If you follow the stock market and investing news, you may have noticed a term that’s been gaining in popularity in recent years: ESG .

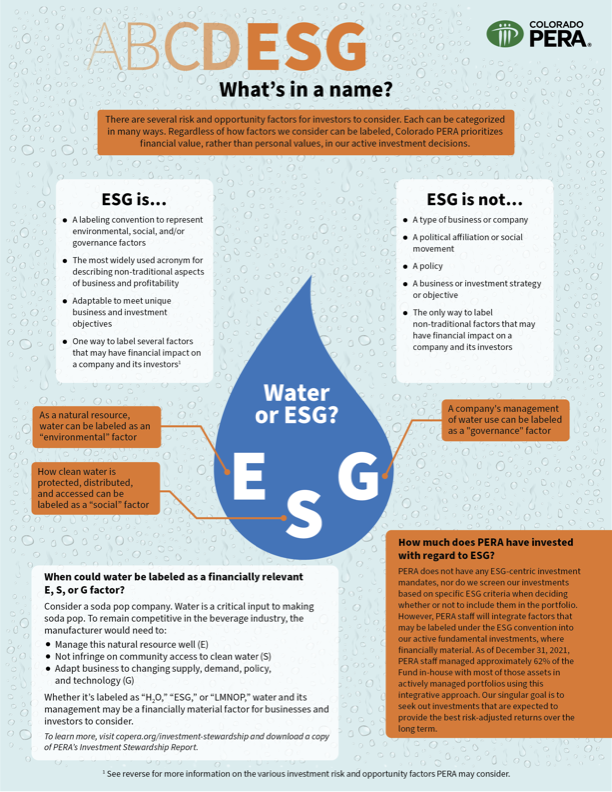

ESG is an acronym for environmental, social, and governance factors. It’s a widely used caption for labeling non-traditional aspects of a business that may have a financial impact on a company and its investors.

The term “ESG” is sometimes used to describe business or investment strategies perceived to have a global sustainability focus. However, that may be a misnomer.

Evaluating business practices through an ESG lens

Rather than being a one-size-fits-all way to describe a company or investor, ESG is intended to be a way to describe nuanced inputs, outputs, and operations that can affect the environment, society, and/or business governance. These factors may or may not be financially relevant to a company and its investors.

Take a soda company for example. The company’s usage of water, an important ingredient in soda and other drinks, makes it neither an ESG nor non-ESG company. Instead, water could be considered a financially relevant input with implications for business that can be labeled through an ESG lens. Water is a natural resource, and it therefore can be considered an environmental factor. How the company accesses and uses that water in relation to the local community can be considered a social factor, and how the company adapts its strategy to changing supply, demand, regulation, and technology could be considered a governance factor.

How the company approaches these and many other elements of its business can affect its ability to remain competitive in its industry. Competitiveness and profitability are important to companies and their investors, and ESG is just one way to label various factors that may influence long-term financial outcomes.

As investors managing the retirement funds for nearly 650,000 members and retirees, it’s important for PERA to consider financially relevant factors when managing the portfolio, regardless of how they are labeled, or whether they may also have non-financial impacts.

PERA’s investment approach

PERA invests with one objective: to provide present and future benefits for our members and their beneficiaries. To that end, our approach to Investment stewardship is to seek out investments that are expected to provide the best risk-adjusted returns. PERA values financial sustainability first and foremost, and we do not invest to suit the personal beliefs of any one person or entity.

PERA staff consider a wide variety of financially relevant factors when deciding what to include in the portfolio, including some that can be labeled as environmental, social, or governance-related. As of Dec. 31, 2021, PERA staff managed approximately 62 percent of the Fund in-house with most of those assets in actively managed portfolios using this integrative approach. PERA does not have any ESG-centric investment requirements and does not screen investments based on any specific ESG criteria.

“As ESG terminology becomes more prominent, it’s important that our members know PERA’s priority is maximizing long-term, risk-adjusted returns so we can continue paying benefits for decades to come,” said PERA Director of Investment stewardship Tara Stacy. “By focusing on financial sustainability in our investment decisions, we uphold the fiduciary duty we owe to PERA members and their beneficiaries.”

For PERA members in the Defined Contribution Plan or a PERAPlus 401(k) or 457 plan who want to invest their own savings in companies that are screened on ESG criteria, PERA offers the PERAdvantage Socially Responsible Investment Fund. The SRI Fund is designed for long-term performance through investment in companies that have demonstrated leadership in ESG-related practices — that is, companies that have shown an ability to manage risks and take advantage of opportunities associated with environmental, social and governance issues. Participants may also choose from a large variety of investments within the self-directed brokerage option.

To learn more about how PERA integrates various financially material factors into its investment decisions, read the 2022 Investment stewardship Report, available online here.

StewardshipThe practice of overseeing or managing something entrusted to one’s care. PERA’s approach to investment stewardship is focused on ensuring the financial sustainability of the fund that pays benefits to retirees and beneficiaries.StewardshipThe practice of overseeing or managing something entrusted to one’s care. PERA’s approach to investment stewardship is focused on ensuring the financial sustainability of the fund that pays benefits to retirees and beneficiaries.FiduciaryA person who manages money on someone else’s behalf and who has a sworn responsibility to manage those funds in the best interest of the client. EsgAcronym for environmental, social, and corporate governance factors that can be used when making investment decisions.Defined contributionA type of individual retirement plan in which an employee saves a portion of each paycheck (along with a potential employer match) and invests that money. The employee’s retirement benefit is based on their account balance at retirement. A 401(k) is a type of defined contribution plan.

YES!! Stick with your financial sustainability approach…

If individuals want to invest in ESG type companies, do it with your own personal funds.

Book me a ticket on the same boat

Agree

AGREE! ESG is a leftist scam trying to destroy legitimate businesses.

Agree!!

I’d rather have a response from PERA that says, “We only consider financially relevant factors.”

Which entity or entities are managing the remaining 38%? Are they investing in ESG or Blackrock?

It’s great that individuals can choose their personal investment options for 457 & 401k.

Tell us more about that 38%. So 38% is ESG?

62% has to over perform to make up for ESG loses?

I am pleased to hear your explanation of priorities in making financial decisions. You offer those who want to get involved a fund where they can invest their own money. That’s fine but keep going on the track to make it possible to keep the fund solid. Good work!

Sane fiscal management.

I liked the way the PERA team explained this. Thank you.

Thanks to PERA for addressing and explaining this. We concur that the focus should be on fiscal responsibility. Those who choose to another emphasis can take advantage of the SRI Fund option.

Thanks for choosing investments that are not politically motivated and have sound economic fundamentals in order to meet current and future obligations. I agree with Sully’s comment above and would like to know if those entities managing 32% of PERA funds have the same requirement as you.

Thanks for offering options for those who wish to invest their own money in a way that satisfies their needs.

Stay the course.

I am relieved to learn of your investment priority. Thank you.

It’s great that you have the option of the SRI Fund.