In this story:

- The PERA Board approved and released the 2020 Comprehensive Annual Financial Report

- In 2020, the total fund’s investment portfolio returned 17.4%, net of fees

- The total fund was valued at $58.3 billion, up from $51.7 billion at the end of 2019.

- The Annual Report also announced that the automatic adjustment provision (AAP) will go into effect in 2022

- The primary drivers of the AAP going into effect were the updates to PERA’s actuarial assumptions and the impact of the pandemic on PERA’s membership

The Colorado PERA Board of Trustees approved the release of the 2020 Comprehensive Annual Financial Report (Annual Report) during its Board meeting on June 19.

The Annual Report is a detailed summary of PERA’s investment performance, funded status and membership information for the 2020 calendar year.

“This report reflects the ways in which we met the challenges faced in a highly unusual year,” said Ron Baker, PERA’s Executive Director. “Last year was a tough year for so many people, and at PERA our focus remained on members and retirees.”

Global equities fuel strong investment return

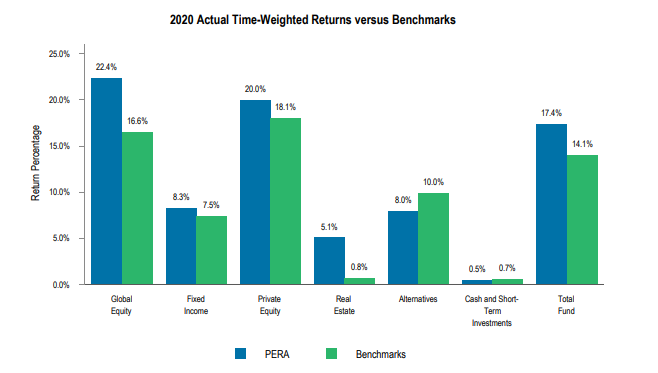

For the year ending Dec. 31, 2020, the total fund’s investment portfolio returned 17.4%, net of fees, significantly above its benchmark of 14.1%. The 10-year annualized return is 9.4%. PERA’s funded ratio at the end of 2020 was 62.8%. The total fund was valued at $58.3 billion, up from $51.7 billion at the end of 2019.

Returns by asset class are shown below alongside the benchmark for each asset class:

Automatic adjustment provision goes into effect in 2022

While the investment returns were positive last year, it is important to remember that investment performance is one of many factors used to calculate a plan’s funded status.

In 2020, the Board reviewed PERA’s actuarial assumptions through a process known as an Experience Study, which takes place every four years. That review resulted in changes to assumptions used to calculate PERA’s funded status. The changes reflect that members are living longer and the workforce is growing more slowly than previously expected.

These updates to PERA’s actuarial assumptions, in addition to the impact of the pandemic on the membership, increased PERA’s liabilities. These increases in liabilities mean the automatic adjustment provision will be triggered in 2022.

Beginning July 1, 2022, employer and member contributions will increase by 0.50 percentage points of salary. The annual increase will be reduced by 0.25 percentage points.

“We understand the changes we’re announcing today are difficult for our members and retirees,” Baker said. “However, the impact is clear: This change will help PERA stay on track to reach its goal of keeping PERA secure for its members now and in the future.”

PERA’s annual report is available here. Highlights are also available in an interactive format at www.copera.org/snapshot.

AapA provision of Colorado law that automatically changes PERA contributions (from employers, employees, and the state) and annual benefit increases based on PERA’s funding progress.Actuarial assumptionData such as demographics, mortality rates, and investment returns that retirement plans use to calculate future assets and liabilities.BenchmarkA tool used to measure performance. For example, an investor can use a stock index as a benchmark to measure his/her own investment performance compared to the market as a whole.Asset classA category of similar investments. Common asset classes include global equity (such as publicly traded stocks), real estate, and cash.

What is the annual increase for 2021?

Is it correct to assume PERA employees were furloughed and essential workers did not receive pay raises since “it was such a difficult year.”

See https://www.copera.org/resources/newsletters/retiree-report/spring-2021/annual-increase-reminder The increase will be 1.25% for benefit recipients whose membership (hire date) began in 2006 or earlier. A little less for those hired later than 2006 who are now retired and eligible for an increase. The increase for 2021 will be included in the benefit payment made on July 30.

