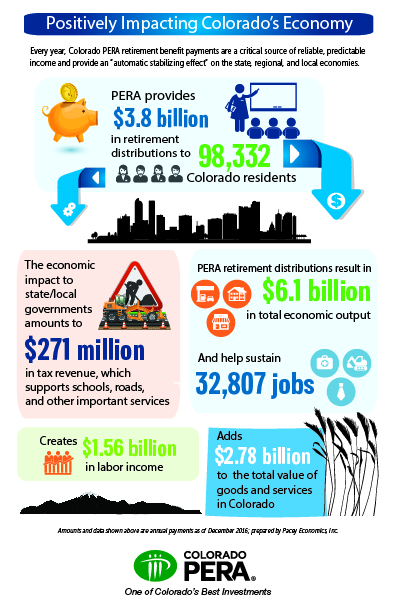

Distributions from Colorado PERA translate to $6.1 billion in economic output and help to sustain more than 32,800 Colorado jobs annually. These figures represent increases over the 2014 data from Pacey Economics. In just two years, the economic impact of PERA retirement payments increased by nearly $1 billion and supported an additional 3,800 jobs in Colorado.

PERA distributions, a sustainable source of reliable, predictable income for not just PERA retirees but for communities across Colorado, add critical value and stimulus to the Colorado economy. That’s according to a new report released by Colorado PERA, “Colorado PERA Economic and Fiscal Impacts.”

With these retirement distributions going to PERA retirees as well as disabled members or survivors upon a member’s death, dollars are pumped back into the economy, whether it is for purchasing groceries, buying clothes or paying for gas.

The report, prepared by economic and business analysis firm Pacey Economics, shows that the $3.83 billion paid in PERA distributions to more than 98,000 Colorado residents has a dramatic benefit to local economies in every corner of the state, from Metro Denver to the Southwest Mountains to the Eastern Plains.

PERA distributions “provide reliable, predictable income allowing for an ‘automatic stabilizing effect’ on state, regional and local economies, especially in economic downturns,” according to the report. Evidence of the importance of this economic impact is especially felt in rural Colorado, where PERA retirement distributions amount to 14.8 and 13.7 percent of area payroll in the Pueblo-Southern Mountain and San Louis Valley regions.

The report notes that PERA provides a significant return on investment, turning employer contributions of $1.32 billion into more than $4.1 billion in retirement payments in 2016. These employer contributions represent 20 percent of the additions to the PERA trust funds, with the majority (63 percent) of source dollars from investment income, and the remaining 17 percent coming from employee contributions.

Households with stable incomes, such as those receiving a regular PERA distribution, spend their money on basic needs and other purchases as well as paying taxes and fees that provide revenue for state and local governments.

That chain of economic activity – of buying groceries from a store, for example, that then pays its employees who in turn spend their income on gas to get to work – is known as the “multiplier effect.”

Colorado’s state and local governments see a total impact of $271 million in revenue from tax payments that result from PERA distributions to retired teachers, snowplow drivers, game wardens and other public workers. These tax payments continue to be directed to paying for our schools, roads, and other community services.

Recipients pay income taxes in addition to taxes on goods and services, such as sales, use and property taxes as well as government fees, licenses and permits. Their spending generates the multiplier effect, which in turn results in another layer of taxes and fees. The report measures fiscal impact, including income and property taxes on that first round of spending as well as other taxes and fees paid on subsequent rounds of spending. That spending generates revenue for state and local government budgets.

The report also finds that fewer than 1 percent of PERA members participate in Social Security, and “therefore, the PERA retirement distribution is designed and funded to provide total retirement moneys consistent with the private sector where retirement is based on a combination of a private plan and Social Security.”

Positively Impacting Colorado’s Economy

Trust fundA fund in which money and/or other assets are held and managed by trustees on behalf of plan participants. PERA maintains trust funds for each of its Defined Benefit Plan divisions (State, Local Government, School, Denver Public Schools, and Judicial).

It is imperative to keep our PERA retirement plans healthy and to remind lawmakers and Colorado citizens that we have no option to collect Social Security as private sector retirees have. Many have the misconception that we can collect both a private pension form the state and Social Security. If changes are made to upset the balance of the PERA system, it would devastate Pera retirees who were public employees all their lives and counted on a promised retirement income.