Recent research by the National Institute on Retirement Security (NIRS) finds that inequalities in access and eligibility for employer-sponsored retirement plans result in retirement savings gaps for Latinos. As a result, Latinos are falling behind in preparing for retirement.

Why does this matter? As the largest minority group in the U.S. workforce, Latinos comprised 16.8 percent of the labor force in 2016. (According to the Pew Research Center, the Hispanic population in Colorado is even higher – at 21 percent in 2014.) Latinos lead population growth in United States, accounting for 17.8 percent of the total U.S. population and numbering over 57.5 million. The U.S. Census Bureau estimates that by 2060, the Latino population will number 119 million and will account for approximately 28.6 percent of the nation’s population. Additionally, the U.S. Administration on Aging predicts the Latino population that is age 65 and older will number 21.5 million and will comprise 21.5 percent of the population by 2060.

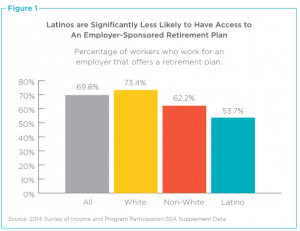

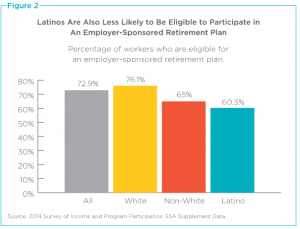

The NIRS research finds that access and eligibility to employer-sponsored retirement plans remains the largest hurdle to Latino retirement security.

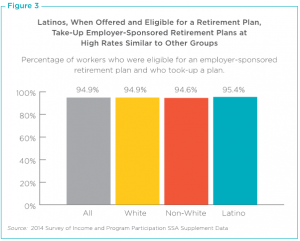

However, when offered a retirement plan for which they are eligible, Latinos participate at the same or higher rates than other Americans.

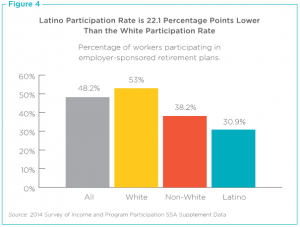

Despite these high take-up rates, Latino workers had the lowest participation rate in employer-sponsored retirement plans, at only 30.9 percent, compared to 53 percent of white workers. The top reason Latinos did not have retirement savings was that they worked part-time, resulting in less access to retirement savings plans. Many employers are allowed by law to exclude part-time workers from participation in their retirement plans.

The NIRS study states that allowing part-time workers to participate in employer-sponsored retirement plans would greatly increase the number of Latinos that could save for retirement.

The gap between Latinos and whites is particularly significant in the private sector, with 47.7 percent of Latinos participating compared to 67.1 percent of whites, a difference of 19.4 percent. In the public sector, retirement plan participation is higher across the board. While the gap in participation for Latinos persists, it is far narrower with 86 percent participation compared to 94.1 percent of whites, a difference of 8.1 percent in public plans.

One part of the solution to the retirement savings gap could be greater awareness of the Saver’s Credit. The Federal Saver’s Credit is a non-refundable income tax credit for taxpayers with adjusted gross incomes of less than $31,500 for single filers and $63,000 for joint filers. Because the median household income for Latinos was $46,882 in 2016, a large number of these households would qualify for the Federal Saver’s Credit if they saved for retirement. By widely promoting the credit, many more Latino households could be rewarded for saving for retirement.

Finally, NIRS recommended that more states explore the adoption of state retirement plans, noting that in 2014, an estimated 103 million Americans between 21 and 64 had no access to an employer-sponsored retirement account. State retirement savings plans can provide low-cost retirement products to working Latinos and other Americans who are not covered by a workplace retirement plan, thereby helping to alleviate the current retirement savings crisis that Latinos, and many others, face.

Read the NIRS study.

Additional PERA on the Issues articles on NIRS retirement research: