension based on work during which they did not contribute to Social Security. The WEP does not apply to those with 30 or more years of substantial earnings in Social Security.Trust fundA fund in which money and/or other assets are held and managed by trustees on behalf of plan participants. PERA maintains trust funds for each of its Defined Benefit Plan divisions (State, Local Government, School, Denver Public Schools, and Judicial).Government pension offsetA provision of federal law that reduces Social Security dependent benefit payments to spouses, widows, and widowers who receive a government pension like PERA.Government pension offsetA provision of federal law that reduces Social Security dependent benefit payments to spouses, widows, and widowers who receive a government pension like PERA.

Is PERA going to fight WEP And get it repealed Or that the state employee suffer?

Write a letter or email your senator

Please fight WEP so I can retire. I am soon 67 and I cannot afford to retire. I paid every penny of my education masters level and I worked and paid SS before teaching the last 10 years. Help!!

So, even though my PERA benefit is only $206, it dings my social security from previous jobs. When can we expect Soc. Sec. to do away with the WEP? Feeling gypped.

Amen! When will the governments see that this penalty is not fair. Do only congressional members benefit from their votes? They already receive their own Cadillac healthcare. How about repeals ng the WEP?

And you should. Working as a government employee paying into other employee’s retirements should leave you feeling gypped. People should check what the retirement benefits are before they accept a position or negotiate that into the requested salary.

I took a job with the contractual promise for a pension.congress changed the rules negating what I was promised upon being hired.i worked additional second jobs and paid SS.they offset my retiremeny,my husband died,my SS benefits are calculated as a widow ,I am unable to receive any spousal benefits.He paid 37 years collected 1 check and his widow gets zero. My income went from middle class to near poverty.congress should be under the same rules

These are not entitlements, they’re monies we have invested and therefore are owed the returns promised. Why do people with small incomes have to be ones who dinged, and not the wealthy who have all the money?

While most PERA employees do not pay Social Security, there are many of us who worked other jobs because the State of Colorado did not pay a living wage adequate to care for a young family. This goes back to 1970 for me. In addition to full time with the state, I worked two part time jobs for five years and paid into SSN during that entire time. It isn’t like we are asking for something we didn’t earn; rather, we are asking for the SSN benefit we paid into and deserve. At least we have Medicare which we pay for every month. WEP must be repealed; no one appreciates getting ripped off. According to PERA, there aren’t that many? Really?

A great article Gayle! Keep up the good work.

I completely agree. This is the most unfair law and it should have been repealed long ago. I can’t believe it is still in effect, and I am betting the number one reason is to fund social security with our hard earned money. I am ashamed of the fact that no elected government officials have done the right thing. It is hard to believe that social security will be forced to let go of the 2/3rd s wages that we legally earned that are rightfully ours. No one can believe the injustice of this, but one of the main problems is most people don’t know it’s even going on, including teachers until they get to retirement age. Very sad state of affairs!

I fully agree, persons who worked in the private sector receive 100 percent of their Social Security benefits. Why do we get penalized because we were public employees.

I was salaried for 20 some years of my career, therefore I did not get paid overtime. All of the employees under me made more than I did and in addition because we were short of help I did not get comp time off. I must have donated at least, if not more than a year of my comp time during my career. So tell me how is it fair to penalize us because we served the people. I don’t see politicians being penalized!!!!

Wondering about a surviving spouse that receives their own Social Security, can this person also receive the deceased spouse’s PERA?

Dear Sheri,

Upon retirement, members may select an option that would continue a benefit payment to a cobeneficiary (who does not need to be the spouse). For more information on option selections, please see this page: https://www.copera.org/members/retirement-benefits

Yes, they can but the GPO will apply instead of WEP. Still a complete rip-off for those who paid the money into Social Security !

