The pension equation is relatively simple: Contributions and investment income must equal benefits and expenses, or C + I = B + E. As with all equations, the task is getting the two sides to balance. When one side of the equation exceeds the other, challenges arise. In the case of PERA, there was an imbalance caused by contributions and investment income being insufficient to fund current and future benefit payments. The difference between those two sides is the unfunded liability.

Let’s look at that equation in greater detail as a way to better understand the need for changes to PERA, many of which were included in SB 18-200, passed in the Colorado Legislature and signed into law earlier this year.

Contributions

Contributions from members ($910 million in 2017) and their employers ($1.6 billion in 2017) are invested and used to pre-fund retirement benefits. These amounts represent a steady stream of capital that is invested every day the financial markets are open. Currently, most members contribute 8 percent of their pay. Employers also contribute a percentage of salary. Research by the National Association of State Retirement Administrators (NASRA) has shown that the member contribution rate for most public non-Social Security retirement plans has increased since 2009. At PERA, the member contribution rate will begin to increase gradually on July 1, 2019, to equal an additional 2 percent of pay (for most members) by July 1, 2021. The employer contribution rate will also increase on July 1, 2019, for PERA employers (except in the Local Government Division).

Investment Income

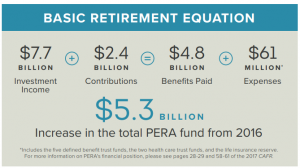

PERA is a long-term investor, with a diversified portfolio of investments currently totaling more than $48 billion. With billions of dollars to invest, the investment team at PERA is able to attain low fees. Most members will work 20 or more years, so investments from contributions have time to compound and grow before they will be used to pay benefits. Investment income in 2017 was $7.7 billion.

Benefits

In 2017, PERA paid $4.8 billion in benefits to more than 118,000 benefit recipients. This amount also includes refunds and rollovers made to those members who withdrew their accounts after leaving PERA-covered employment.

Changes included in Senate Bill 18-200 combined with investment returns resulted in a significant improvement of PERA’s funded status for all five divisions, with each reaching full funding within 30 years. These significant changes made to the benefits side of the equation reduced PERA’s liabilities by $3.4 billion, bringing the equation further into balance.

Expenses

Some have questioned whether or not PERA’s expenses could be reduced. PERA invests $48 billion in member assets and pays more than $4 billion in benefits annually – all with the foremost attention to cost. The overall cost to invest assets and pay benefits has averaged about 50 basis points (0.50%) over time – an extremely cost effective and competitive sum that allows PERA to have more assets to invest.

The changes in benefits included in SB 200 were necessary to rebalance the equation, ensuring that C + I = B + E.

Unfunded liabilityThe difference between the projected amount of money needed to pay benefits earned to date and the amount of money currently available to pay those benefits.Basis pointOne hundredth of one percent. 100 basis points = 1%.

Why do you keep trying to justify this.. Enough already.. We get it

Dear Mr. Shine,

Thank you for your feedback.

What really infuriates me is that those of us who have worked social security jobs, receive a reduced social security because we receive PERA and that PERA is cutting our increases also. Seems unfair to me.

I have to agree. I worked enough non-PERA years to qualify for a Social Security benefit and went to PERA employment later in life. However, Social Security off-set 2/3 of my benefit leaving me a total of $92 dollars a month. I can receive a widow’s benefit, and still MY benefit from him is offset by 1/2 from Social Security. So a pension and Social Security leave me with a very low income for the rest of my life, as well as, no longer having his income to help defray expenses. Expenses that continue to go up. I am scared, worried, and mad.

Good job PERA board and members, we all have sacrificed something to gain everything, a successful future!! Now lets keep up the good work, with luck and perseverance, we’ll reach that goal of full funding in the allotted time.

Dear Mr. Harris,

Thank you for your support of PERA.

