That’s what CEM Benchmarking, an international firm that analyzes pension fund performance, concluded about Colorado PERA after comparing 73 different pension plans across the globe. Pension plans are analyzed relative to a peer group of similar-sized plans as well as to all 73 different funds.

For another year, Colorado PERA has been recognized for outstanding customer service and low administrative costs by a global company that analyzes pension funds worldwide.

Colorado PERA is included in a peer group of 13 U.S. plans including Ohio PERS, with a membership of 1,045,000 down to TRS Louisiana, with 184,000 members. PERA is in the middle of this group, with 549,000 members as of July 2015.

The range of U.S. pension plans varies from CalSTRS and CalPERS in California to Nevada PERS and Utah RS. Global pension plans studied include Rolls Royce and Scottish Public Pension Agency in the United Kingdom to Ontario Pension Board in Canada, Abu Dhabi RPB and numerous other plans in several countries.

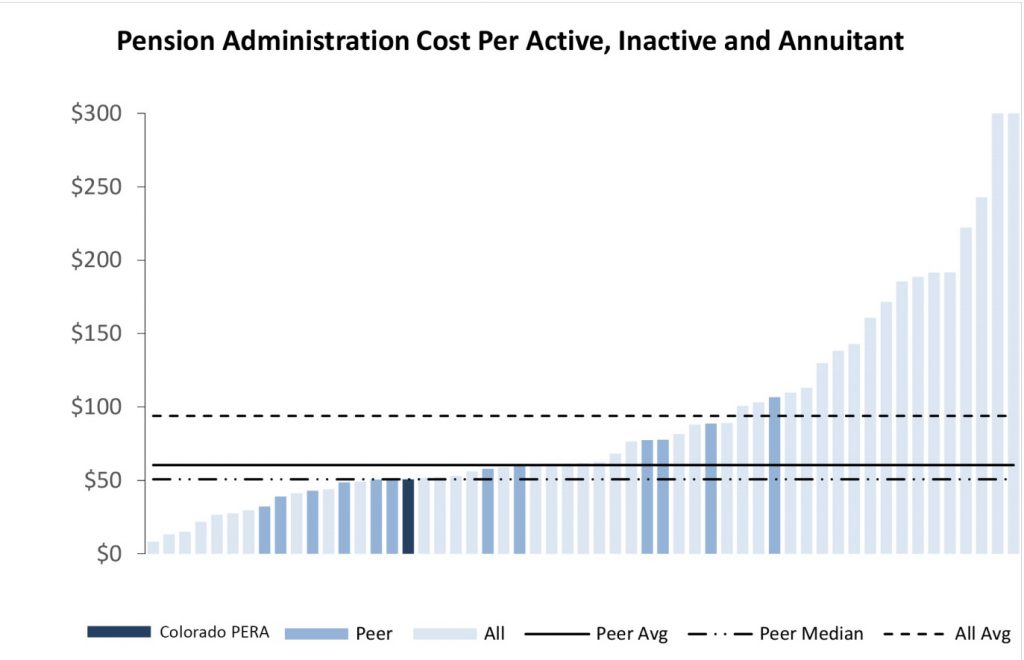

For 2014, PERA’s administrative costs were well below the average of both the 13 funds in its peer group and the 73 pension funds evaluated across the globe. PERA’s annual pension administration costs were $51 per active member per year (or annually), inactive member, and retiree, or $9 below the peer average of $60 per year.

Source: CEM Benchmarking presentation to the Colorado PERA Board of Trustees, September 2015.

The reasons for PERA’s lower than average costs included higher employee productivity and lower costs for activities like information technology and financial control. PERA had 3.54 Full Time Employees (FTE) per 10,000 members, below the peer average of 4.62.

