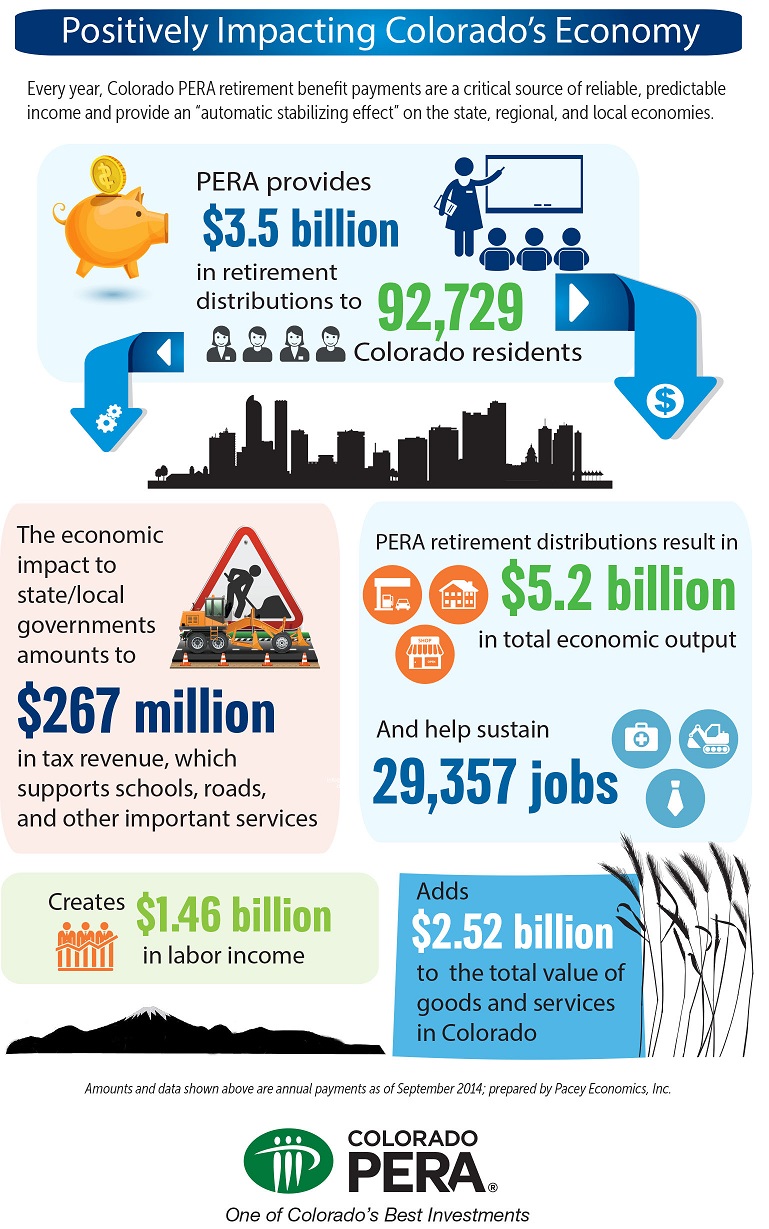

Distributions from Colorado PERA translate to $5.2 billion in economic output and help to sustain more than 29,000 Colorado jobs annually, amounting to 1.2 percent of Colorado’s gross domestic product.

PERA distributions, a sustainable source of reliable, predictable income for not just PERA retirees but for communities across Colorado, add critical value and stimulus to the Colorado economy. That’s according to a new report released by Colorado PERA, “Colorado PERA Economic and Fiscal Impacts.”

The report, prepared by economic and business analysis firm Pacey Economics, shows that the $3.51 billion paid in PERA distributions to more than 90,000 Colorado residents has a dramatic benefit to local economies in every corner of the state, from Metro Denver to the Southwest Mountains to the Eastern Plains.

With those distributions going to PERA retirees as well as disabled members or survivors upon a member’s death, dollars are pumped back into the economy, whether it is for purchasing groceries, buying clothes or paying for gas.

PERA distributions create “an infusion of income into the local economy that creates a chain of economic activities whose total impact is greater than the initial retirement distribution payment. The impact of the PERA retirement distributions reaches well beyond those who receive the initial retirement distributions (retirees or survivors),” according to the report.

Regular and predictable monthly distribution payments are an important source of financial stability across Colorado, providing an “automatic stabilizing effect” for the economy at every level, which is especially critical as the state works to recover from an economic downturn. These distributions are especially critical in rural areas of the state that have been slower to recover than have communities along the Front Range.

Households with stable incomes, such as those receiving a regular PERA distribution, spend their money on basic needs and other purchases as well as paying taxes and fees that provide revenue for state and local governments.

That chain of economic activity – of buying groceries from a store, for example, that then pays its employees who in turn spend their income on gas to get to work – is known as the “multiplier effect.”

Money from PERA distributions ripples through the economy, and for every dollar spent by a PERA recipient, an additional 48 cents is generated through additional rounds of spending.

Colorado’s state and local governments see a total impact of $267 million in revenue from tax payments that result from PERA distributions to retired teachers, snowplow drivers, game wardens and other public workers. These tax payments continue to be directed to paying for our schools, roads, and other community services.

Recipients pay income taxes in addition to taxes on goods and services, such as sales, use and property taxes as well as government fees, licenses and permits. Their spending generates the multiplier effect, which in turn results in another layer of taxes and fees. The report measures fiscal impact, including income and property taxes on that first round of spending as well as other taxes and fees paid on subsequent rounds of spending. That spending generates revenue for state and local government budgets.

In total, the report shows that $3.5 billion in annual PERA distributions to Colorado residents drives:

- $5.2 billion in economic output (all goods and services transactions);

- $2.52 billion in value-added, or state gross domestic product;

- $1.46 billion in labor income (worker impact in Colorado measured in wages); and

- 29,357 jobs.

The report notes further that the economic impact of PERA distributions increased nearly $2 billion since 2009, “substantially adding to the recovery of the state and local economies from the recent recession.”