Note: This is the first article in a series highlighting each of PERA’s investment asset classes and how they contribute to a diversified portfolio that provides reliable income to Colorado’s retired public employees.

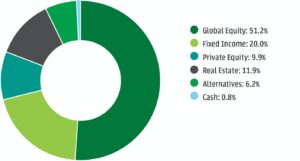

Colorado PERA’s investment team, guided by the PERA Board of Trustees’ investment policies and strategic asset allocation, invests plan assets with the primary goal of achieving the best risk-adjusted returns for members. The team pursues this goal through a well-diversified portfolio divided between five categories — or classes — of investments: Global Equity, Private Equity, Fixed Income, Real Estate, and Alternatives.

The largest single asset class is Global Equity, which makes up more than half of PERA’s total fund.

What is Global Equity?

The Global Equity asset class includes publicly traded stocks in companies based in the United States and abroad. It covers various sectors and industries, and encompasses companies of all sizes (large, medium, and small). Because Global Equity is such a large percentage of the portfolio, PERA’s Equities team has to manage a diverse group of stocks to limit the risk of any one holding, while earning the long-term financial reward for holding stocks.

PERA’s Global Equity portfolio includes shares in some of the biggest companies that conduct business around the world, such as Apple, Microsoft, and Amazon, as well as shares in smaller companies from various emerging economies. Global Equity is a primary driver of investment returns over the long term, in addition to providing liquidity to the portfolio.

Click here for more information on PERA’s Global Equity holdings.

Internal vs. external management

Decisions about what to include in PERA’s equities portfolio fall to two groups: Internal managers (PERA staff) and external managers. PERA has a strong preference for internal management, with approximately 75% of its Global Equity holdings being managed by in-house investment professionals.

The Equities Division has 15 people working on the asset class . They have all earned the right to use the Chartered Financial Analyst (CFA) designation, and eight of the 15 also have advanced degrees. The average investment experience of the team members is 18 years, making this a very experienced group of portfolio managers, analysts, and traders.

Jim Liptak, Director of Equities at PERA, said there are many benefits to managing the majority of assets internally, the biggest of which is the cost savings.

“We are fortunate at PERA to have the scale, resources, and skill to internally manage equities just as well — if not better — and at a much lower cost, than most external equity managers,” Liptak said.

By relying on internal equity asset management, PERA saves tens of millions of dollars in external manager fees every year.

That being said, external managers serve an important role. They offer unique perspectives and often use different strategies than what’s used in PERA’s internal portfolio management process, thus offering the opportunity to diversify the return to the overall asset class .

Active vs. passive management

The benchmark PERA uses for its Global Equity asset class is an index called the MSCI ACWI IMI with USA Gross. It is a commonly used benchmark for institutional investors like PERA and is designed to capture 99 percent of the Global Equity market.

The Equities team achieves its diversified investment portfolio by using a combination of active and passive management strategies. On the active management side (about 68% of Global Equity assets), the investment professionals on the Equities team assess, buy, and sell stocks in an effort to exceed benchmark returns. With the passively managed portion of the portfolio, the team selects investments that mimic the index, with the goal of achieving similar returns.

The Equities team utilizes all the tools at its disposal to form a low-cost and well-diversified portfolio of stocks that outperforms the benchmark on a risk-adjusted basis over long time periods. That kind of performance helps ensure PERA can continue providing retirement and other benefits to Colorado’s public employees.

“Being good stewards of PERA members’ assets is the primary focus of the Equities team,” Liptak said. “Our long-term, high-quality investing philosophy, combined with an emphasis on cost and risk, reflect this focus and are appropriate for a long-term equity investor like PERA.”

More information about PERA’s investments:

- Colorado PERA Investment stewardship Report

- Statement of Investment Policy

- PERA asset allocation

- PERA asset classes

- PERA Investment FAQs

Global equityA type of investment that includes publicly traded stocks in companies based in the United States and abroad.Global equityA type of investment that includes publicly traded stocks in companies based in the United States and abroad.Asset classesA category of similar investments. Common asset classes include global equity (such as publicly traded stocks), real estate, and cash.StewardshipThe practice of overseeing or managing something entrusted to one’s care. PERA’s approach to investment stewardship is focused on ensuring the financial sustainability of the fund that pays benefits to retirees and beneficiaries.StewardshipThe practice of overseeing or managing something entrusted to one’s care. PERA’s approach to investment stewardship is focused on ensuring the financial sustainability of the fund that pays benefits to retirees and beneficiaries.LiquidityThe ease with which an asset can be converted to cash without a significant loss of value.AlternativesA broad category of investments that don’t fit into traditional categories like stocks and bonds.Asset allocationAn investor’s mix of stocks, bonds, and other investments. PERA’s strategic asset allocation is set by the PERA Board of Trustees.Asset allocationAn investor’s mix of stocks, bonds, and other investments. PERA’s strategic asset allocation is set by the PERA Board of Trustees.Private equityA type of investment in which investors purchase shares of a company that is not traded on a public stock exchange.Fixed incomeA type of investment that pays investors a fixed rate of interest over a set period of time. Bonds are a common type of fixed income investment.BenchmarkA tool used to measure performance. For example, an investor can use a stock index as a benchmark to measure his/her own investment performance compared to the market as a whole.Asset classA category of similar investments. Common asset classes include global equity (such as publicly traded stocks), real estate, and cash.Asset classA category of similar investments. Common asset classes include global equity (such as publicly traded stocks), real estate, and cash.

O, my goodness! What a bunch of progressive crap. There is no hope for public education.

Look up Classical Education and give yourself an intellectual treat.

Randy,

“Equity” in this article means the good old fashioned financial markets sense of equity: stocks and collections of stocks. I am no progressive, my kids are in classical education, and I think the DEI redefinition of “equity” to mean “equality of outcome” is deeply confused and morally problematic. But this article is not talking about that. It’s just talking about an investment asset class that consists of US and International equities.

I don’t think you actually read the article! You saw equity and reacted. Right? Lol.

Informative article, thanks.