Like many public employee retirement funds, Colorado PERA employs a range of strategies to manage its investments, including what are frequently termed “active” and “passive” investment strategies.

Read more about PERA’s Investment Policy from PERA on the Issues.

Active investors try to beat the market over a reasonably long period of time, or generate returns on investments that exceed a particular investment portfolio benchmark. This difference between a given benchmark’s investment gains (or losses) is known as the “alpha,” or the portion of an investment return that represents the outperformance of the strategy over its benchmark The “beta” portion of a return represents the amount of a return that can be explained by the benchmark Together, the combination of “alpha” and “beta” represents the total investment return.

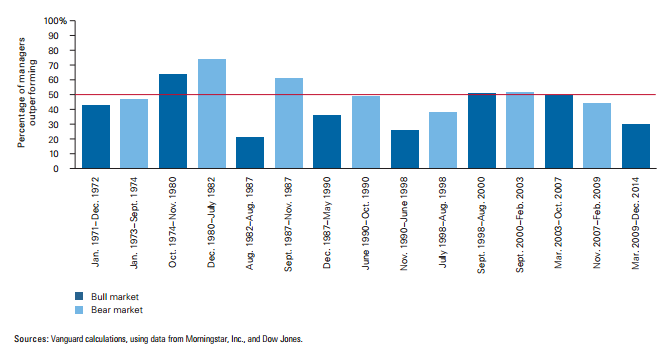

Although alpha generation, or outperformance of benchmark investment returns, is the goal of most professional investors, only a small number of them achieved these elevated returns over a sustained time frame. Academic studies have shown that the average active manager could not beat the market over a particular horizon, when fees and taxes are considered. Exhibit 1 illustrates the comparatively small percentage of active managers who have outperformed. Investors who can do so in multiple periods are even scarcer.

Exhibit 1. Percentage of managers outperforming market during bull and bear cycles

Multiple factors explain the phenomenon, although fee drag is cited most often. Active investing in public markets is inherently competitive, and is ultimately a zero-sum game even before considering fees and trading costs. Investment managers who prove an ability to consistently (or, on average) select the correct side of a trade are rewarded for their skill. The reward is provided by fee income, although fees fund more than just the investment manager’s compensation.

Fees and other costs are an important consideration when selecting a manager (The Importance of Understanding Investment Fees provides a more thorough discussion). Because more successful managers are more in demand, they may also charge higher fees. Higher fees, however, make net-of-fee alpha generation more difficult. The level of fees may reduce an active manager’s net-of-fees returns below those of the benchmark, while the gross-of-fees returns may be higher. This is because benchmark do not account for fees.

Given this reality, institutional investors like Colorado PERA must be very thoughtful in constructing portfolios. In both the defined benefit and defined contribution plans, assets are managed with a mix of passive funds and active funds. Active strategies may be employed when there is conviction in a manager’s ability to generate outperformance, net of fees. In addition, we believe that one of PERA’s competitive advantages is our ability to internally manage assets (both actively and passively) at a low cost compared to external investment management. As such, we manage a significant portion of our assets internally. In addition, when PERA uses external managers, they tend to have lower cost, institutionally oriented fee structures, which increase the probability of active management being effective.

According to a year-end-2015 study by Bank of America (summarized by Bloomberg), “In the past four years, passive investments have gone from one-fifth of long-only assets under management to one-third today.” The chart below shows how growth is the result of substantial inflows into passive strategies.

Exhibit 2. Cumulative annual flows into active and passive funds ($MM)

Portfolio Approach: Combining Active and Passive

While passive strategies are valuable components in a portfolio, in many instances a solid result is achieved when active and passive strategies are paired together. These strategies may be called core/satellite, where the passive core provides beta return while the satellite – the alpha component – seeks higher returns.

The decision to incorporate passive management reflects an investor’s view on market efficiency. Market efficiency is the investment industry term of art that represents how extensively, quickly, and correctly the market incorporates new information into security prices. According to Investopedia.com:

Market efficiency – championed in the efficient market hypothesis (EMH) formulated by Eugene Fama in 1970, suggests that at any given time, prices fully reflect all available information on a particular stock and/or market… In the real world of investment, however, there are obvious arguments against the EMH. There are investors who have beaten the market – Warren Buffett, whose investment strategy focuses on undervalued stocks, made billions and set an example for numerous followers. There are portfolio managers who have better track records than others, and there are investment houses with more renowned research analysis than others.