Eligible retirees who were hired before 2007 will see an increase of 1.25% in their July checks. Those hired after 2007 will see an increase of 1.2%. As a note: annual increases are always announced one year in advance. This year, PERA announced the July 2022 annual increase amounts while 2021’s increase was announced last year.

Am I reading this right–retiree increases will DECREASE in 2022 by 0.25% DESPITE the fact that gas prices and everything else are going UP??? If so, every single person managing PERA ought to be FIRED!!! We need a completely new COMPETENT group of managers that quit placing the burden on those of us who worked our asses off for years, promised what used to be a 3% COLA, that’s now reduced to literally pennies that won’t even buy a cup of coffee! If I read this wrong, then I stand corrected.

Increase is 1.25% I think. I understand what you mean but don’t agree that PERA employees should be fired. It’s a large group of people who make the assessment based on many factors. I don’t like it either but am grateful that I have a pension.

The increase is 1.25% this year–2021. But if they are reducing it another .25 percent next year it will be only 1% in 2022. At least, that’s how I read it. If so, it isn’t even an increase! It’s like throwing out pennies. I had full retirement with just under 40 years at all PERA employers combined, yet unless you were in a higher classification that got a large salary when employed, a stagnant lower HAS with basically no increases (amounting to pennies) year after year after year is meaningless. That’s my point again, unless I read it wrong.

You are absolutely right. We are very lucky to have COPERA.

Why not add a paragraph as you have done in the past:

What this means in dollars and cents to:

An employee who has worked 40 years; 30 years; 20 years; 10 years; 1 year

A retired employee

A retired survivor of an employee

and any other category I have missed.

Thankful for fiscal responsibility. Not thankful it amounts to more money from active employees and less benefits to retired employees. Wish the State would kick in more, but that is not realistic. Rock meet hard place. People get squeezed.

This is the harsh reality. Better to face it than resist it. The process has been transparent and well-telegraphed.

What type of return on investments is necessary to stop automatic adjustments?! 17.4% return is great and significantly above the benchmark. This is hard to take as a retiree that was promised a 3% yearly increase when I retired. We are getting further and further behind.

Unfortunately it will take time to meet some of the expectations imposed on PERA regarding full fundedness. What is questionable is the validity of the concept. There should never be a moment that everyone has to be “paid off” what’s due them, and the changes in the retirement schedules will certainly address what might have been a “too generous” benefit to some retirees. So, hang in there. Politics is a factor, similar to the mistreatment of the Postal Service, but right now, we can be optimistic. It could be a lot worse.

So, on top of all the real cuts, deprivation of retirees, and hikes withholding more from active contributors, PERA educators continue prohibited from working as substitutes more than 110 days. This in spite of teacher substitute shortages and the fact that PERA subs pay into the PERA system without expectation of remuneration. This archaic idea may at one time had merit, but now it just prohibits teachers from benefiting schools as temp instructors who actually know how to do the job. Even the slow members of the class recognize this restriction, and inadequate pension means again educated and educators get the short end of the bureaucratic stick. Get out of the way and let retired teachers profit their vocation while yet they can.

Again PERA does not support its teachers. Cost of living must not mean anything to the people who run it. SS does better and we are not really allowed to use it. Promises were made and broken. Teaching will loose good people due to this. Can’t help to wonder how this effects the judges and other branches ?

I’m sure the employees at the pera offices receive more than 1% on a regular basis and all the account managers.

This is down right criminal.

The state government is swimming in money. Over 4 billion dollars of additional revenue as compared to the 2020 budget. And that doesn’t count the additional windfall federal rescue revenue coming to the state from Uncle Biden and his congress. Plus a bevy of new taxes (called fees) from the democrat controlled legislature and governor. Ye, gods, they could have at least payed the $200 million they owed PERA they failed to pay from 2020. No wonder the PERA fund is constantly underfunded and criticized by both the democrats and republicans. If it can’t balance its books by providing measly 1% benefit increases then something needs looked at with the political, management and investment scheme.

Let’s see the individual annual increases management is giving themselves.

sadly…this is what happens with poor planning by a retire who unwittingly relied solely on PERA. suggest all state agencies conduct personal retirement and financial planning courses on first day of employment.