I feel like the WEP program is another way for the goverment to cheat the taxpayer. I worked prior to paying into Pera and earned enough credits to receive social security becauase I had enough credits. When I was working they deducted taxes from my paycheck every week but, because I choose to have a better life and went to work and started paying into PERA the goverment decided I cannot receive all of the benefits I had earned from SS so they cheated me out of all of the money they kept from my paycheck. Just proof that the goverment does not know how to manage the taxpayers money. Retired School Teacher

And if your spouse dies you don’t get their social security if you receive PERA … double Rip Off!!! I don’t receive my own Social Securiy … yes I received my 40 credits from working since age 16 , worked other jobs while teaching and even now I pay into it as a retired teacher because I’m still working! I don’t get a penny of money I paid…. who gets MY social security & my deceased husband’s. I sure don’t!!!

AMEN✔️

My husband paid into SS for 55 years, and I was a teacher in CO for 20 years; I have a pension of less than $50,000 a year, am a 78 yr.old widow and can draw nothing from SS because I make “too much money!” I was told this by a SS advisor!! BooHiss!!

Amen!! Someone is benefiting from your retirement money and it is not you.

I worked from 1968 to 1994 full time, 24 years paying into ss as required, to build retirement funds for myself and family. Then worked under Pera for 18 years full time. I was surprised by the amount my ss was dinged when I drew my Pera. Thankful spouse worked 50 plus years under ss. But what is this about my not being able to draw on his ss, if he should pass, simply because I draw Pera?? His $ is larger than my Pera. Where is that written? Repeal the provisions now and give us seniors what we Earned As A Benefit. IT IS OUR MONEY. Do the right thing, please.

Boy Howdy! Work and contribute to Social Security meeting your 40 credits and then go to work for the state that doesn’t support Federal Social Security and work and earn your retirement only to learn that the Fed’s consider you having earned more than a “lower wage earner” so “they” reduce “your contribution” to your “retirement benefit” and there you are on the short end of the stick….again. When will the politicians ever get it “right?”. Thanks for nothing!

Oh… kindly note as well that teachers who are “stay at home” moms/dads to raise their children and EVEN endure the hardships of “PUTTING A SPOUSE THROUGH” grad school for a Ph.D. etc.- then get “dropped” by the newly highly degreed spouses when they enter their new status in highly lucrative income brackets and find a trophy partner …the EX ( if married for a minimum of 10 years-between 1965 and – 1975) is “entitled “ to the spousal SS which is way beyond what a stay at home parent earned by raising the children IS DENIED THE SPOUSAL BENEFIT! I saw the word “gyped” in this thread. Yep… many are entitled to both their spousal and earned benefits. NOPE… it just does not happen. Our newly elected governor PROMISED when he was a Congressional Representative for Colorado that he would definitely get this fixed-somehow it was NEVER DONE. Where are the masses of gyped teachers? Perhaps with the many catchy new movements being activated we should round up some TEACHER’S LIVES MATTER marches and get these hard earned SS benefits rolling into automatic deposits!Where are those earned benefits stored? We earned them but no one seems to know where they are stashed !

We ALL need to write our Governor and other politicians to get this addressed!

I wish I never worked for the state under Pera. It is a rip off. I don’t receive any where near that average stated above in the example but yet my SS is dinged anyway. It is not right and I can’t get either my representative nor my senators to say they will support the repeal bill. I’ve tried. They ignore the question or they answer with some other generic response to a different SS question. They don’t care.

I got my 40 quarters before I started paying into social security at age 26. I get very little social security because I have a good pera retirement. I should get my full social security benefit because I earned it.

There are many of us that are not getting the full ss benefits we earned by working summers and weekends while teaching just to make ends meet! It’s happening to teachers in many other states as well as Colorado. PERA administration or CEA or NEA should be out there lobbying for us! It’s a retirement penalty that needs to be addressed. Individually our voices can be ignored so we need a large presence to help us!

How many states allow the SS members with more than the 40 hours to collect both retirements??? I do not care if it is just a few we should get all monies if we paid into both. I worked SS jobs before college, then put 32 years in PERA, and since my retirement from PERA have worked 14 years at another SS job all the while paying into SS. We are only asking the politicians to far with us!