An investor’s portfolio may be managed a number of ways based on a particular view of efficiency, something that might be reflected in its investment policy. On one end of the spectrum is a view that no investment manager can beat the market over time (passive management); on the other end is complete reliance upon an investment manager’s skill and decision-making (active management). Between the two is semi-active management or enhanced indexing, wherein the investment manager uses the components of the index to construct a portfolio, but expresses their own view by overweighting or underweighting certain sectors or securities.

Differences in asset classes or markets

Market efficiency generally refers to the public asset classes such as global equity or fixed income (often referred to as just “stocks and bonds”) because they are more transparent and more liquid. Developed markets are more likely to be considered efficient. In emerging markets, myriad restrictions prevent perfect market efficiency (for example, local regulation). As a result, emerging markets may be viewed as less efficient than the developed markets. Market efficiency may apply to certain “alternative” asset classes (including commodity funds, currency funds, and hedge funds), but there are several that are considered inefficient, including real estate and private equity. Because of their inefficiency, these asset classes are considered to be purely skill-based and actively managed. Many alternative asset classes (such as private equity.nd real estate) do not have investable index products available to capture market returns because they are not publicly traded assets.

Implications of shift to passive management

An investor’s view on market efficiency informs its view on whether mispriced securities exist. Differing views on securities drive public market investment performance. Investors subscribing to the efficient market hypothesis are likely to allocate assets to passive funds in markets they consider efficient. As a greater percentage of capital moves to passive funds, the markets could become less efficient as fewer investors are willing to express views on securities. It should be noted that investment academics and investment practitioners seem to be divided on whether passive management will make the markets more or less efficient. Researchers recently summed up these arguments, stating:

Active and passive management have a symbiotic relationship. Active management keeps markets efficient, allowing passive management to exist. But the proliferation of passive management can and does lead to pricing anomalies that seem to justify the continued presence of investment selection.

(B)oth styles of investment management appear to support each other in a virtuous circle. Adherents of passive investing claim that greater market efficiency makes for fewer opportunities to identify and exploit mispricings, but it is active managers who identify those anomalies and increase market efficiency. In a further twist of irony, the profusion of passive management has led to decreased market efficiency. Index managers attempt to minimize tracking error by adjusting holdings in response to investor in- and outflows rather than by changing company fundamentals.

Conclusion

PERA’s investment management team monitors markets closely. In light of the market’s dynamics, some of which were summarized in the preceding paragraphs, PERA continues to see a place for both active and passive management within investment portfolios.

PERA on the Issues posts are written and compiled by the staff of Colorado PERA under the direction of Executive Director Greg Smith and the PERA Board of Trustees. We encourage you to comment with your thoughts and feedback.

Global equityA type of investment that includes publicly traded stocks in companies based in the United States and abroad.Asset classesA category of similar investments. Common asset classes include global equity (such as publicly traded stocks), real estate, and cash.Assets under managementThe value of an investor’s entire portfolio. PERA reports this number, which includes all assets in the PERA Defined Benefit Plan division trust funds, every year in the Annual Comprehensive Financial Report.Defined benefitAlso known as a pension, this is a type of pooled retirement plan in which the plan promises to pay a lifetime benefit to the employee at retirement. The plan manages investments on behalf of members, and the retirement benefit is based on factors such as age at retirement, years of employment and salary history.Defined contributionA type of individual retirement plan in which an employee saves a portion of each paycheck (along with a potential employer match) and invests that money. The employee’s retirement benefit is based on their account balance at retirement. A 401(k) is a type of defined contribution plan.Private equityA type of investment in which investors purchase shares of a company that is not traded on a public stock exchange.Private equityA type of investment in which investors purchase shares of a company that is not traded on a public stock exchange.Fixed incomeA type of investment that pays investors a fixed rate of interest over a set period of time. Bonds are a common type of fixed income investment.BenchmarkA tool used to measure performance. For example, an investor can use a stock index as a benchmark to measure his/her own investment performance compared to the market as a whole.BenchmarkA tool used to measure performance. For example, an investor can use a stock index as a benchmark to measure his/her own investment performance compared to the market as a whole.BenchmarkA tool used to measure performance. For example, an investor can use a stock index as a benchmark to measure his/her own investment performance compared to the market as a whole.BenchmarkA tool used to measure performance. For example, an investor can use a stock index as a benchmark to measure his/her own investment performance compared to the market as a whole.Asset classA category of similar investments. Common asset classes include global equity (such as publicly traded stocks), real estate, and cash.