Consider these two questions:

Question #1

Which of the following poses the biggest retirement risk in the United States?

- Market risk (investment losses)

- Family risk (unforeseen needs of family members)

- Longevity risk (outliving savings)

- Health risk (unexpected health expenses)

- Policy risk (changes in law that affect retirees)

Question #2

What is the average life expectancy for someone who is 65 today?

The Answers – and Why They Matter

New research shows that longevity risk poses the biggest threat to retirees. However, most people perceive market risk as the biggest risk to their retirement.

The answer to Question #2 underscores why retirees should take Question #1 seriously: Data shows that the average 65-year-old woman will live to be 86.1, and the average man lives to be 83.5.

The average response to this question, however, shows that people underestimate this reality: 65-year-old women guess 78.2 while men guess 77.4.

That gap—six to eight years—represents a retirement that’s longer than retirees anticipate. If relying heavily on defined contribution accounts, a retirement plan that accounts for 12 years of spending instead of 20 can lead to serious problems down the line.

The Benefit of Lifetime Income

Retirement plans that rely heavily or completely on defined contribution accounts carry more individual risk: increased market risk, increased longevity risk. A person might enter retirement with seemingly adequate 401(k) savings. The first 10 or 15 years of retirement could even go exactly as planned. But retirements can last longer than expected. Investments can underperform at any point. Savings can dry up.

Retirees in a defined benefit plan like PERA’s receive a steady stream of income they can’t outlive. Member contributions, employer contributions, and investment returns together help fund the retirement for thousands of members. The individual does not bear the risk of outliving retirement savings in plans like these.

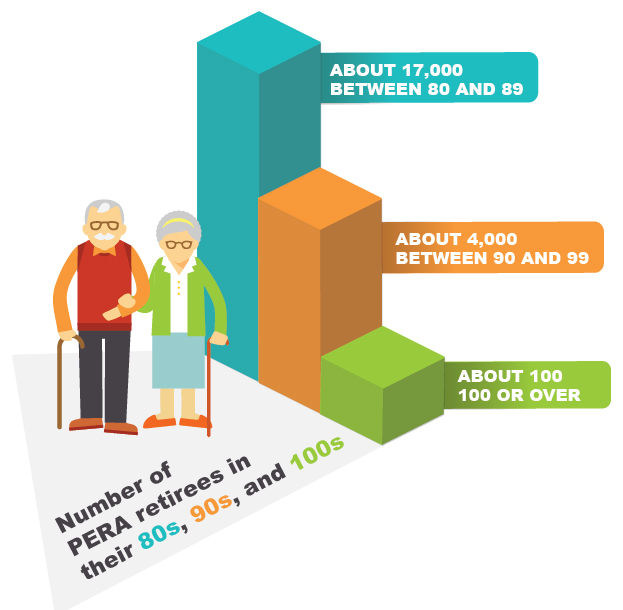

Those who are fortunate to have a retirement that’s longer than average—and the average PERA member has a higher life expectancy than the average American—know the value of a defined benefit plan first-hand. Currently, more than 17,000 PERA retirees are between 80 and 89. Nearly 4,000 are between 90 and 99. About 100 are 100 or older.

What Lifetime Income Means to PERA Members

Michael Judish has been a PERA Customer Service Representative for 15 years. During his tenure he’s spoken with countless PERA retirees and family members who have commented on the value this type of benefit provides.

Judish said that the annual statements retirees receive often prompt calls to PERA. The statements show how much retirees put into their account and how much they’ve received in retirement. On average, retirees receive all of their contributions, plus interest, back in the first five years of retirement. But the benefit lasts a lifetime, whether that means 10, 20, 30 years or more.

PERA Customer Service Representative

“Many retirees will call in and ask ‘am I still receiving a benefit?’” Judish said. “Many can’t fathom how much they have received compared to how much they put in. There is a lot of appreciation when they see the actual numbers.”

Family members of retirees who have recently died often express similar sentiments. “Children maybe realize that they didn’t need to come up with money for their parents because their parents had a lifetime benefit,” Judish said. “Although many of these relatives aren’t PERA members, they knew their relative had a benefit they could rely on, and they were grateful.”

Judish added that the benefits of lifetime income extend beyond the bank account. The peace of mind contributes to overall health, too. “People have told me that part of the reason they have a long life is PERA,” he said. “Knowing that they had a lifetime benefit took a lot of stress out of their life. The longer they live, the more grateful they seem to be.”

Defined benefitAlso known as a pension, this is a type of pooled retirement plan in which the plan promises to pay a lifetime benefit to the employee at retirement. The plan manages investments on behalf of members, and the retirement benefit is based on factors such as age at retirement, years of employment and salary history.Defined contributionA type of individual retirement plan in which an employee saves a portion of each paycheck (along with a potential employer match) and invests that money. The employee’s retirement benefit is based on their account balance at retirement. A 401(k) is a type of defined contribution plan.

I have lived a lot longer than any of my family members and I am very thankful that I worked for Pera and have such a good retirement.

I am so grateful for PERA’ s

lifetime benefit. I didn’t even realize what this meant until shortly before I retired. It would be helpful to spell it out to members early on in their career. And also we must all work to preserve it because it is always under attack from the right.

Not all Colorado State Employees are eligible for the defined benefit plan. I don’t recall the exact years, but early in the 1990s, as a professor at a state university, we were given the choice of staying in PERA’s Defined Benefit (DB) plan or opting out and going with a Defined Contribution (DC) plan that was portable should we take employment out-of-state. The portability of the plan was being emphasized and as I recall many, if not most, professors I worked with chose to switch to the portable DC plan. At that same time, new hires of professors were not given the choice of a DB plan. I’m so very blessed I chose to stay with the DB plan and I also bought many years of service credit so I could retire at 55 and receive 90% of my 3 high year average as I had 36 years in the system.

I appreciate PERA and do appreciate being able to reach a person knowledgeable about many things, especially the health care plan. I have appreciated the service they have provided me. My PERA pension is a lifeline and a Godsend. I would never have survived without it theses past 15+ months. I see we are ranked 8th in the states in retirement health care rankings. I have LOVED ANTHEM from a patient’s perspective. I certainly hope the board and powers that be have made the best decision in probably choosing United Health Care. I have seen some unfavorable reviews. I never felt like Anthem “nickel and dime” me in excess costs. They state what they would pay and paid it. Never a problem on the patient end of things. I hope we are not making a big change to just get somewhat lower premiums. I am more than anxiously hoping this is a better decision, but I was never unhappy with Anthem. K.Flynn