When I signed up and decided to put my life in the line to protect the citizens of Colorado, I was told I would get a return for a certain amount for the rest of my life. A+b+c all this nonsense that cuts beneifts is just a reflection of why future employees will never commit to 25 years

Or more to this disaster

Dear Mr. Webb,

Thank you for your service to the citizens of Colorado. We continue to believe that the PERA benefit is a strong attraction and retention tool for Colorado’s public employers and that the PERA plan is competitive when compared to other retirement plan designs. The sacrifices made by current and future members and retirees are significant and reduced PERA’s risk by shortening the time it will take to reach full funding.

And that amount of time has to be shortened because? It’s a purely arbitrary number. So what if it takes longer, as long as we’re not losing ground these breaches of contract with current retirees have ZERO legitimate justification. Do your job and fulfill your promises to us, our COLA was “guaranteed”. Find the money somewhere else.

Dear Mr. Richards,

The goal of fully funding the PERA trusts in 30 years was adopted by the Board of Trustees in 2015. Please see the Colorado PERA Defined Benefit Pension Plan Funding Policy here: https://www.copera.org/sites/default/files/documents/fundingpolicy2015.pdf

Colorado State statute also sets forth a 30-year funding goal at §24-51-211(1): https://www.copera.org/sites/default/files/documents/5-6.pdf (page 26)

Yeah except.if you are trying to have additional.funding to put back into Pera gor.the members of.Pera that equation makes no sense as you should be adding the additional funding back into Pera Investments which would based simply on your equation above Would.increase the investment availability by almost what the expenses and payments were in 2016 so why you are increasing wjat we have to pay so that you can make for.more.investments is absurd get our funding back into low risk investments eith a higher long term return instead charving us more.investing hisgh risk investments that take.away from our gunding like was happe ing from like 2011-3015 as Pera was totally fine up until the investment porrfolio and stock that were chosen not in the Long term benefit for its members by people that have now retured from Pera keep our mo ey tgat we already invest with the program which based the 2015 numbers and equation above says that for 2016 7.7bill+2.4bill= 4.8bill+66mill

Would equal a large amount of funds over what would be needed to payout pera defined benefit payments and cover all expenses by an excess of 5.3billion which doesnt even begin to cover the how many billion dollars on bad investments lost over the last few years by whomever is making bad choices with our.funding?

Lets be real for just a quivk minute and actually address why Pera which was well above funded status until ehat was it exactly like 2013 or 2014maybe because a huge amount of money that reallocated in to bad investments.didnt pan out how they were expected too so now once againinstead of the people who caused itto happen losing the money of ours they get paid to lose ourmo ey spread out thatloss that caused us tolose ourinvestment funds on and so the solution is now spmehow we need to put more in to cover your mistakes wheres your accountability i dont being accountable.by charging is more to make yp for.your losses how about i dont know you dont get paid and you can reinvest your money into.reinvesting to pera to pay those funds back instead.

Dear Mr. Fuller,

Thank you for your comments. The PERA investment program is diversified by asset class with a high level of attention paid to the risk associated with investing $48 billion on behalf of 580,000 current and former public employees. The PERA Board has adopted risk parameters that are outlined in their Statement of Investment Policy: https://www.copera.org/sites/default/files/documents/investmentpolicy.pdf

In 2017, the portfolio outperformed the policy benchmark by 200 basis points. For more on the policy benchmark, please see this PERA on the Issues post: https://www.peraontheissues.com/index.php/2017/09/05/policy-benchmark/

The PERA investment program has consistently outperformed the policy benchmark since it was established in 2004.

The investment part of the equation is the one that PERA has the least control over – the financial markets will go up and down. Expenses are already low. Adjusting contributions and benefits are the only other parts available that can be used to significantly reduce the time it will take for PERA to reach full funding.

Please refer to the Colorado PERA 2017 Comprehensive Annual Financial Report for a full accounting of PERA. https://www.copera.org/sites/default/files/documents/5-20-17.pdf

It is my opinion that my ‘retirement fund with PERA’ has been annuitized.

This implys that my future benefits are assured, and cannot be decreased!

IS THIS NOT TRUE?

Sharon K.