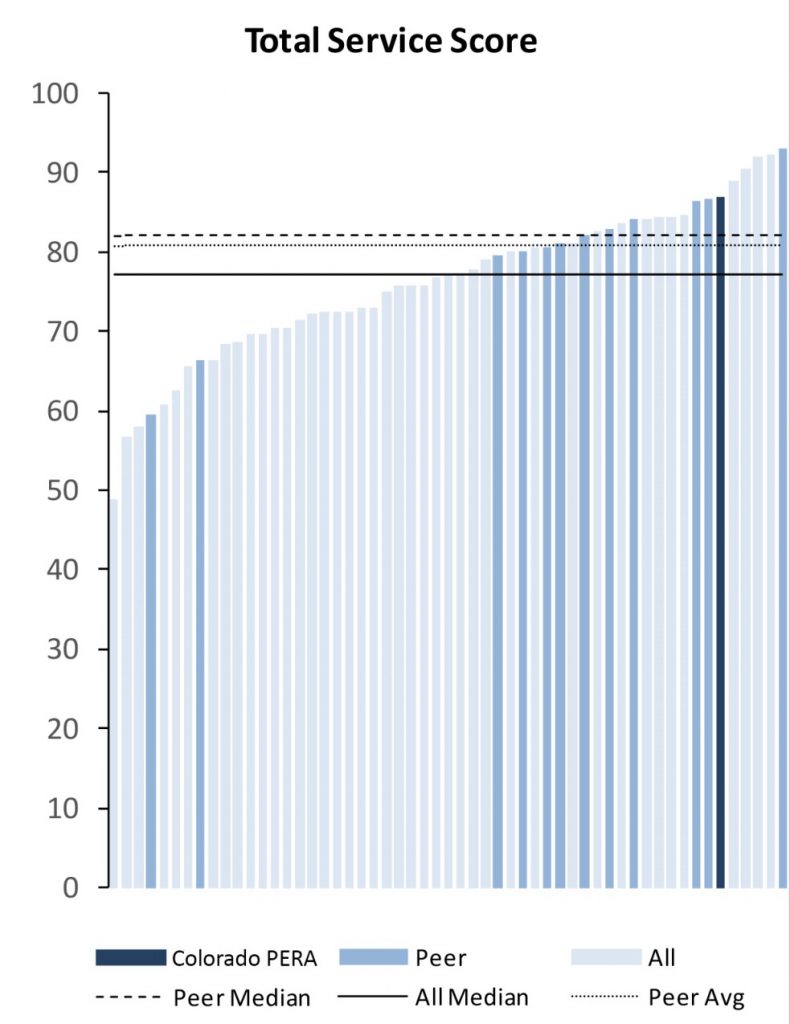

PERA’s overall service score, measuring the customer service PERA provides its members and retirees, was 87 out of 100. Only five funds out of the 73 measured had higher service scores than PERA.

Source: CEM Benchmarking presentation to the Colorado PERA Board of Trustees, September 2015.

It is notable that PERA has such strong customer service scores while maintaining below-average costs, given that strong customer service tends to drive costs higher.

“It’s important that Colorado PERA members, policymakers, and taxpayers know that PERA continues to receive high marks when we are compared to our peers in the United States, as well as around the world,” said Greg Smith, PERA’s executive director. “It is infrequent that one of our members would have the occasion to interact with another pension fund, so the CEM Benchmarking service confirms what many of our members tell us – that PERA is one of the best customer service experiences they have. Every business strives to have satisfied customers and meet their needs at a low cost. This report shows that we continue to do that at PERA,” Smith concluded.

PERA’s call center and customer satisfaction survey scores, in particular, were higher than many of its peer plans. The report also noted that 100 percent of annuity pension inceptions, or monthly retirement distributions, are paid without an interruption of cash flow greater than one month between the final paycheck and the first retirement distribution check.

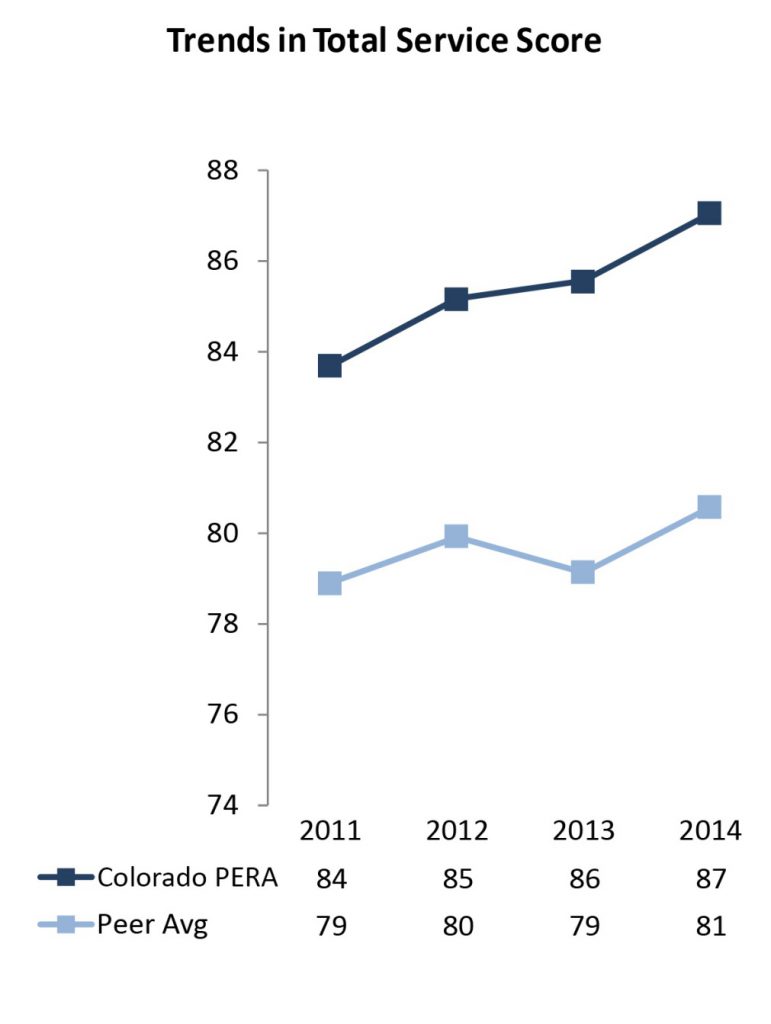

PERA’s service score increased by three points from 84 to 87 over the last four years, while the average score of the peer group remained relatively flat over that time. The CEM report noted that PERA had one of the highest service ratings in the CEM global pension universe.

Source: CEM Benchmarking presentation to the Colorado PERA Board of Trustees, September 2015.

The results of the CEM Benchmarking study further demonstrate the strong commitment of PERA on a daily basis to deliver exceptional service for PERA members and retirees. PERA provides this level of service at a low cost, protecting the retirement savings of its members and continuing to be one of Colorado’s best investments for members, retirees, and taxpayers across the state.

AnnuityA type of financial contract in which a person pays a lump sum or a series of payments in exchange for a guaranteed stream of income for the rest of their life.BenchmarkA tool used to measure performance. For example, an investor can use a stock index as a benchmark to measure his/her own investment performance compared to the market as a whole.BenchmarkA tool used to measure performance. For example, an investor can use a stock index as a benchmark to measure his/her own investment performance compared to the market as a whole.