I have worked since I was 15 years old, joined the military at age 17, retired in 2005 and paid into SS during that whole time. I worked for the state since 2008 and I find out that PERA will decrease my SS? What kind of BS is that? I have my 40 credits for SS and I’m supposed to get about $1,273 per month. Now with PERA that could be reduced about $463 leaving me with only $810 a month? I’m not even going for the pension benefit with PERA (defined contribution) because I would have to work till I’m almost 70 and that ain’t happening with the failed leadership of the state and where I work.

Looking back I should have never worked for the state/ PERA. IF Colorado was smart they would repeal this stupid WEP so the state could get more tax money from those retired on PERA and getting SS. Alas the state is too stupid to keep people in this state. The only thing that I can hope for is my wife to stay healthy enough so she can get her credit hours for SS and make up the difference.

It is not fair. I got hurt on the job and paid into PERA and left it in to get income at 60. I am currently working and paying into Social Security. The way I am reading this is unfair. I have no choice but to pay into SS and have for many years just to see nothing of it. If I die my wife who is a stay at home mom will get nothing of my SS because she will get my PERA? Do I understand this correct

John,

If your surviving spouse receives a Social Security benefit based on your work history and is your named PERA benefit cobeneficiary (who will receive a continuing benefit upon your death), her Social Security will not be reduced. For more information, please see the PERA and Social Security publication: https://www.copera.org/sites/default/files/documents/5-36.pdf

I feel triply ripped off. I paid into SS and have enough credits to get it. I get over $700 less than I should on SS. Then PERA didn’t give us the 3% annual raise so I lost more money. For the last several years I have lost about $50-$60 per month in income per year because of health insurance costs going up. So after 12 years of retirement I’m living on less than I did when I retired. In all I’ve lost over $160,000 because of all this. Now the government wants to give all illegals SS because they claim it is an entitlement and the illegals deserve it. It is not an entitlement, we earned it but don’t get it. Guess it is time to get rid of all politicians until they give us our true earnings.

OK folks!

Bottom line is that you need to vote for city, county, state and Federal elected officials who will support Eliminating, Repealing WEP!

Regardless of which party they represent!

The way WEP is going to be repealed is that a Majority of States Vote For Repealing WEP!

60 % of all 50 States need to Vote to Repeal WEP! Then the House And Senate WILL Listen and Vote to Repeal WEP!

It starts at the STATE level! Vote Into Office People who will Vote to Repeal WEP!

Regardless of Party!

Vote out the People who DO NOT Care!

I vote for people who Have the Working Class Best Interest At Heart!

NOT Getting Reelected or fund raising for there Party!

I am fed up with our elected officials Lying to Me to Get Elected then having Memory Laps when it comes to representing There constituents, All of there Constituents!

STOP Being for one party or the other! only divides us all and the Fat Cats keep getting richer on our Backs!

please list state politicians names that support this!!

Social Security WEP does not take into equation those who bought retirement years after 9/01/01 market crash. I was substitute teaching and working other private jobs and had 22 years of substantial earning years per social security, but WEP because I retired from PERA, will take 2/3 of my PERA…How is this ok?

I can’t use my real name because I am worried about repercussions. I work at a state university and am underpaid when looking at what other people make in my profession, both at other schools and in the private sector. I’ve done a lot of odd jobs outside of working my full-time job, and have to pay heavy FICA amounts every year that eats up much of a potential refund. And I am close to retirement and you’re telling me I don’t deserve that money, but these worthless politicians get ridiculous benefits even for short term service.

It’s things like this that we should all vote for term limits and to do away with the benefits these so-called politicians working for the people get. They’re working for themselves, be them R or D’s (or fake independents like Bernie). I WANT THE MONEY I EARNED NOT GIVEN TO THEM OR TO SOMEONE ELSE TO BUY THEIR VOTE!

What about disability? Do pera member’s get the same sort of disability coverage as when you pay into ss? Do you qualify for Medicare when disabled? My understanding is that ssdi means you get Medicare as well. I’m not seeing specific answers anywhere and could really use help understanding it all.

Hi Lori, PERA does offer disability coverage, including both short-term disability and disability retirement: https://www.copera.org/disability-benefits. PERA also offers Medicare coverage to benefit recipients (including those on disability retirement) through the PERACare program: https://www.copera.org/health-benefits-peracare.