Dear Ms. Kirkman,

Your retirement benefit is an annuity. You will continue to receive your benefit until your death and if you chose a continuing benefit at retirement, your cobeneficiary will receive a benefit until their death. Your benefit is not being reduced. The Annual Increase will be suspended in 2018 and 2019 and then capped at 1.5%, but your base benefit – the amount you are receiving right now before any deductions are made – will not be reduced.

No, NOT TRUE! SB200 granted sweeping powers to take even more away from us at any time, all without any sort of review process. Sharon, you and I and most other retirees got the shaft.

Hopefully, this communication isn’t setting the stages for additional, unexpected cuts. A disparaging part of my public service career was wage disparity as educators compared other professions, lack of raises for deserving employees because of continued budgetary crisis, and wage and benefit reductions. Many PERA retirees have already endured this climate and morale issues this employment climate produces. Additionally, many of us worked and contributed to Social Security prior to committing a second career to PERA publIc service employment to find our Social Security benefits all but negated due to penalty imposed because of employment with PERA employers. Now cost-of-living continues to rise and we will not receive PERA adjustments to equalize. So decided to wreurn to work for PERA employer to find that 10% will be taken out of my earnings, but that none of the money will be added to my PERA benefit.

Dear Ms. Morris,

Thank you for your comments. You may return to work for an employer that is not affiliated with PERA and contribute to that employer’s retirement plan (if they offer one) and Social Security. The reduction in your Social Security is because you did not contribute to the federal program while working for a PERA employer. We encourage retirees who are concerned about this to contact their Congressional representatives. Working retiree contributions, currently 8 percent and increasing to 10 percent over time, are used to reduce PERA’s unfunded liabilities.

So…PERA made 5.3 BILLION dollars more than it paid out, and we need to increase our contributions for some reason?

Dear Mr. Smith,

Yes, 2017 was a good year in the financial markets, but all years won’t be like 2017. Defined benefit plans like PERA are designed to invest contributions for future benefit payments. The outperformance of the investment portfolio in 2017 is used to reduce the unfunded liabilities and shorten the time it will take for PERA to be fully funded.

Judicial and State Police still have their outrageously inappropriate sweetheart deals. Clearly those should have been the absolute first things to be chopped. I had a CONTRACT for a 3.5% annual COLA, it was “guaranteed”. The PERA board through collusion with the Republicans who have been trying for years to dismantle our retirement has repeatedly broken this contract. And now via SB18-200 they don’t even have to get permission in order to take even MORE away from us. I’m disgusted by how this has been spun.

Dear Mr. Richards,

Members of the State Patrol contribute more to PERA so that they are able to retire at an earlier age. Each membership division (State, School, Local Government, DPS, Judicial) is a separate trust fund and the demographic experiences of each division are evaluated separately. Members and employers of one division do not subsidize the members and employers of other divisions.

Please respond to Mr. Richards’ issue of the guaranteed 3.5% annual increase. What benchmark in the economy and windfall to PERA must be reached before this provision of our retirement in re-instated ? The interest alone from this years 5.3 Billion increase would significantly fund that small group of retirees who actually retired under the 3.5% guarantee. That began I believe, in 2000, and was taken away in 2010, so only the retirees within that window are owed that amount. In addition, by normal actuarial tables that group is now significantly smaller, and gets smaller each year as retirees age and die, increasing even more the funds retired by PERA. How many retirees are there still alive that retired between 2000 and 2010. ? Please answer that question. And please explain why the last 3 comments submitted here have been censored, and not posted.

Dear Ms. Thorpe,

In 2014, the Colorado Supreme Court ruled that the Annual Increase can be changed, thus it is not guaranteed as part of the retirement base benefit, which the Court ruled could not be altered. The Court, in their ruling, stated, “We hold that the PERA legislation providing for cost of living adjustments [SB 10-001] does not establish any contract between PERA and its members entitling them to perpetual receipt of the specific COLA formula in place on the date each became eligible for retirement or on the date each actually retires.”

All members hired before January 1, 2007, have the Annual Increase provision that is now capped at 1.5 percent (not just those who retired before 2010). Those hired on or after January 1, 2007, have an Annual Increase that is the lesser of the 1.5 percent cap or the average of the monthly CPI-W for the previous calendar year. For this group of members, the Annual Increase paid cannot exceed 10 percent of the divisional Annual Increase Reserve Fund.

