Recent news about PERA’s 2015 investment performance has prompted a few calls for changing the PERA plan design from a defined benefit plan to a defined contribution or 401(k)-like plan. We remind PERA on the Issues readers about what others have said about switching plan designs and we invite you to review what an independent, third-party analysis found about the cost effectiveness of PERA. The next time you hear someone say that a defined contribution plan would be better for Colorado’s public employees, you’ll have these excellent resources to use.

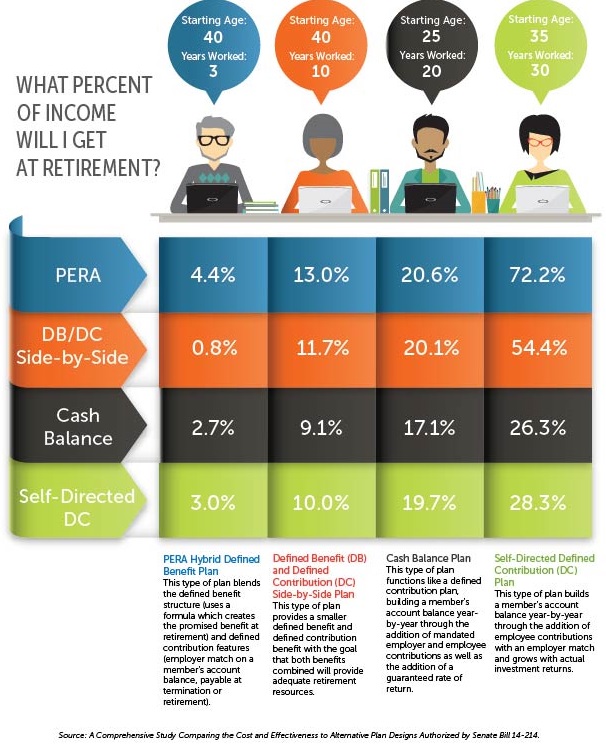

In July 2015, the Colorado General Assembly’s Legislative Audit Committee released a report determining that the cost to fund PERA benefits is lower than the cost of other plans in the public and private sector. Independent actuarial firm Gabriel, Roeder, Smith & Company (GRS), with oversight from the Office of the State Auditor, examined the plan design of Colorado PERA and released the report. The report also found that when costs are held constant, PERA’s Hybrid defined benefit Plan delivers the highest percentage of salary replacement income in retirement – for short-term as well as career public employees in Colorado.

The GRS study findings have not gone unnoticed. Gregory W. Smith, PERA’s Executive Director, joined Leslie Thompson from GRS to share the study’s conclusions with members of the National Institute on Retirement Security (NIRS). Smith noted during the webinar that the GRS study found that PERA “truly serves every single member in the plan.” He went on to say, “it’s important to quantify the trade-offs between the PERA DB Plan and other plan designs, and this report does that.”

Read the GRS report.

NIRS is the nonprofit research and education organization established to contribute to informed policymaking by fostering a deep understanding of the value of retirement security to employees, employers, and the economy as a whole.

Defined benefitAlso known as a pension, this is a type of pooled retirement plan in which the plan promises to pay a lifetime benefit to the employee at retirement. The plan manages investments on behalf of members, and the retirement benefit is based on factors such as age at retirement, years of employment and salary history.Defined benefitAlso known as a pension, this is a type of pooled retirement plan in which the plan promises to pay a lifetime benefit to the employee at retirement. The plan manages investments on behalf of members, and the retirement benefit is based on factors such as age at retirement, years of employment and salary history.Defined contributionA type of individual retirement plan in which an employee saves a portion of each paycheck (along with a potential employer match) and invests that money. The employee’s retirement benefit is based on their account balance at retirement. A 401(k) is a type of defined contribution plan.