The 1.5 percent cap is subject to change with the Automatic Adjustment feature in SB 200. If PERA is ahead of the 30-year amortization period, the Annual Increase percentage paid to eligible benefit recipients can be increased by up to 0.25 percent in one year, not to exceed a cap of 2.0 percent. If PERA is behind the 30-year amortization period, the Annual Increase percentage paid to eligible benefit recipients can be decreased by up to 0.25 in one year, not to be reduced below 0.5 percent. Under the Automatic Adjustment feature, the Annual Increase can change each year, but no adjustment can be made prior to July 2020.

More on the Annual Increase may be found in this fact sheet: https://www.copera.org/sites/default/files/documents/2-247.pdf

Because this is a public forum, PERA reserves the right to decline to post comments that are inconsistent with our Social Media Policies: https://www.copera.org/media/social-media-policies

Mr. Richards, Ms. Thorpe, and many others (myself included) deserve to have our comments and questions posted and answered…least the moderator of this site, not unlike PERA Board & Staff (PERA B.S.), forget who’s interests they’re obligated to serve or who is paying for this webpage and their salaries!

Our retirement fund has been anesthetized not so much annuitized. Just my opinion.

My investments at Vanguard average 0.14% for management fees. PERA’s 0.50% still seems high. Just think how much of our investment money could be saved? On $48B, PERA could save $173,000,000!

Dear Mr. Follett,

Thank you for your comment. The Colorado PERA investment portfolio is both actively and passively managed. We’ve discussed the value added to the portfolio and strategy behind using a mixture of actively and passively managed investments here: https://www.peraontheissues.com/index.php/2016/08/16/active-passive-management-brief-summary/

PERA’s portfolio is diversified and consists of bonds, private equity, real estate, and other asset types in addition to global equities. PERA believes that the most effective and efficient long-term strategy is to invest in a broad array of asset classes.

Vanguard beats your performance for considerably less cost. For all the PR, your performance is mediocre at best. It seems that the management of objective at PERA is reward management and PERA employees first. Empirical studies have repeatedly demonstrated the inadequacies of active management, and you, just by the way, are proof of it. The State looks like it could improve returns and reduce costs just by firing a lot of PERA management and outsourcing to an index fund company like Vanguard. Hopefully Vanguard is working towards developing that product and the legislature wakes up and realizes it.

Mr. Makar you are not alone! I have been trying to figure out why the legislature allows PERA to manage DC plans or the 401(k) and 457 funds. They come up with mediocre performing companies like Voya that essentially do nothing or hand us off to foreign owned companies like T.D. Ameritrade (whereby one does all one’s own work). As a member of the DB plan with 401(k) and 457 PERAPlus accounts, I value and rely upon what was suppose to be a good (DB) plan until SB-001 & SB-200, and if the way the legislature and PERA Board & Staff (PERA B.S.) have diminished the DB plan is any indication, then PERA becoming a “hybrid DC/DB Plan” will not bode well for current retirees, taxpayers, or future “PER-covered” workers. As PERA obviously moves away from (and abandons any fiduciary duty to DB plan participants) one can only hope they do much better with DC plans in the future (or the legislature relieves PERA of all their DC managerial duties by privatizing such investment activities).

This post is in response to Mr. Santo’s comment of August 14:

Colorado PERA will post comments and replies to questions when they are within the guidelines of our Social Media Policies: https://www.copera.org/media/social-media-policies

We will also respond via email directly to those who have questions or would like to post comments, but whose comments are in violation of the above policy. These commenters are asked to resubmit comments and questions within the Social Media Policies.

To Whom It May Concern: This “comment” (that I’d like posted without additional response), is meant as constructive criticism, to wit: Many PERA members, as I’m sure PERA Board & Staff are aware, rely solely on these benefits and rightly feel some umbrage when their submissions to this website are meet with polished cliches parroting a public relations pitch by anonymous moderators (stemming from articles of unattributed authorship). The insult to injury of loosing benefit increases, while paying faceless staff behind this website (and I don’t believe that’s an inaccurate statement), is to have one’s questions, challenges and comments from members summarily dismissed or robotically “answered” with canned statements that belie the real political and budgetary reasons which is the cause behind many readers ire and very likely any financial problems PERA may have. Many times (in my opinion, and caveating it as such, to keep within PERA’s policies, unless the first amendment and truth conflicts with PERA’s policies), town hall meetings and reaching out to members seems like an exercise in Potemkin village building or not so subtle cheer leading by the “Ambassador Program,” or through an onslaught of mailings and emails, etc. All the while not a single word from PERA to acknowledge the late night rail-road of SB-200 through the General Assembly or the fact the Comprehensive Annual Financial Report for the year ending December 31, 2016 was held in abeyance to put a positive spin on SB-200 ad nauseam! Yes, it would be too little and too late to address that now, especially as a response to this comment which itself is a reply to the very kind of website moderating that offends so many (or at least me). I suggest you (or your superiors) start learning some humility and stop coming off so arrogant, and start by just publishing my (unedited) comment and leave it at that (this time) … I challenge you to “please” do that! Good day, whoever you may be?

PERA you make an excellent case in defending what you have done with your equations, but in the process have left out other facts. Fact number one is that PERA has been underfunded by $4.5 billion not including the investment loss on this money. If PERA had this money now invested would the recommendation for retirees to have their annual increases reduced under the senate bill in 2010 and now again SB 200 in 2018 been brought up or even considered? What is being done about this shortfall? I’ve asked about this in the past, but I haven’t received any comments. Fact number two is that retirees were influenced by the information that PERA provided us with to base one’s retirement decisions accordingly. Does PERA admit or take any responsibility for that? I would certainly hope so. It appears that retirees are considered as an easy target. It’s certainly regretful that PERA states one thing, but does just the opposite. May I remind PERA of the guest commentary by Timothy M. O’Brian.

Without a COLA provision, PERA retirees would see a loss of about 32 percent of their anticipated retirement income. It is not just this loss of income that concerns the PERA board, but also the decline in retirees’ purchasing power, or their ability to purchase products with current monetary values. The value of any currency changes as inflation changes. Without the inflation protection a COLA provides, retirees would experience a 58 percent reduction in purchasing power over the 38-year period. The PERA board believes strongly that we cannot make such drastic cuts to our public servants’ retirement.

By TIMOTHY M. O’BRIEN | Guest Commentary

January 5, 2018 at 12:00 pm

We again are seeing drastic cuts! We don’t need to be reminded of the Colorado State Supreme Court decision. It doesn’t make a wrong right. We know now that PERA’S goal is to get all divisions 100% funded in thirty years or less. How are retirees supposed to recover from these cuts? It is hard for me to imagine that retirees are being penalized for living longer. I would think that PERA would look upon that favorably. With annual increases being cut and a lower standard of living maybe that will lower one’s life expectancy.

I live in Kentucky now and I have written both Senators and my congressman about the Windfall Elimination provision. The bill before the House and the Senate will probably not make it to the floor again for a vote. This happens every year. With our annual increases being reduced we need like never before to have the WEP repealed. One thing that PERA always informed us at the meetings was how we would be impacted from the WEP and the GPO provisions. Along with that information PERA informed us not to worry because our retirement benefit would be more than adequate. Considering full retirement and adequate annual increases one would have thought so. Not the situation that we face now!

Dear Mr. Clevenger,

In response to the questions you posed: The $225 million annual distribution from the State of Colorado begins to make up for the contribution deficiencies experienced in the past. The statement made by Board Chairman Timothy M. O’Brien was in response to proposals to completely eliminate the Annual Increase until PERA was better funded (80 to 100 percent funded) made before the 2018 legislative session began. The Board’s proposal contained a two-year suspension of the Annual Increase and then an Annual Increase capped at 1.5 percent. These recommendations were contained in the bill that passed the Legislature.